A six-step strategy to find Blue Ocean for eCommerce in China

In previous years, this type of products was very easy to find, and it was relatively easy to set up a new product line. However nowadays, eCommerce is becoming more and more popular in China. Thus, it is more and more difficult to find Blue Ocean products without extensive data mining. Now, let’s look at a six-step strategy to find Blue Ocean for eCommerce in China.

Cross-border on Chinese eCommerce Platforms

More than 14,500 foreign brands from 63 countries are selling on Chinese eCommerce platforms, and more than half of these brands have their presence on Tmall International platform. Two major reasons for this emergence of foreign brands on Chinese eCommerce platforms are: growing demand of foreign products, and relaxed policies on consumers purchasing personal items from foreign website.

A New Retail Era Is Coming to China

In an survey conducted by JD.com, about 90% of participants are willing to increase their spending on high-end products by at least 5%, with nearly 60% of them willing to increase their spending by more than 10%. Data shows that non-necessities products page views increased significantly higher than daily necessities products.

The Lean Approach to Selling Online in China

In conclusion, start selling in China with 2Open in a record time. Most of the actual medium sized cannot, literally, afford to wait for bureaucratic complexities, licenses, or customs.

How to Promote your Business in China

How does Chinese Market work? How can companies promote themselves without Facebook and Google? How do people survive under huge competition there?

China is -still- a mystery for foreigners. The country means a huge cake, but before entering the market you will need to answer to this and other questions. To make it easier to you, in 2 Open we have taken a brief look of the Chinese market and done a list of the most basic tips you should consider before landing in China.

Gone wrong? It can go much worse

When many companies started their business in China for the first time, the things they used quite a lot in local made no sense in China.

Ebay is one of the biggest e-commerce platforms around the world and a perfect example to explain the experiences many foreign companies face in China. Due to its leadership, the company assumed that its landing in China would be no much different to that experienced in other countries, so in the beginning they refused to establish a partnership with JD.com. The company soon realized there were no more choice but to cooperate with them.

What are the most common problems that foreign companies face in Chinese territory?

Foreign enterprises in China often fall into the same shortcomings we analyze below. Let´s see:

First, Always try to show their high-end enterprise images

Foreign enterprises always show their best face: high-quality services, responsible attitude, respect to the customers… and so on. But in China, price is the key and can always be the KPI which attract the customers’ sight immediately.

Second, Focus on high-end target audiences but ignore the rapid growth of China

When companies like Blueberry entered China, they set the target group to those corporate users. As the earliest and past No.1 smart phone, Blueberry had already been famous in China. But within 7 years (2006-2013), they retreated from China and closed their Chinese official website.

When Huawei set off their business, what they did was to set the target audiences as all people who want smart phone. Since the average income of Chinese people is increasing, so that more and more can afford a smart-phone. Huawei was right about its strategy.

Third, Copy the promotion strategy directly to China

Many foreign companies would prefer to make a wonderful advertisement, an amazing poster and advertise in the subway stations, supermarkets… and everywhere. But they always find out that the ROI is quite low, since they might only get 1 customer for a 100 RMB budget. Does it outweigh? We don´t think so.

In China, since the civil quality is still on a shallow level, what the customers care most is whether they are interested in, but not what is a good design. That is why when Taobao.com stepped out their first step, they even promoted on some illegal websites which had huge traffics every day.

Fourth, Think too much about customers but ignore what the customers are thinking about ICQ. The instant messaging software also failed in China!

The U.S. companies are always stricts on protecting the users’ privacy. With such a policy, users can’t find the chat record if they log in on another PC, since the software will not memorize or save these records in order to protect the privacy to the most degree.

Its counterpart in China, Ma Huateng, found out this fault which doesn’t fit the Chinese users’ requirement. In response he created QQ, which is based on the technology of ICQ and make this software become the most-used IMS in China.

Fifth, Rely too much on the Western promotion ways, companies do not want to do things directly

E-mail, Mail and SMS promotion require low budget and have huge audience quantity. Well, they do not make sense in China. For many Chinese people, it is absolutely offensive if they receive advertisement in these channels since they have watched and received too many advertisements already. Moreover, for most Chinese these all are considered private.

They don’t like to be bothered by anything they don’t even know. In China, what people prefer is face to face, no matter if it is for sales promotion or negotiation. The Chinese only trust the people in real life. That’s why when Zhou Hongyi took the responsibility of Yahoo China, he fired all employees who only did E-mail promotion but never visited the clients.

What should you do, then?

First, Pay attention to Chinese culture

Chinese culture is totally different comparing with the Western cultures. Different political systems, different History, different religious beliefs. Thus, the culture strike shows extremely seriously in China.

Your company should do its best to avoid the culture strike and assume their role. We suggest you yo have a look to Lancôme experience in China.

Second, Explore the Chinese consumer behaviour and preferences

Knowing the Chinese consumer behavior and their preferences make the difference. What are the KPIs to attract them? What they care the most? What they pay less attention to? What channels they prefer to get promotion information?

All these questions need to be taken into account when setting up the marketing strategy in China.

Third, Know the correct channels

Due to the firewall in China, many foreign websites (Google, YouTube, Facebook, Twitter, etc.) are not allowed in the China mainland. Thus, use Chinese sources.

Fourth, Speak that language

Chinese people still prefer to speak Chinese. So, when doing business with them, try Mandarin: it is always more than welcome.

There are still lots of thing we need to explore and learn about China. In search of an Ecommerce and Digital Marketing Agency?

This article has been edited by Paula Vicuña, from 2 Open.

Tencent and JD Launch Targeted Brand Advertising on WeChat

From the association of Tencent –owner of the biggest social platforms in China- and JD.com –the leading online direct sales company in the country-, has emerged a new conception of Marketing and Brand Advertising.

In 2016 in Beijing, both released a plan based on Ecommerce marketing service called “J&T Plan”.

The new policy was aimed to provide a tool to accurate a better portrait of the potential user, and improve the interaction with the consumer.

As a result, users data has become extremely valuable for any company:

Knowledge is power, more than ever.

What are their main Goals?

The aspiration of Tencent and JD.com partnership has been to provide a pleasant and high quality service to their users.

To reach its purpose, they have focused on three main objectives to strength its business on mobile and Internet, such as:

- Mobile access points

- Traffic support

- Ecommerce activities

Their desire to turn the user into the protagonist of the new Marketing, has launched a new approach based on three main ideas:

- Multi-dimensional user insight

- Effectiveness analysis

- Precision target audience

What do they want in Return?

Not only a commitment to the future and an advantage over its competitors, their relationship also give them some specific advantages:

JD.com obtains a stake in Yixun, PaiPai C2C marketplace businesses, logistics personnel and assets and QQ Wanggou B2C.

On the other hand, Tencent will offer level one access points in Weixin and Mobile QQ and support from other key platforms to JD.com.

In order to provide a better online shopping experience, they will also work together on providing solutions to online payment services and an overall digital marketing solutions.

If you are thinking on improving your company services, before starting a Business and Marketing Plan you should take in consideration some basic recomendations:

Build a well-aimed portrait of the users, improve brand experience with the client, and enhance technological tools to achieve it, have become the three key factors to consider on any approach to potential customers, and the best guarantee for the future of your company.

From 2 OPEN we have conformed a team capable of responding to new challenges and specialized on Business Intelligence. We can help you to deal with the new Marketing and Ecommerce trends.

Come with us. Together we will reach your company goals.

This article was edited by Paula Vicuña from 2 OPEN.

Do other e-commerce platforms stand a chance against Tmall?

All of us are very well aware of the magnitude of the Chinese online market and, although it is currently the largest e-commerce market in the world, most of the market share is owned by the Chinese e-commerce giant Alibaba. Nevertheless, there are some other companies that also want their piece of the pie and with their vertical e-commerce platforms they are starting to put up a fight. This article will focus mainly on those vertical platforms that constitute an important part of the diverse Chinese e-commerce environment.

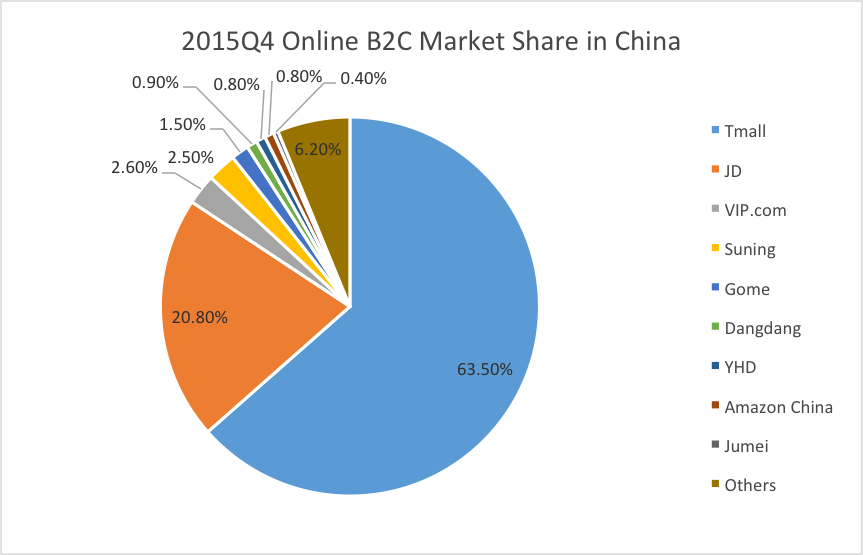

In the 4th quarter of 2015 China’s online transactions surpassed 644.38 billion RMB, the pie chart shown bellow contains the market share of the top ten Chinese e-commerce platforms:

Before we continue, we first have to clarify the concept of vertical e-commerce. In this context, vertical refers vendors that offer goods and/or services that are specific to an industry or customers with specific needs. A vertical e-commerce platforms could be a independent brand or a specified category within a wide range of products such as clothes, 3C (computer, communication, and consumer electronics) products, cosmetics, etc.

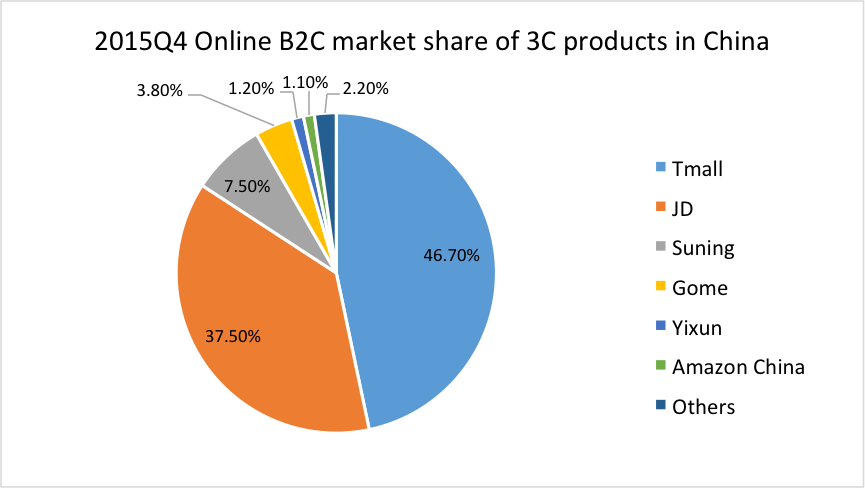

If you already have a basic understanding of the Chinese e-commerce market, then you are probably familiar with JD.com. Currently the second e-commerce platforms in China after Tmall (owned by Alibaba Group), JD.com started as a 3C products vertical B2C website. Now, let us take a look at the market share of 3C products in China B2C online market:

Although Tmall is still on the first spot, the difference in market share of JD.com is considerably higher than with regular products. Tmall and JD.com combined own more than 80% of the Chinese 3C products market. Suning, on the 3rd spot, and Gome, on the 4th, both also started specializing in 3C products, however, nowadays they have also diversified their range of products. At the end, it seems that there are no actual vertical platforms anymore.

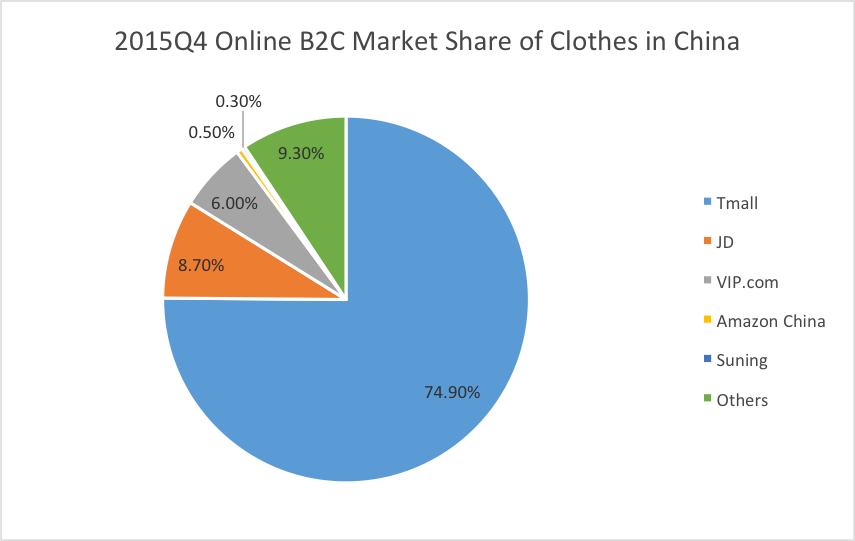

To study the online market, we cannot miss the biggest category, clothes. In the 4th quarter of 2015, the total transaction of clothes is 235.57 billion Yuan, market share is shown below:

In this case, Tmall is leading with an absolute advantage of almost 3/4 of the market share. In this category, JD has 8.7% of the market share, VIP.com has 6%, and surprisingly others do not even have 1% individually, so from the big picture the vertical market for clothes is not active enough.

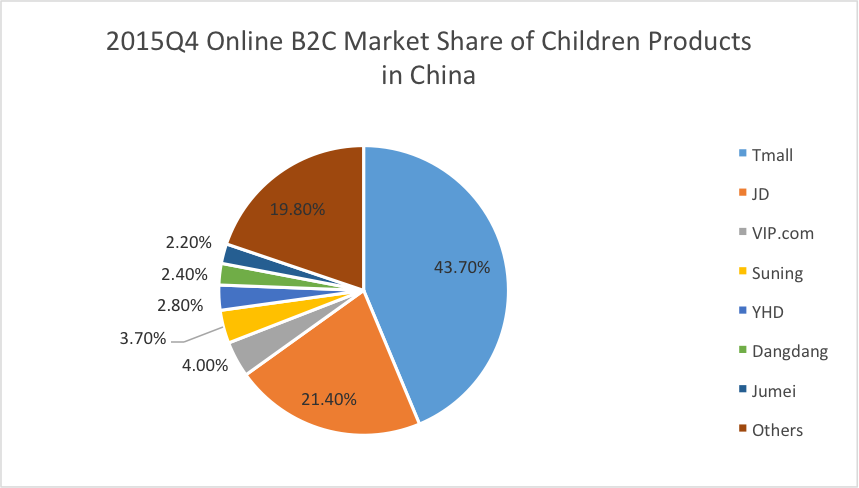

Another category that has had such a rapid growth we cannot ignore is the maternal and children products. Shown below is a pie chart containing China’s maternal and children products market share figures of major competitors in the last quarter of 2015:

The most noticeable difference in comparison with other categories is the porcentage own by other platforms that adds up to almost 20 %. Although Mia, Beibei, Babytree and others are in that 20% it is still a big figure. In this category Tmall and JD.com own less than 70 % of the Chinese clothing market, so we can say, to some extend, that there is still space for vertical players.

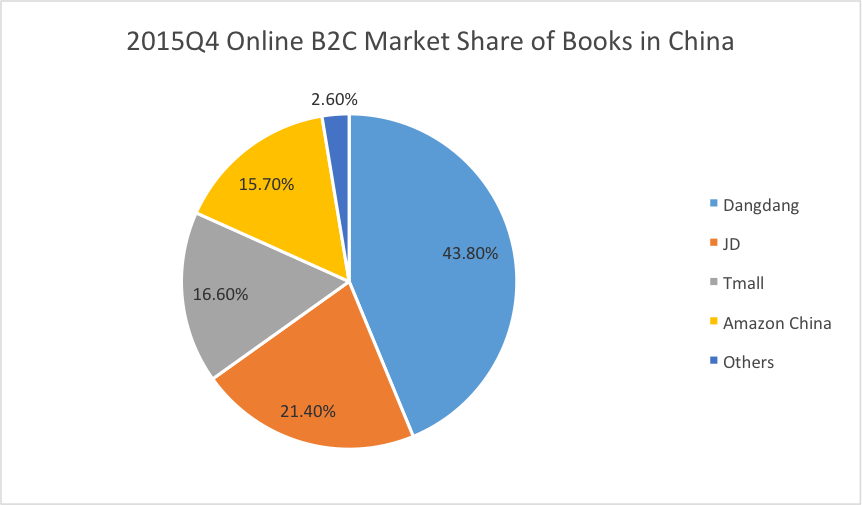

The next category is books and, even though the books total transaction was just 5.31 billion Yuan, the market share gives us a slice hope of competing with general platforms, in this case Dangdang is leading with 43.8%, and Tmall is only on the 3rd spot, just after JD.com.

Finally, we cannot say all vertical online platforms are dead in China just because most of the categories are gloomy, there are still some worth a try, and you just need to know enough about the current situation. If you don’t, luckily you saw this article, and you know 2open can always help you to find the right channels. So don’t hesitate, contact us now!

All in all, even though Tmall dominates in the Chinese market, there is still space for other platforms to flourish. Vertical e-commerce platforms seem to be the wisest option, specify in a certain category, gather information about the current situation in the Chinese market, and carry out your business plan. If you need further information about the market, would like to help you find the right channels, or want us to set up your business in China, do not hesitate in contacting us. Our group of specialists will happily assist you.

This article was edited by Andres Arroyo Olson from 2 Open.

References.

All products data from

http://www.analysys.cn/yjgd/17684.shtml

3C data from

http://www.analysys.cn/yjgd/17676.shtml

Clothes data from

http://www.analysys.cn/yjgd/17678.shtml

Children products data from:

http://www.analysys.cn/yjgd/17680.shtml

Books data from: