Is China becoming more open for imported goods?

Despite its enormous potential, in China the ease of doing business experiences a lightning-fast evolution.

Trade in China still suffers from some difficulties that require a certain courage by those who seek success in the country.

Such evolution is aimed at providing increasing facilities for the establishment of trade relations in the country but, according to World Bank´s report, it still keeps the 84th position on the ranking.

What are the main challenges a foreign company must face in its landing in Chinese territory?

From 2 OPEN we have elaborated a guide with some basic steps to face the first stage of procedures, certifications and regulations any company need to face before entering on Chinese market.

Goods import: Are them all allowed in China?

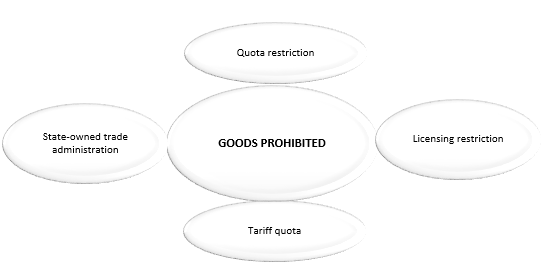

The Chinese government has established in its Foreign Trade Law some basic categories over the import of goods.

However, not all goods are accepted by law; in every approach to the country, we must consult in the Catalogue Of Goods Prohibited from Export and Import.

Some enjoy specific requirements: Tariff quota is only available for licensed importers, and State-owned trade administration must be imported by authorized enterprises.

There are also some other terms to test: certifications, packaging, labelling, transportation…From 2 OPEN we can help you to face all the specific bureaucratic procedures involved in any approach to Chinese market.

Standars

Some goods may require specific certificates, registration by Chinese authorities or labelling requirements.

Standars varies depending on the levels, profession and industry your company comes from.

Being aware of the specific needs of our goods will facilitate the following steps for a successful importation into the country.

Importers, a key entrance

Whether your entry into the country is done in an autonomous manner or with the help of a qualified external importer, in both cases will be required to have a Foreign trade operator.

Remember that only those companies already ratified in China as a Foreign Invested Enterprise are able to get the permission to become a Foreign Trade Operator.

In case you prefer to have the assistance of an external operator, try to avoid surprises!

The Ministry of Commerce of China provides an official list of importers where you can find the most suitable to your company needs.

Warehouses and declaration procedures

Procedures will change depending on a set of variables, but the very basic requirement is The Customs Declaration Form of Imported Goods.

A specific stamp will be used for every Bonded warehouse goods coming into Chinese territory.

In case import goods change their formal bonded warehouse, particular formalities for custom transit and transport will be required.

Attending to a fair?

If your company is thinking on attending to any special exhibition in China, there is also specific legislation according to temporary import goods. Temporary goods are those which are planned to be in China for less than six months for specific reasons, such as fairs or expos.

Those goods should be approved by the authorities, and usually a deposit will be required.

The landing in the country requires of the understanding and the expertise of an expert team in China environment.

From the company, we have assisted companies from different fields to develop their business in Chinese market.

Let us lead your company into China!

It’s official! Taxation reform will start on April 8

On March 24, 2016, the Ministry of Finance of the People’s Republic of China released an article on its website to finally put an end to the on-going rumours. Turns out that all the gossips were right all along, so brace yourselves because the taxation reform for imported retail products through cross-border e-commerce is coming.

According to the article approved by the State Council, starting on the 8th of April 2016, China will implement the import tax policy for cross-border e-commerce retail sales (business to consumer, or B2C), and also adjust the tax policy on personal postal articles.

Currently, items for personal use are considered to be personal postal articles, these types of items represent a reasonable number of cross-border imported goods and will be taxed according to the new tax policy on personal postal articles. The new personal postal article tax is targeted on non-trade imported goods; it combines tariffs, import VAT and consumption tax. Generally speaking, the tax rates of personal postal article tax will be lower than those of imported goods for trade.

Products for cross-border e-commerce retail sales are imported through postal channels and these work differently than the traditional trade of files and correspondences, this is the main reason why unfair competition exists between cross-border e-commerce retail imports and general trade imports within the same category. This is the main reason why cross-border e-commerce imported goods will be considered as merchandise and charged with tariffs, import VAT and consumption taxes.

As a response to consumer’s reasonable demand, the single transaction limit for cross-border e-commerce retail goods will be increased from 1000 RMB to 2000 RMB, furthermore, the annual limit will also be increased to 20000 RMB. For cross-border e-commerce retail goods within the 2000 RMB price limit the tariff will be 0% with an import VAT and consumption tax of 70 % of the current statutory tax. As for the goods that surpass the single transaction or annual limit, they will be charged with full taxation under the general trade model.

Taking into account current regulatory conditions, for the moment, only cross-border e-commerce retail imports that can successfully provide trading, payment, logistics and other related electronic information, will be taken under the scope of the new policy. Personal belongings and imported goods that are unable to provide related electronic information will remain subjects to current regulations. Meanwhile, to optimize the taxation structure, simplify customs declaration and tax payments, and improve customs clearance efficiently for passengers and customers, China will adjust tax policies on personal postal articles. The changes include a reduction from the current four tax items (tax rates: 10%, 20%, 30% and 50%) to three. Under the new policy, tax item 1 is mainly for commodity from MFN with zero tariffs; tax item 3 is mainly for high-end commodity with consumption tax; the rest will be subject to tax item 2. Tax rates for the three new tax items will be 15%, 30% and 60% respectively.

We will have to wait and see how this affects cross-border e-commerce in the following years. Any enquiries you may have about how to increase sales and manage a successful ecommerce business model do not hesitate in contacting us. Our group of specialist will be more than happy to assist you.

This article was edited by Andres Arroyo Olson from 2Open.

References

http://gss.mof.gov.cn/zhengwuxinxi/gongzuodongtai/201603/t20160324_1922972.html