Can Specialist Retailers Survive against Alibaba and Amazon?

It is said that whoever hits first, hits twice. Some days ago, Zalando signed a partnership with its biggest competitors, Amazon and Alibaba. Far from thinking that they were wrong, we feel confident about the future of these new alliances between Europe, China and United States.

Zalando was founded in Berlin (Germany) in 2008. Born as an European electronic commerce company, the brand already holds the leadership as the largest online fashion retailer, while also has become the second largest group in Ecommerce in European region.

Zalando was founded in Berlin (Germany) in 2008. Born as an European electronic commerce company, the brand already holds the leadership as the largest online fashion retailer, while also has become the second largest group in Ecommerce in European region.

Although originally its activity was focused in marketplaces, in 2010 Zalando starts its jump into developing and selling its own brands. Online selling shoes, clothes and fashion items constitute the core of the company, under a cross-platform perspective.

A step to break: boundaries to online shopping

Even if such perspective still remains today, observers enjoy its dramatic effects: to an unique Refund – Return policy in retail and a highly attractive shipping, have joined an effective logistic management and a recent prospection in offline context.

Although timidly, its development in the offline environment constitutes a new movement to establish its brand in the retail market and its visibility on some physical multibrand markets in Germany. To this point is joined an attractive shipping policy that enhances its appeal to the consumer: it is fast, secure and in case the users feel dissatisfied with their purchase, they have the chance to return them within 90 days.

Even if its payment and reimbursed model is constantly criticized for its high risk, it is also truth that this pillar has become an emblem for Zalando, its trademark and distinction over its competitors.

Zalando pushes online to grow

The company shows a steady growth in its presence in Europe, while designing its jump to the international area. The future seems promising according to their latest analysis prospects, with a year revenue growth close to 20%.

This rise is the result of three main reasons:

- Its total adaptation to mobile user experience: U-commerce is the new king in sales –check our articles “How to Take Advantage of the Latest E-commerce Revolution? U-commerce Trend” and “5 Things to Avoid When Doing Business in China” to discover a bit more!–

- Mobile purchases are already more than half of its sales

- A wide range of products and therefore, a great audience to address

- Its advantage of using a vast network of online platforms

A twist to Ecommerce

The desire of the Group is boosting its international sales and take advantage of the huge possibilities that the electronic market and their highly developed logistics presents to them.

To achieve its goals, Zalando has woven alliances with the giants of E-commerce: Amazon and Alibaba. Although its presence on Tmall is expected for the coming months, its bet for B2C trade -previously discussed by us in our article “Do Other Ecommerce Platforms Stand a Chance Against Tmall?”- some steps further on international distribution are already in discussion.

It is worth noticing that this giant enterprises are transforming traditional business into a new business model. Digital Marketing and Ecommerce helps to create new partnership systems for other companies around the World, and it will become more and more important in the following years.

In search of a Digital and Ecommerce Company? If you have any question or require any information about our services,

Sources:

How to Leverage Chinese Ecommerce to Become a Top 10: The Rise of Zara

Some months ago, we identified some Insights on ZARA in the Chinese digital market that came to underline its first steps on Chinese Ecommerce and the main reasons which led the company to choose Tmall as its official flagship store.

Zara´s stay in China began ten years ago and would not be long before the Management decided to set up its own online shopping website The Zara China and publish an M-shop called Zara.

What has been the result of the policy undertaken in recent years?

The unstoppable rise of Zara

After its landing in Shanghai, Zara currently counts with 182 stores in China. The brand is undergoing a process of rapid expansion, but gradual: after settling in major cities, continues to expand its business model in medium-sized cities –Second and Third Tier cities-.

The expansion of Zara in China occurs while increasing its international presence; the company is already present in 90 countries with a network of 2.170 stores…and there are still much more worlds to conquer.

In a curious twist of fate, while Zara undertakes an ambitious international growth -focused on Asia-, some others Chinese counterparts are the ones which starts their landing in Europe. It is especially noteworthy the case of Chinese Mulaya. Born in a spirit reminiscent of Zara, it advances rapidly in the West as a flagship Chinese in women’s clothing.

Ten years to become one of the 10 most recognized brands by Generations Y & Z

It would be this August when the Chinese RTG Consulting launched its latest study 2016 RTG Brand Relevance Report. The Report comes to underline the relevance that some brands reach between so-called Generation Y and Generation Z in China, their consumer behavior and lifestyles.

Surrounded by Chinese –Xiaomi, AliPay, Wechat, Taobao- and some others well-known international brands –Apple, Adidas, Nike, Uniqlo, H&M, Converse, New Balance-, Zara has entered into the Top 10, after becoming the sixth Most Recognized brand in China for the generation under 36 years.

But results are better for the Spanish company when we dive into Clothing brands. If we look at the survey results, we find that young Chinese place Zara as the second most-recognized brand in their industry, just behind Adidas.

China is already the second most important market thanks to ECOMMERCE

Its huge success in China is due to the combination of three main factors we describe below more in detailed:

- Zara offers a constant renewal and an affordable luxury as concept.

- Zara decided to start playing at the Chinese ecommerce scene by the hand of Tmall.com, instead of trying to build its own infrastructure to cover the entire Chinese market.

- Its Electronic commerce policy not only supports the growth of its own Digital industry, but also the Company growth as a whole: it has become a safe way to promote the brand in places where physical presence does not yet exist.

After going through critical situations in its implementation process in China, the company has adapted to the specific conditions of the market to which it is addressed. Zara not only has understood that nowadays, any approach to the Chinese territory must have a policy consistent with the preferences of the target population and be brave and fast to react to local consumer tastes, but also that Ecommerce has become the board in which the battle occurs, an step into future and the key that makes the difference.

All we can we do for you

Inevitably, the present is already future and both are settle on the virtual world. Knowing the ins and outs of the digital industry, take advantage of Ecommerce for the growth of our business and not give up a proactive marketing policy are the keys for successful development in the country.

In the company, we have the experience of an expert team. We are used to deal with the constraints of the Chinese market and we seize opportunities.

Let us team together. Visit us in 2 Open.

Is Sina Weibo On The Way Out?

There are plenty of Social Media platforms in China: while a few achieve great success, many succumb to a highly competitive scenario.

Result of its dynamism, it is essential to keep attention on the changes that China faces in the digital world.

From 2 Open, we have prepared a brief introduction about Weibo´s current situation.

Our goal is to give you some tips to fully understand what is going on with one of the biggest Chinese Social Media.

Do not hesitate to contact us for a more thorough analysis!

Weibo is a Social Media platform to produce, share and find out Chinese-language content.

As a leading platform, provides an easy way to express in real time and interact with people and corporations.

Its importance is not only due to its capacity to be an official/unofficial news source, but also because it allows people to express themselves in a public way.

The doomsayers come into the picture

Currently, Alibaba is the biggest Chinese e-commerce company: it provides C2C, B2C and B2B sales services via web portals, plus electronic payment services, a shopping search engine and data-centric cloud computing services.

Three years ago, Alibaba bought 18% stock of Weibo. Since then, several media have speculated that Weibo or even Sina might be acquired by Alibaba in a short time.

Encouraged by the rise of Wechat, many marketers have predicted the fall of Weibo. Well, the latest Earnings report proves they were wrong.

Is Weibo on the way out? Let the Earnings speak the truth

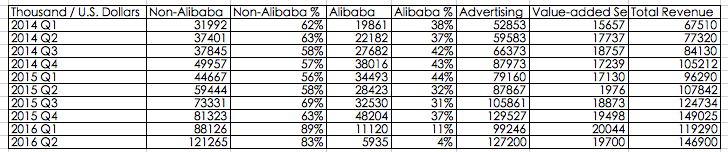

According to official Earnings Report of 2016 Q2 from Sina Weibo, the Net profit of 25.9 million dollars (net revenues of $ 146.9 million) increased 516% compared to the same period last year.

Moreover, Weibo 2016 Q2 data shows the Total revenue of Weibo is 146.9 million, including 127.2 million revenue from Advertising business, value-added services $ 19.7 million for value-added services.

Let’s review the users’ data on Weibo now

Monthly Active Users –MAU- is 282 million, increase 33% compared to the same period of last year. In addition, Daily Active Users –DAU- is 126 million with 36% increase compared to same period of last year.

Is noteworthy that 89% of them are mobile users.

The progress is closely related to their own media advantage

Three years ago, relying on its social communication advantages, Weibo attracted $ 600 million of Alibaba, while became an effective channel for celebrity campaigns, events, marketing and other commercial activities.

After that, Weibo focused on the advertising model. At the end, it decided to put aside Alibaba and manage the business alone.

In 2016 Q1, advertising investment from small and medium enterprises increased 147%. The quantity of SME’s and self-service advertisers reached 830K with 25% increase compared to previous quarter.

In 2016 Q1, investment in small and medium advertising revenue grew 147%, the number of SMEs and self-service advertisers reached 830,000 and a 25% increase the previous quarter.

Why both SMEs and big brands value Weibo a lot?

Both leverage it as an important channel frequently, specially because:

- Increase of traffic and users with 282 million MAU

- Optimized Algorithm of Ad Platform

- Active Internet Celebrities

- Live-streaming

The outbreak of short videos

We should add that speaking of its development path, the outbreak of short videos is also a milestone of growth of Weibo.

According to the 2016 Q2 Earning report, the playback amount of short videos on Weibo has increased 200%.

Meanwhile, the Internet celebrity economy is rapidly booming. Based on short videos, live-streaming broadcast and e-commerce, Weibo occupies the core position of social media with its incredible social power.

Margin improvement for future

The operating leverage will keep being prominent in the future. Based on the non-GAAP, the operating Margin rate of Weibo was 23.6% in the second quarter.

It is expected that the Weibo´s operating Margin rate could reach 25.2% in the third quarter, 23.4% in 2016 financial year, and 28.7% in 2017 financial year.

After seven years, Weibo proves to the world its strength and influence.

Do you still think Weibo is on the way out?

Our Digital Marketing and Ecommerce Agency have the experience of a team dedicated to know in depth the Chinese Social Media.

If you are looking to push your sales in China, do not hesitate to contact us.

Moreover, if you are interested in receiving to your mail the latest trends of Chinese Social Media, please suscribe to our monthly Newsletter!

This article has been edited by Paula Vicuña, from 2 Open.

Do other e-commerce platforms stand a chance against Tmall?

All of us are very well aware of the magnitude of the Chinese online market and, although it is currently the largest e-commerce market in the world, most of the market share is owned by the Chinese e-commerce giant Alibaba. Nevertheless, there are some other companies that also want their piece of the pie and with their vertical e-commerce platforms they are starting to put up a fight. This article will focus mainly on those vertical platforms that constitute an important part of the diverse Chinese e-commerce environment.

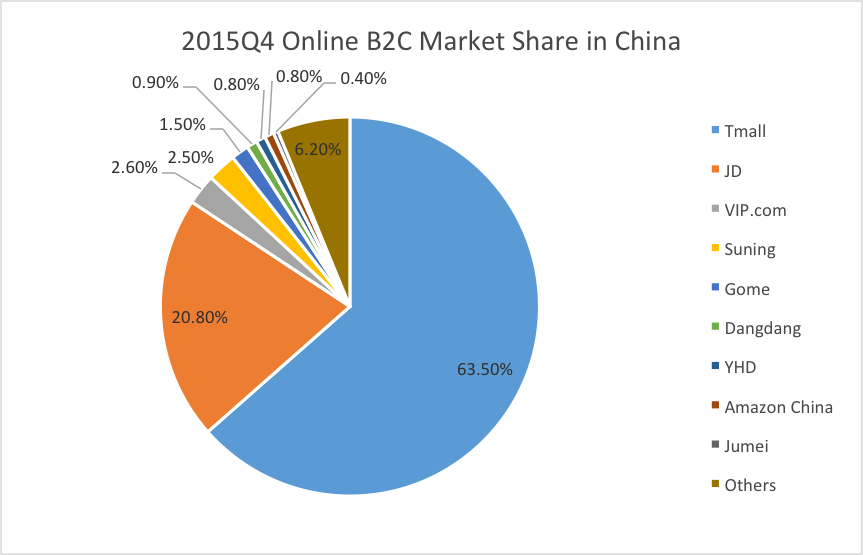

In the 4th quarter of 2015 China’s online transactions surpassed 644.38 billion RMB, the pie chart shown bellow contains the market share of the top ten Chinese e-commerce platforms:

Before we continue, we first have to clarify the concept of vertical e-commerce. In this context, vertical refers vendors that offer goods and/or services that are specific to an industry or customers with specific needs. A vertical e-commerce platforms could be a independent brand or a specified category within a wide range of products such as clothes, 3C (computer, communication, and consumer electronics) products, cosmetics, etc.

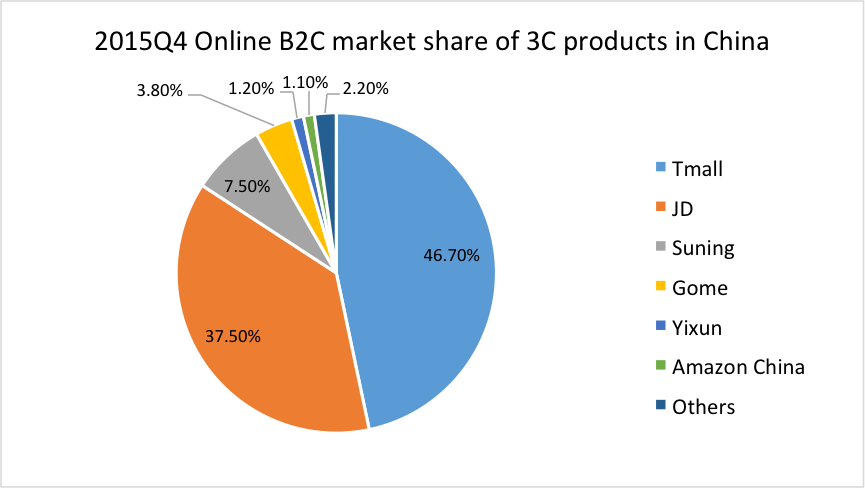

If you already have a basic understanding of the Chinese e-commerce market, then you are probably familiar with JD.com. Currently the second e-commerce platforms in China after Tmall (owned by Alibaba Group), JD.com started as a 3C products vertical B2C website. Now, let us take a look at the market share of 3C products in China B2C online market:

Although Tmall is still on the first spot, the difference in market share of JD.com is considerably higher than with regular products. Tmall and JD.com combined own more than 80% of the Chinese 3C products market. Suning, on the 3rd spot, and Gome, on the 4th, both also started specializing in 3C products, however, nowadays they have also diversified their range of products. At the end, it seems that there are no actual vertical platforms anymore.

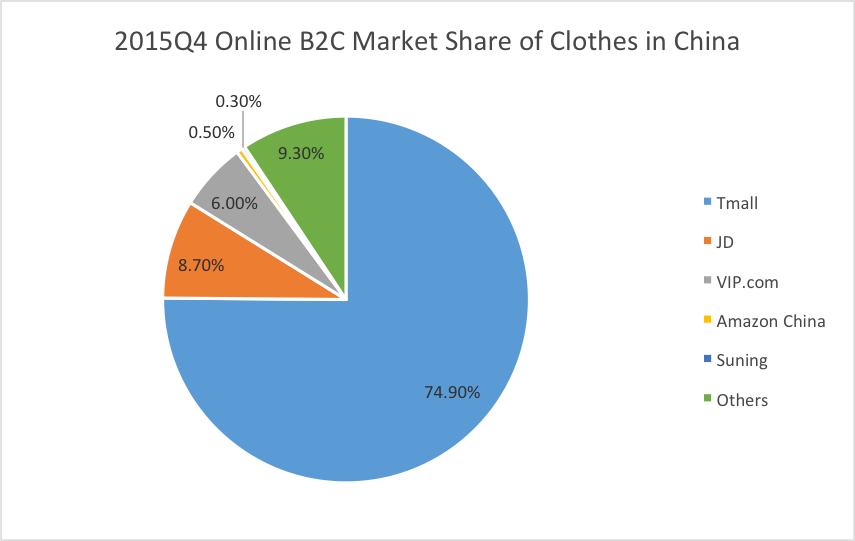

To study the online market, we cannot miss the biggest category, clothes. In the 4th quarter of 2015, the total transaction of clothes is 235.57 billion Yuan, market share is shown below:

In this case, Tmall is leading with an absolute advantage of almost 3/4 of the market share. In this category, JD has 8.7% of the market share, VIP.com has 6%, and surprisingly others do not even have 1% individually, so from the big picture the vertical market for clothes is not active enough.

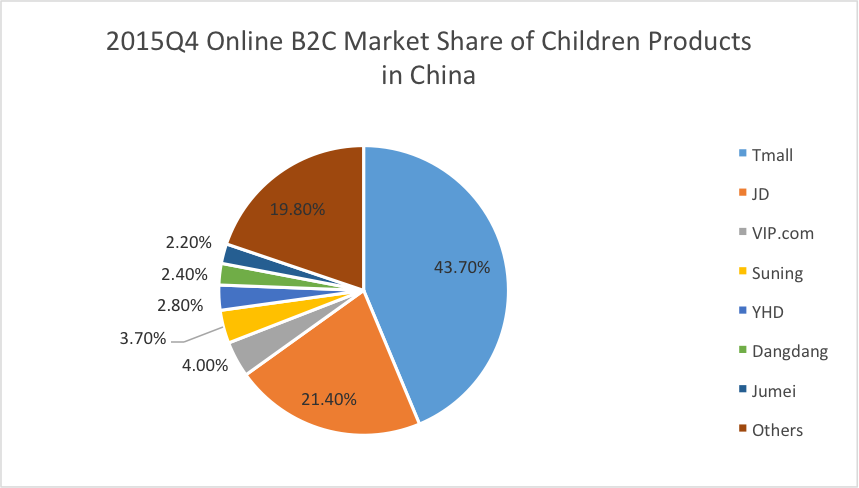

Another category that has had such a rapid growth we cannot ignore is the maternal and children products. Shown below is a pie chart containing China’s maternal and children products market share figures of major competitors in the last quarter of 2015:

The most noticeable difference in comparison with other categories is the porcentage own by other platforms that adds up to almost 20 %. Although Mia, Beibei, Babytree and others are in that 20% it is still a big figure. In this category Tmall and JD.com own less than 70 % of the Chinese clothing market, so we can say, to some extend, that there is still space for vertical players.

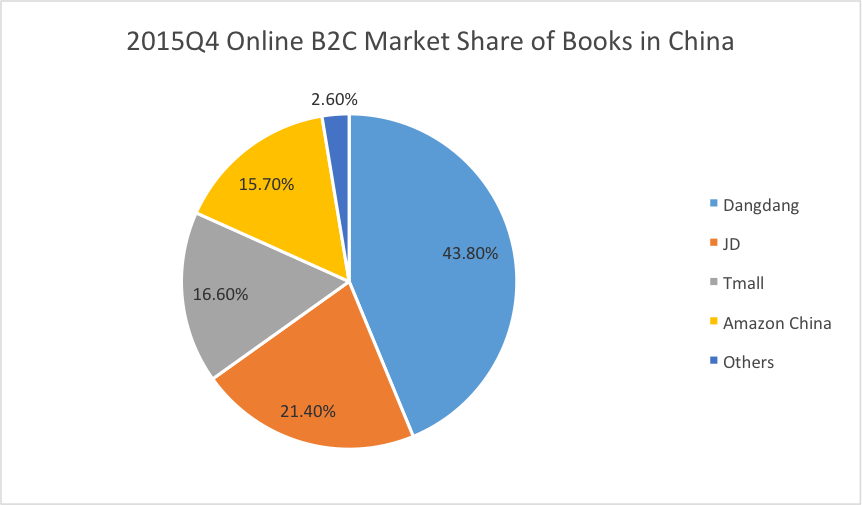

The next category is books and, even though the books total transaction was just 5.31 billion Yuan, the market share gives us a slice hope of competing with general platforms, in this case Dangdang is leading with 43.8%, and Tmall is only on the 3rd spot, just after JD.com.

Finally, we cannot say all vertical online platforms are dead in China just because most of the categories are gloomy, there are still some worth a try, and you just need to know enough about the current situation. If you don’t, luckily you saw this article, and you know 2open can always help you to find the right channels. So don’t hesitate, contact us now!

All in all, even though Tmall dominates in the Chinese market, there is still space for other platforms to flourish. Vertical e-commerce platforms seem to be the wisest option, specify in a certain category, gather information about the current situation in the Chinese market, and carry out your business plan. If you need further information about the market, would like to help you find the right channels, or want us to set up your business in China, do not hesitate in contacting us. Our group of specialists will happily assist you.

This article was edited by Andres Arroyo Olson from 2 Open.

References.

All products data from

http://www.analysys.cn/yjgd/17684.shtml

3C data from

http://www.analysys.cn/yjgd/17676.shtml

Clothes data from

http://www.analysys.cn/yjgd/17678.shtml

Children products data from:

http://www.analysys.cn/yjgd/17680.shtml

Books data from:

Jumpstart your E-commerce business in China

E-commerce in China is growing so rapidly and it appears to have big rewards for those who manage to thrive in the market. Problems for companies who want to enter China arise due to limited knowledge about the Chinese market and the variety of e-commerce platforms, but how exactly should you start your e-commerce business in China? Where should you start?

Indeed, there are countless B2C (Business-to-customer) e-commerce platforms in China, Tmall/Taobao are in the leading position, followed by JD, then VIP.com, Suning, Gome, Dangdang, YHD, Amazon China, and so on. Usually each platform has a deposit, some annual fees, and commissions. If your are starting your e-commerce business opening a Tmall/Taobao shop first would be a smart move from your part, later, when your business grows, you could extent and broaden your sales channels. You might be wondering, Why Tmall/Taobao? Why here and not in other platforms?

Firstly, let us look at this from an investor’s point of view, minimizing initial investment. For a Tmall shop different products and shop types have different deposit amounts that range from 50,000 RMB to 150,000 RMB. The annual service fees are 30,000 RMB or 60,000 RMB depending on the category, they may be half or totally refunded if the business is good enough to reach certain revenue. As for the commissions, different categories also have different commission rates, commissions in Tmall start from 0.5% to 5%, this is quite competitive since other usually range from 10% to 15%. After all, Tmall is mainly an open platform for all vendors.

Some small companies or cautious companies should consider starting with a Taobao shop. Taobao is supposed to be a C2C platform, since its requirements, compared to the ones of Tmall, are considerably lower, some small companies opt to start with a Taobao shop first. Why is this option so appealing to small companies? There are two types of Taobao shops to choose from, the first one is owned by a person and the second one is owned by a company. The personal Taobao shop can be upgraded into a company account if the owner is the legal representative or a shareholder. The best thing about Taobao is that it is free, you only need 1000 RMB as the deposit and Taobao has no annual fees or commissions. For those who are really cautious or lack resources, this might turn out to be a wise choice.

Secondly, let us analyse the human resource factor. You might have agencies working for you or maybe a few employees; however, trying to start with all channels at once may not always be the best option for your business. To successfully manage an e-commerce shop it takes dedication and time, even though opening a shop is not a difficult task, managing that shop is. Analyse, optimize traffic and content, and increase sales is something that requires time and focus. The target is to turn those open channels into productive channels, it is worth mentioning that most of these e-commerce platforms are similar or even copy Tmall/Taobao, so getting familiar with platforms is kind of like getting familiar with the e-commerce industry in China.

How is the e-commerce environment looking in China? Tmall/Taobao have been leading the free traffic in China for years, each day there are more than 40 million visitors on Taobao. Even Suning, Dangdang, YHD and Amazon China now opening their shops on Tmall.

As for the payment side, Taobao/Tmall have their own payment method, Alipay. With more than 0.3 billion registered users, 0.27 billion active users, and links to over 180 banks both in China and other countries, Alipay is the largest third party online payment platform in China, some active users even use Alipay to pay for their home power, gas and water fees. It makes it easier for consumers to pay.

Finally, let us discuss product control. Since Tmall/Taobao are mainly open platforms, vendors have almost fully control of their products. You can categorize the type of product your selling, upload or remove it anytime you want and also have full control of the price and logistics company you want to use to deliver your products.

So if you are planning on entering the Chinses market through e-commerce you might want to start with a Tmall or Taobao shop first. Here at 2Open we specialize in digital marketing and e-commerce, our goal is to understand our clients business needs, in order to provide the best possible services. If you have any questions or require any information about our services, please do not hesitate in contacting us, our group of specialists will happily assist you.

This article was edited by Andres Arroyo Olson from 2Open.

References: