5 Bugs To Avoid When Doing E-Commerce In China

Have you ever tried to build a new overseas brand and fail in your attempt? In any approach to China, foreign brands often make some common mistakes when trying to sell their products in China mainland. Although such misconceptions are not exclusive to online environment, we will focus on those that particularly affect your approach to e-commerce in China. China is already the world’s first e-commerce market.

Are you going to miss its enormous potential?

First bug: China is mobile, and you better record it

It is not the first time we tell you this, and for sure it won´t be the last. As we mention before in our article “How to Take Advantage of the Latest Ecommerce Revolution?”, Ecommerce has been a great revolution for both companies and customers.

Nowadays, Chinese prefer to use their mobile devices rather than their laptops and according to the new trend, companies have already starting to adapt themselves to portable devices. Moreover, those companies using U-commerce are focused on improving the customer experience through customizing and navigation created in cooperation with the User.

Second bug: E-commerce may be an asset in your country, but in China is irreplaceable

We cannot fail to mention Frank Lavin, CEO of Export Now, when he says,

“In China, Ecommerce is the cake.”

This may mean that you will need to adapt your business to the new environment. Do not expect it to be China who suits you, this does not work this way.

Remember that whoever hits first, hits twice. Embrace e-commerce as the enabler of your business it is, and take advantage of the immense benefits that electronic commerce can bring to your company to start selling around the World!

Third bug: Social Media is there to stay. Register your account and start moving!

Surely you’ve never heard the words Baidu, WeChat and Weibo… and let us tell you that you have a huge problem in China.

Not only around the 93% of the online searches in China are done in their own search engines –Have you ever heard Google does not work in China?– but also about a 68% of the customers take a look on the official Social Media account before buying.

Do not miss the opportunity to have a voice in that huge chicken coop is the network, start developing a tailored communication strategy for your brand and gain your piece of the cake!

Fourth bug: Domestic and lazy thinkers, or how the triumph from a day doesn’t make it daily

Do you think you will keep doing in China pretty much the same things you were doing before and as a result you will achieve success?

A basic rule you should never forget again is, no matter the experience and the many different markets in which you have entered before, is that new horizons always implies a new starting on your understanding of the target, so we definitely encourage you to start a market analysis.

Will your brand be competitive in China?

Do you offer something different regarding your competitors?

Is there a suitable market niche in the country ?

These and a thousand more questions require a prior discussion, keeping in mind that China should not be underestimated: the country enjoys some peculiarities you definitely must know before starting your landing.

We strongly recommend you seek assistance from professionals focused on the Chinese market, in order to enhance your chances of success in the country.

Fifth buf: Do not try to do everything by yourself, ask for advice

We are not tired of saying it, and will do so again: China is not a flat road. Do not try to embark on this mission unaccompanied, but pick very well with whom.

Look for complementary partners interested in joining forces, go to Government agencies dedicated to external actions and internationalization and definitely search for specialized agencies in the country to start outsourcing some tasks.

Already in search of a consulting expert in digital marketing and e-commerce? You have come to the right place.

How to Leverage Chinese Ecommerce to Become a Top 10: The Rise of Zara

Some months ago, we identified some Insights on ZARA in the Chinese digital market that came to underline its first steps on Chinese Ecommerce and the main reasons which led the company to choose Tmall as its official flagship store.

Zara´s stay in China began ten years ago and would not be long before the Management decided to set up its own online shopping website The Zara China and publish an M-shop called Zara.

What has been the result of the policy undertaken in recent years?

The unstoppable rise of Zara

After its landing in Shanghai, Zara currently counts with 182 stores in China. The brand is undergoing a process of rapid expansion, but gradual: after settling in major cities, continues to expand its business model in medium-sized cities –Second and Third Tier cities-.

The expansion of Zara in China occurs while increasing its international presence; the company is already present in 90 countries with a network of 2.170 stores…and there are still much more worlds to conquer.

In a curious twist of fate, while Zara undertakes an ambitious international growth -focused on Asia-, some others Chinese counterparts are the ones which starts their landing in Europe. It is especially noteworthy the case of Chinese Mulaya. Born in a spirit reminiscent of Zara, it advances rapidly in the West as a flagship Chinese in women’s clothing.

Ten years to become one of the 10 most recognized brands by Generations Y & Z

It would be this August when the Chinese RTG Consulting launched its latest study 2016 RTG Brand Relevance Report. The Report comes to underline the relevance that some brands reach between so-called Generation Y and Generation Z in China, their consumer behavior and lifestyles.

Surrounded by Chinese –Xiaomi, AliPay, Wechat, Taobao- and some others well-known international brands –Apple, Adidas, Nike, Uniqlo, H&M, Converse, New Balance-, Zara has entered into the Top 10, after becoming the sixth Most Recognized brand in China for the generation under 36 years.

But results are better for the Spanish company when we dive into Clothing brands. If we look at the survey results, we find that young Chinese place Zara as the second most-recognized brand in their industry, just behind Adidas.

China is already the second most important market thanks to ECOMMERCE

Its huge success in China is due to the combination of three main factors we describe below more in detailed:

- Zara offers a constant renewal and an affordable luxury as concept.

- Zara decided to start playing at the Chinese ecommerce scene by the hand of Tmall.com, instead of trying to build its own infrastructure to cover the entire Chinese market.

- Its Electronic commerce policy not only supports the growth of its own Digital industry, but also the Company growth as a whole: it has become a safe way to promote the brand in places where physical presence does not yet exist.

After going through critical situations in its implementation process in China, the company has adapted to the specific conditions of the market to which it is addressed. Zara not only has understood that nowadays, any approach to the Chinese territory must have a policy consistent with the preferences of the target population and be brave and fast to react to local consumer tastes, but also that Ecommerce has become the board in which the battle occurs, an step into future and the key that makes the difference.

All we can we do for you

Inevitably, the present is already future and both are settle on the virtual world. Knowing the ins and outs of the digital industry, take advantage of Ecommerce for the growth of our business and not give up a proactive marketing policy are the keys for successful development in the country.

In the company, we have the experience of an expert team. We are used to deal with the constraints of the Chinese market and we seize opportunities.

Let us team together. Visit us in 2 Open.

Infographic: 10 Things You Need To Know To Build a Chinese Website

A picture is worth a thousand words

After the great success achieved by our two articles 10 Things You Need To Know To Build a Chinese Website (I) (II), in the team we have thought it would be a good idea to summarize and turn them into an infographic.

We hope you enjoy it as much as we enjoyed its elaboration 🙂

Are you looking for a digital marketing and ecommerce agency?

Visit us. Let´s have a talk!

Is Sina Weibo On The Way Out?

There are plenty of Social Media platforms in China: while a few achieve great success, many succumb to a highly competitive scenario.

Result of its dynamism, it is essential to keep attention on the changes that China faces in the digital world.

From 2 Open, we have prepared a brief introduction about Weibo´s current situation.

Our goal is to give you some tips to fully understand what is going on with one of the biggest Chinese Social Media.

Do not hesitate to contact us for a more thorough analysis!

Weibo is a Social Media platform to produce, share and find out Chinese-language content.

As a leading platform, provides an easy way to express in real time and interact with people and corporations.

Its importance is not only due to its capacity to be an official/unofficial news source, but also because it allows people to express themselves in a public way.

The doomsayers come into the picture

Currently, Alibaba is the biggest Chinese e-commerce company: it provides C2C, B2C and B2B sales services via web portals, plus electronic payment services, a shopping search engine and data-centric cloud computing services.

Three years ago, Alibaba bought 18% stock of Weibo. Since then, several media have speculated that Weibo or even Sina might be acquired by Alibaba in a short time.

Encouraged by the rise of Wechat, many marketers have predicted the fall of Weibo. Well, the latest Earnings report proves they were wrong.

Is Weibo on the way out? Let the Earnings speak the truth

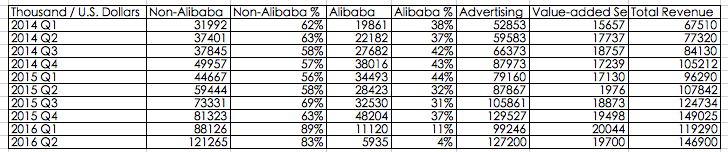

According to official Earnings Report of 2016 Q2 from Sina Weibo, the Net profit of 25.9 million dollars (net revenues of $ 146.9 million) increased 516% compared to the same period last year.

Moreover, Weibo 2016 Q2 data shows the Total revenue of Weibo is 146.9 million, including 127.2 million revenue from Advertising business, value-added services $ 19.7 million for value-added services.

Let’s review the users’ data on Weibo now

Monthly Active Users –MAU- is 282 million, increase 33% compared to the same period of last year. In addition, Daily Active Users –DAU- is 126 million with 36% increase compared to same period of last year.

Is noteworthy that 89% of them are mobile users.

The progress is closely related to their own media advantage

Three years ago, relying on its social communication advantages, Weibo attracted $ 600 million of Alibaba, while became an effective channel for celebrity campaigns, events, marketing and other commercial activities.

After that, Weibo focused on the advertising model. At the end, it decided to put aside Alibaba and manage the business alone.

In 2016 Q1, advertising investment from small and medium enterprises increased 147%. The quantity of SME’s and self-service advertisers reached 830K with 25% increase compared to previous quarter.

In 2016 Q1, investment in small and medium advertising revenue grew 147%, the number of SMEs and self-service advertisers reached 830,000 and a 25% increase the previous quarter.

Why both SMEs and big brands value Weibo a lot?

Both leverage it as an important channel frequently, specially because:

- Increase of traffic and users with 282 million MAU

- Optimized Algorithm of Ad Platform

- Active Internet Celebrities

- Live-streaming

The outbreak of short videos

We should add that speaking of its development path, the outbreak of short videos is also a milestone of growth of Weibo.

According to the 2016 Q2 Earning report, the playback amount of short videos on Weibo has increased 200%.

Meanwhile, the Internet celebrity economy is rapidly booming. Based on short videos, live-streaming broadcast and e-commerce, Weibo occupies the core position of social media with its incredible social power.

Margin improvement for future

The operating leverage will keep being prominent in the future. Based on the non-GAAP, the operating Margin rate of Weibo was 23.6% in the second quarter.

It is expected that the Weibo´s operating Margin rate could reach 25.2% in the third quarter, 23.4% in 2016 financial year, and 28.7% in 2017 financial year.

After seven years, Weibo proves to the world its strength and influence.

Do you still think Weibo is on the way out?

Our Digital Marketing and Ecommerce Agency have the experience of a team dedicated to know in depth the Chinese Social Media.

If you are looking to push your sales in China, do not hesitate to contact us.

Moreover, if you are interested in receiving to your mail the latest trends of Chinese Social Media, please suscribe to our monthly Newsletter!

This article has been edited by Paula Vicuña, from 2 Open.

Why China E-commerce Goes So Fast?

All of us are very well aware of the magnitude of the Chinese online market and, although it is currently the largest Ecommerce market in the world, it is also the most changeable one.

From 2 Open, we want to enable your approach to China giving you some practical guidelines about the current state of Ecommerce in China.

Understanding what is happening in China needs time and a constant willingness to learn: sometimes its fast evolution makes it hard to follow the new trends, other times foreigners just find an incomplete analysis.

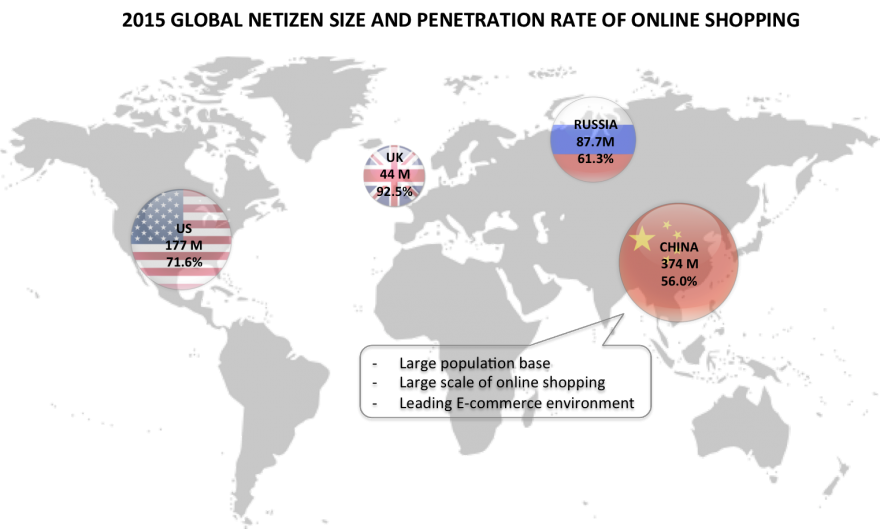

According to the analysis report done by Data Center of China Internet -from now on DCCI-, China has currently taken the first place as the greatest E-commerce country in the world, while the online shopping penetration rate of China is in the second place after United States.

The result of China E-commerce indicates the Chinese economic keystone in recent years, also their development trend of commerce in the future.

As a result, in 2 Open we strongly believe there are more opportunities in the future for E-commerce development.

There are a range of factors we should take into consideration in our approach to the country:

E-commerce market is booming, due to the existence of multiple factors which stimulate the development

In 2015 in China, penetration rate of online shopping reached to 56%. This means there is a huge space to further development comparing with the most-developed countries, and a great opportunity to companies coming to China.

Although there are many factors which are promoting the trend, the main reasons can be summarized in a set of main points:

- Population: Until June 2015, China has 668 million netizens, 594 million mobile phone users and 374 million online shoppers. This leads us to a great size of online shoppers and a strong demand in domestic market.

- Policy: China and its Government have adapted many strategies and measures to promote the E-commerce development. It is a fact that the confluence of two forces have achieved incredible results in recent times.

- Technology: The mature E-commerce relating technologies facilitates the promotion of various industries, especially those related to the Big Data, Internet security, Online payment and Mobile technology. A niche market that is worthy.

- Enterprise: Internet companies have finally joined and distribute to the whole industry, so the result has been that most of the traditional E-commerce companies are transforming to the New Model. Thanks to it, the industry chains of BAT (Baidu, Alibaba, Tencent) cover a large area in China and it is expected to keep growing in future.

- Ecological Integration: The whole industry is getting into a mixture between online and offline industry. Take a look to Alibabas example: they have relied on the industry chain of E-commerce to integrate video, games, travel, finance and other fields into a complete unity. That is the future!

- Basic Infrastructure: Internet infrastructure develops rapidly, especially the Mobile Internet. But also 4G is changing the scene: in the end of July 2015, China 4G accumulated more than 250 million users and 4G base stations were over 1.53 million, of which the construction of TD-LTE base stations were over 1 million. Nowadays, 4G smart phone has already accounted for 82.7% of the domestic smartphone market and seems there is still a gap to fill.

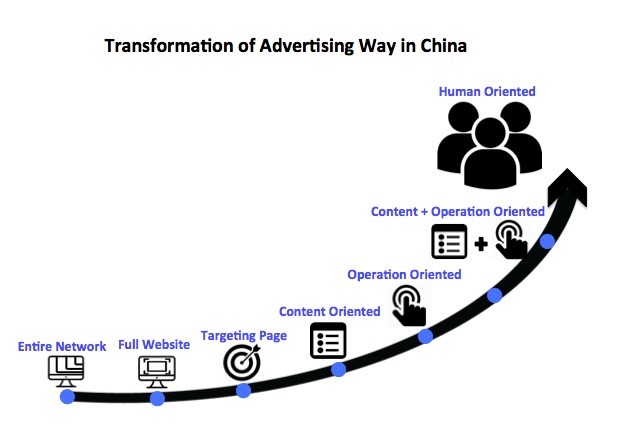

Accommodating to the human-oriented strategy, the E-commerce marketing gets a standout result

With the diversification of E-commerce, the elements influence on the marketing result also became complicated, thus the marketing KPIs should be clear for the marketing themes and goals.

E-commerce marketing has changed from past into a new model of advertising, which is accommodated to the Internet users.

The Model of procedural purchase facilitates the result of advertising, optimizing the convention, and achieves 3 times of ROI:

- The user is the focus: Advertisement position of E-commerce marketing is transforming into human-oriented.

- Procedural purchase is pushing E-commerce marketing into OTG (On-The-Go) model.

Rapid growth of mobile terminal and Big Data brings more commercial values

Now in China Ecommerce market, users, marketing and advertisement investors are in favor of mobile terminal. With the development of mobile technology, the traditional business was greatly impacted.

¿The result? Big Data sharing connects user, product and service together; each data channel communicate with others can release a higher-value data stream.

Vigorously develop of the “festival event”

In recent years, the festival promotion has become an important way of arresting customers. Since November 2011, it has already turned into a battle for the Chinese leading E-commerce companies.

But also the advantage of big data sharing and innovated technology did a tremendous support in the precise marketing and advertisement.

Take Tmall as an example: in 2015, the turnover of Tmall reached ¥57.1 billion just in one day. A huge amount that can still increase.

The tremendous transformation that China lives, cannot be understood without experiencing it by firsthand.

From 2 Open, we have a global perspective and the expertise any company thinking on coming to China needs to develop its business in the country.

If you are looking to take advantage of Chinese Ecommerce, we will be happy to help you.

This article has been edited by Paula Vicuña, from 2 Open

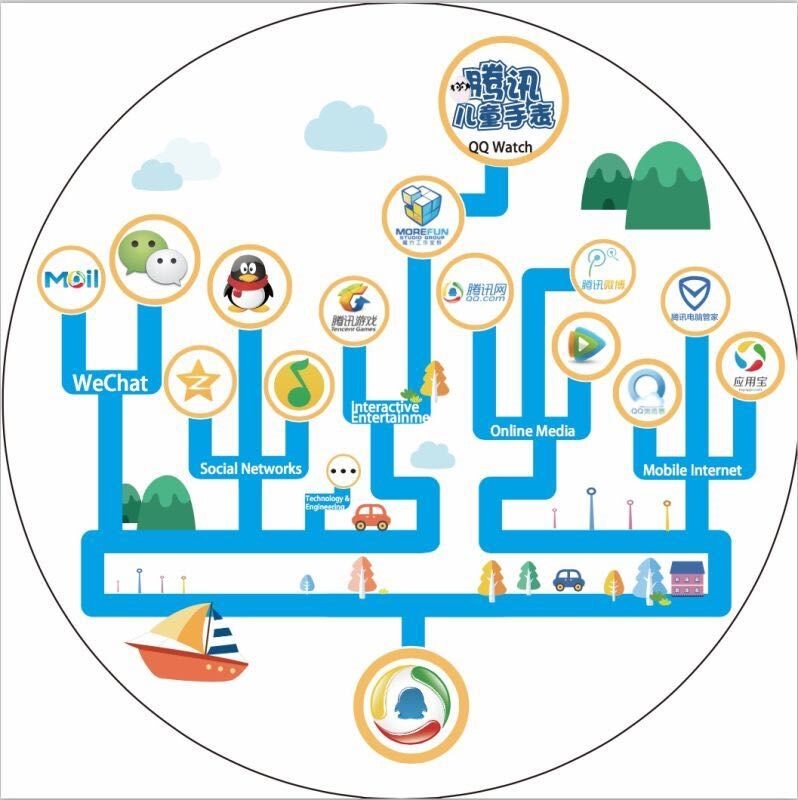

How to use Tencent Penguin Intelligence in your approach to the Chinese market?

Are you looking for the latest news of Tech innovation in China?

The goal of this article is to shed some lights of why Penguin Intelligence is a work-tool to keep in mind on your approach to China.

Penguin Intelligence is the official data platform from Tencent Technology

Tencent Research Organization works such as a professional organization which publishes in-depth reports about the Chinese mobile ecosystem.

Penguin Intelligence performs research and advocacy concerning hot-topics. It also studies markets, trends and best emerging practices.

Their work is founded on a rigorous thorough understanding of every Industry Focus, Sector Dynamics, Case Studies, Data Analysis and Macro environment.

Penguin Intelligence is constantly optimizing the analytical model

Penguin Intelligence is your best choice if you want to figure out what is happening in Chinese Internet Industry. Unfortunately, their business analysis and reports are only available in Chinese for the moment.

Penguin Intelligence also counts with three original sub-columns:

- Penguin Investigation

- Penguin Analysis

- Penguin Portfolio

In addition, Penguin Intelligence includes an Open Platform, which is a huge cohesion of all wisdom from China technological business.

What will you find in Penguin Intelligence?

As we have mention above, Penguin Intelligence contains a full variety of reports, infographics and data.

There are more than thirty valuable Business research reports, hundreds of in-depth analysis reports that have been already published and the Platform keeps growing every day.

The influence of these reports / studies has touched up multiple areas of Internet and traditional industries.

Due to its importance, Penguin Intelligence currently enjoys high reputation and credibility in Governments and Enterprises.

To illustrate the kind of searches which can be done, from 2 OPEN we have compiled a brief list of some of the most striking examples that you can find on the Platform:

- In-depth reports and fresh data about Tencent ecosystem; WeChat public accounts: What type of articles get the most attention from readers?

- Many infographics and graphs about mobile ecosystem in China; iPhoneS sales in China

- Data about digital marketing customer behavior; Do customers prefer hongbao or discounts?

Relying on Tencent, Penguin Intelligence contains a large user base and massive data advantage of products in multiple fields:

- Social networking application: WeChat (Most-used application in China)

- Social networking service: Qzone, Tencent microblog, Tencent Video

- Instant messengers: QQ, QQ International

- Online payment system: TenPay (which is similar to Paypal)

- Cloud storage service: Tencent Weiyun

- Own search engine: Soso.com

- Media player: QQ player, QQ Music, KuGou Music, KuWo Music

- C2C auction site: paipai.com (now merged with JD.com)

The huge scale of Tencent Data is the cornerstone of Penguin Intelligence ability to mine and analyze data, and serving professional market insights and industry reports.

Do you want to discover a little more of Penguin Intelligence?

As a Digital Marketing and Sales Agency, from 2 OPEN we often suggest you to contact us for a deeper understanding of all knowledge Penguin hosts.

Do not forget to subscribe to our Newsletter to receive some special information about China!

This article has been edited by Paula Vicuña from 2 Open.

Do other e-commerce platforms stand a chance against Tmall?

All of us are very well aware of the magnitude of the Chinese online market and, although it is currently the largest e-commerce market in the world, most of the market share is owned by the Chinese e-commerce giant Alibaba. Nevertheless, there are some other companies that also want their piece of the pie and with their vertical e-commerce platforms they are starting to put up a fight. This article will focus mainly on those vertical platforms that constitute an important part of the diverse Chinese e-commerce environment.

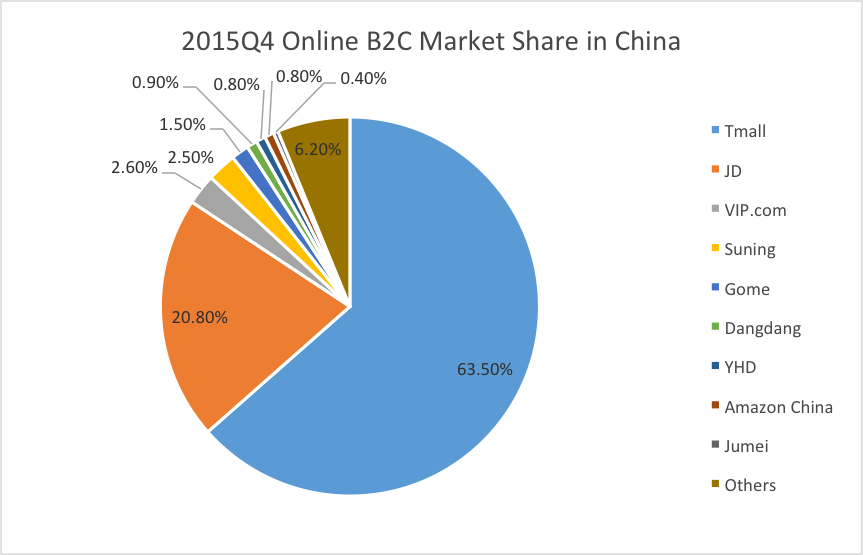

In the 4th quarter of 2015 China’s online transactions surpassed 644.38 billion RMB, the pie chart shown bellow contains the market share of the top ten Chinese e-commerce platforms:

Before we continue, we first have to clarify the concept of vertical e-commerce. In this context, vertical refers vendors that offer goods and/or services that are specific to an industry or customers with specific needs. A vertical e-commerce platforms could be a independent brand or a specified category within a wide range of products such as clothes, 3C (computer, communication, and consumer electronics) products, cosmetics, etc.

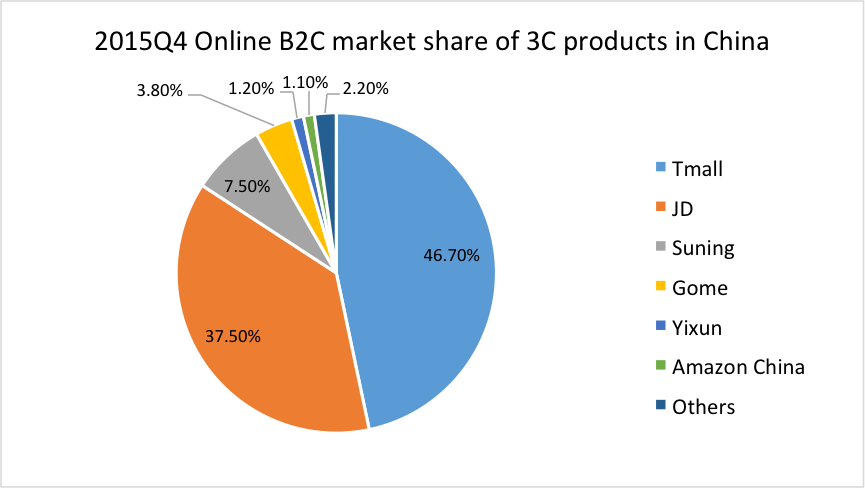

If you already have a basic understanding of the Chinese e-commerce market, then you are probably familiar with JD.com. Currently the second e-commerce platforms in China after Tmall (owned by Alibaba Group), JD.com started as a 3C products vertical B2C website. Now, let us take a look at the market share of 3C products in China B2C online market:

Although Tmall is still on the first spot, the difference in market share of JD.com is considerably higher than with regular products. Tmall and JD.com combined own more than 80% of the Chinese 3C products market. Suning, on the 3rd spot, and Gome, on the 4th, both also started specializing in 3C products, however, nowadays they have also diversified their range of products. At the end, it seems that there are no actual vertical platforms anymore.

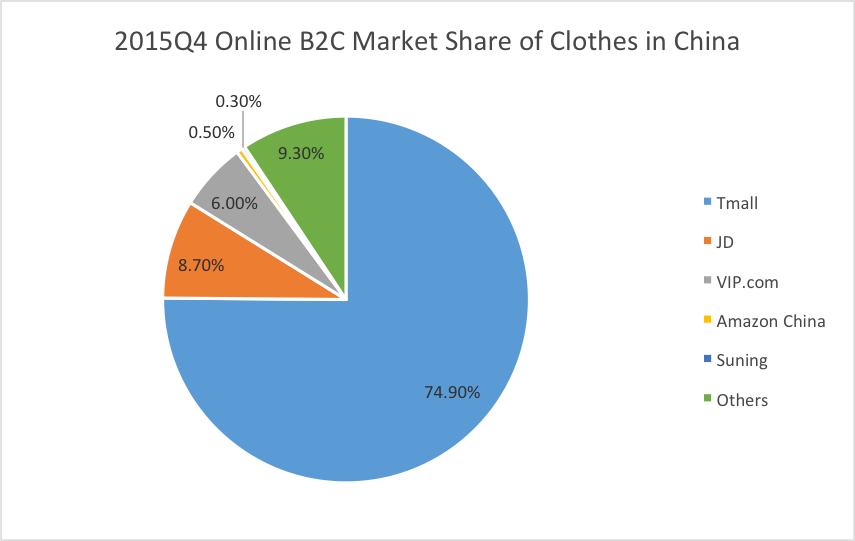

To study the online market, we cannot miss the biggest category, clothes. In the 4th quarter of 2015, the total transaction of clothes is 235.57 billion Yuan, market share is shown below:

In this case, Tmall is leading with an absolute advantage of almost 3/4 of the market share. In this category, JD has 8.7% of the market share, VIP.com has 6%, and surprisingly others do not even have 1% individually, so from the big picture the vertical market for clothes is not active enough.

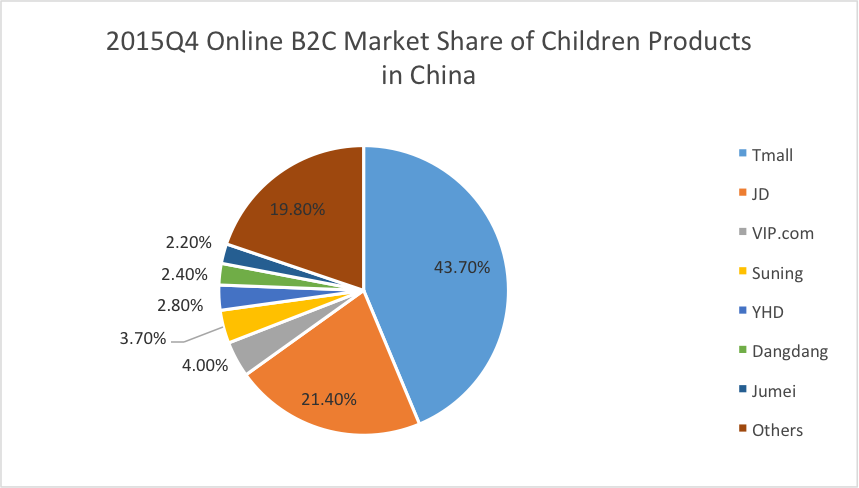

Another category that has had such a rapid growth we cannot ignore is the maternal and children products. Shown below is a pie chart containing China’s maternal and children products market share figures of major competitors in the last quarter of 2015:

The most noticeable difference in comparison with other categories is the porcentage own by other platforms that adds up to almost 20 %. Although Mia, Beibei, Babytree and others are in that 20% it is still a big figure. In this category Tmall and JD.com own less than 70 % of the Chinese clothing market, so we can say, to some extend, that there is still space for vertical players.

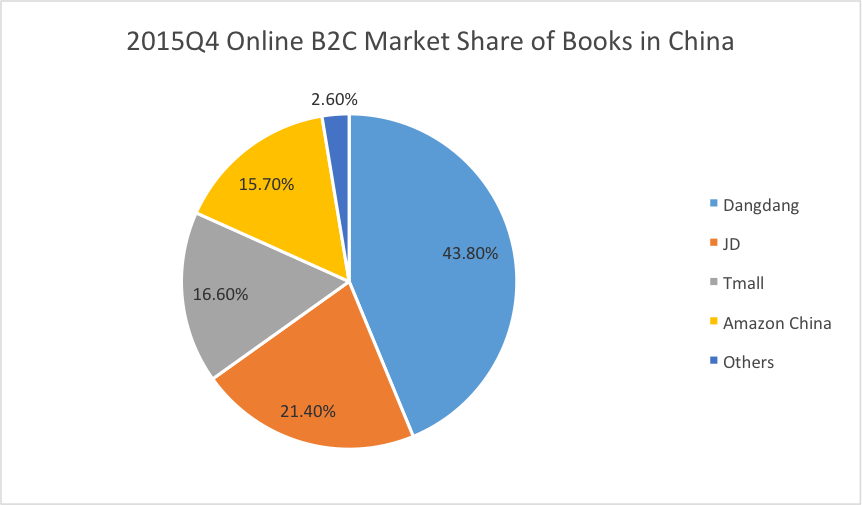

The next category is books and, even though the books total transaction was just 5.31 billion Yuan, the market share gives us a slice hope of competing with general platforms, in this case Dangdang is leading with 43.8%, and Tmall is only on the 3rd spot, just after JD.com.

Finally, we cannot say all vertical online platforms are dead in China just because most of the categories are gloomy, there are still some worth a try, and you just need to know enough about the current situation. If you don’t, luckily you saw this article, and you know 2open can always help you to find the right channels. So don’t hesitate, contact us now!

All in all, even though Tmall dominates in the Chinese market, there is still space for other platforms to flourish. Vertical e-commerce platforms seem to be the wisest option, specify in a certain category, gather information about the current situation in the Chinese market, and carry out your business plan. If you need further information about the market, would like to help you find the right channels, or want us to set up your business in China, do not hesitate in contacting us. Our group of specialists will happily assist you.

This article was edited by Andres Arroyo Olson from 2 Open.

References.

All products data from

http://www.analysys.cn/yjgd/17684.shtml

3C data from

http://www.analysys.cn/yjgd/17676.shtml

Clothes data from

http://www.analysys.cn/yjgd/17678.shtml

Children products data from:

http://www.analysys.cn/yjgd/17680.shtml

Books data from: