Europe and China Partner to Provide Mobile Payment Solutions by Alipay

Not quite a month we woke up with the news that two technological giants had joined forces in creating an alliance with huge chance of success. The alliance between Ingenico Group and Alipay is focused on payments innovation as part of a wider international push, but is also a recent demonstration of the growing momentum of Chinese companies in Europe.

Over recent years, Chinese ambitions in Europe are clearly visible: just in 2016, Alipay has forged alliances with Uber app and Wirecard to offer mobile payments services around the World.

The alliance is based in European mobile payments

Ingenico Group is a french company specialized in designing a wide range of payment solutions, whatever the sales channel or payment method is chosen, according to three main needs that merchants and consumer ask: a secure, easy and seamless experience.

In recent years, China has created a vast and well integrated digital ecosystem in which highlights Alipay– a Chinese equivalent to PayPallaunch by Alibaba– which is already China’s leading third-party online payment solution with no transaction fees. The company already has more than 400,000,000 active Users.

Although there are many reasons behind this alliance, the clear purpose was to tap into the huge Chinese tourist flow in Europe. As we wrote in our previous article “How to Acquire Chinese Tourists through Digital Marketing“, the Chinese tourism consumption is already estimated to be the highest in the World. Moreover, Chinese tourism market will keep growing even faster: in year 2019, estimations says that consumption will reach US 264 billion dollars.

Although there are many reasons behind this alliance, the clear purpose was to tap into the huge Chinese tourist flow in Europe. As we wrote in our previous article “How to Acquire Chinese Tourists through Digital Marketing“, the Chinese tourism consumption is already estimated to be the highest in the World. Moreover, Chinese tourism market will keep growing even faster: in year 2019, estimations says that consumption will reach US 264 billion dollars.

The motivation to exploit the partnership is shared: on the one hand, Europe has become the major vacation destination by a sector of the population with high standard of living; on the other hand, Alipay seeks to exploit the existence of more than 120 million Chinese tourists arriving in Europe every year and an approximately cost of $ 875 on average, while offering a payment experience nearest to their day to day.

Chinese tourists in Europe will be able to pay via Alipay App at any store that uses the Ingenico solution

The announcement not only underscores the growing relationship in business between two increasingly interconnected areas, but also the enormous benefits that such collaboration can mean to both. With such a perspective, it is not surprising the happy ending. As Philippe Lazare, Chief Executive Officer of Ingenico Group said,

“We are very excited to partner with Alipay and contribute our unique omni-channel expertise, products and services to help them optimize the user experience and boost sales all over the world. Their choice for Ingenico is a tribute to our high success rate and ability to meet even the most demanding customers’ requirements.”

Chinese tourists are accustomed to using electronic payment methods, an innovation that fails to catch on among European citizens. Presumably, this cultural difference has become a barrier that discourages expenditure among Chinese tourists. As Jacques Behr, Ingenico’s executive vice-president for Europe and Africa said,

Chinese tourists are accustomed to using electronic payment methods, an innovation that fails to catch on among European citizens. Presumably, this cultural difference has become a barrier that discourages expenditure among Chinese tourists. As Jacques Behr, Ingenico’s executive vice-president for Europe and Africa said,

“Payment becomes a friction for business so we are removing this friction by allowing the retailers to capture sales to the Chinese tourist population.”

The measure therefore seeks to stimulate Chinese people expenditure in their major holiday destination, but also tries to take advantage of the huge market Alipay already has in China: more than 450 million users liable to become target audience, and a market share in mobile payments in China higher than 80%. As they themselves spelled out,

“We are building international business step by step. There is much still to do with our customer base, and is still expanding.”

Such collaboration not only benefits the Chinese people, but also means a qualitative leap in technological enjoyment for Europeans. The alliance seeks to provide to European online retailers and to customers the possibility to pay and accept payments through Alipay´s eWallet through some marketplaces. An excellent way to boost e-commerce and sales in China and Europe.

Although the operation has already begun, both companies estimate that Alipay won’t be fully operational in Europe yet.

Just to start

While Alipay makes its movements, the rest of the world watches. Only companies that have a deep understanding of Chinese market can cope with the changes that are to come.

In search of accurate and personalized information to your sector and business?

Visit our Digital Marketing and eCommerce Agency!

Sources:

How to Leverage Chinese Ecommerce to Become a Top 10: The Rise of Zara

Some months ago, we identified some Insights on ZARA in the Chinese digital market that came to underline its first steps on Chinese Ecommerce and the main reasons which led the company to choose Tmall as its official flagship store.

Zara´s stay in China began ten years ago and would not be long before the Management decided to set up its own online shopping website The Zara China and publish an M-shop called Zara.

What has been the result of the policy undertaken in recent years?

The unstoppable rise of Zara

After its landing in Shanghai, Zara currently counts with 182 stores in China. The brand is undergoing a process of rapid expansion, but gradual: after settling in major cities, continues to expand its business model in medium-sized cities –Second and Third Tier cities-.

The expansion of Zara in China occurs while increasing its international presence; the company is already present in 90 countries with a network of 2.170 stores…and there are still much more worlds to conquer.

In a curious twist of fate, while Zara undertakes an ambitious international growth -focused on Asia-, some others Chinese counterparts are the ones which starts their landing in Europe. It is especially noteworthy the case of Chinese Mulaya. Born in a spirit reminiscent of Zara, it advances rapidly in the West as a flagship Chinese in women’s clothing.

Ten years to become one of the 10 most recognized brands by Generations Y & Z

It would be this August when the Chinese RTG Consulting launched its latest study 2016 RTG Brand Relevance Report. The Report comes to underline the relevance that some brands reach between so-called Generation Y and Generation Z in China, their consumer behavior and lifestyles.

Surrounded by Chinese –Xiaomi, AliPay, Wechat, Taobao- and some others well-known international brands –Apple, Adidas, Nike, Uniqlo, H&M, Converse, New Balance-, Zara has entered into the Top 10, after becoming the sixth Most Recognized brand in China for the generation under 36 years.

But results are better for the Spanish company when we dive into Clothing brands. If we look at the survey results, we find that young Chinese place Zara as the second most-recognized brand in their industry, just behind Adidas.

China is already the second most important market thanks to ECOMMERCE

Its huge success in China is due to the combination of three main factors we describe below more in detailed:

- Zara offers a constant renewal and an affordable luxury as concept.

- Zara decided to start playing at the Chinese ecommerce scene by the hand of Tmall.com, instead of trying to build its own infrastructure to cover the entire Chinese market.

- Its Electronic commerce policy not only supports the growth of its own Digital industry, but also the Company growth as a whole: it has become a safe way to promote the brand in places where physical presence does not yet exist.

After going through critical situations in its implementation process in China, the company has adapted to the specific conditions of the market to which it is addressed. Zara not only has understood that nowadays, any approach to the Chinese territory must have a policy consistent with the preferences of the target population and be brave and fast to react to local consumer tastes, but also that Ecommerce has become the board in which the battle occurs, an step into future and the key that makes the difference.

All we can we do for you

Inevitably, the present is already future and both are settle on the virtual world. Knowing the ins and outs of the digital industry, take advantage of Ecommerce for the growth of our business and not give up a proactive marketing policy are the keys for successful development in the country.

In the company, we have the experience of an expert team. We are used to deal with the constraints of the Chinese market and we seize opportunities.

Let us team together. Visit us in 2 Open.

Is Sina Weibo On The Way Out?

There are plenty of Social Media platforms in China: while a few achieve great success, many succumb to a highly competitive scenario.

Result of its dynamism, it is essential to keep attention on the changes that China faces in the digital world.

From 2 Open, we have prepared a brief introduction about Weibo´s current situation.

Our goal is to give you some tips to fully understand what is going on with one of the biggest Chinese Social Media.

Do not hesitate to contact us for a more thorough analysis!

Weibo is a Social Media platform to produce, share and find out Chinese-language content.

As a leading platform, provides an easy way to express in real time and interact with people and corporations.

Its importance is not only due to its capacity to be an official/unofficial news source, but also because it allows people to express themselves in a public way.

The doomsayers come into the picture

Currently, Alibaba is the biggest Chinese e-commerce company: it provides C2C, B2C and B2B sales services via web portals, plus electronic payment services, a shopping search engine and data-centric cloud computing services.

Three years ago, Alibaba bought 18% stock of Weibo. Since then, several media have speculated that Weibo or even Sina might be acquired by Alibaba in a short time.

Encouraged by the rise of Wechat, many marketers have predicted the fall of Weibo. Well, the latest Earnings report proves they were wrong.

Is Weibo on the way out? Let the Earnings speak the truth

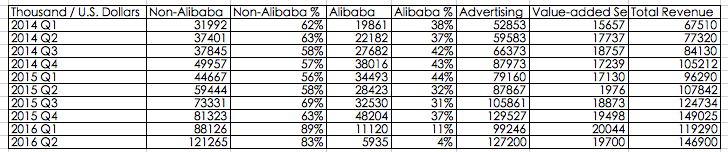

According to official Earnings Report of 2016 Q2 from Sina Weibo, the Net profit of 25.9 million dollars (net revenues of $ 146.9 million) increased 516% compared to the same period last year.

Moreover, Weibo 2016 Q2 data shows the Total revenue of Weibo is 146.9 million, including 127.2 million revenue from Advertising business, value-added services $ 19.7 million for value-added services.

Let’s review the users’ data on Weibo now

Monthly Active Users –MAU- is 282 million, increase 33% compared to the same period of last year. In addition, Daily Active Users –DAU- is 126 million with 36% increase compared to same period of last year.

Is noteworthy that 89% of them are mobile users.

The progress is closely related to their own media advantage

Three years ago, relying on its social communication advantages, Weibo attracted $ 600 million of Alibaba, while became an effective channel for celebrity campaigns, events, marketing and other commercial activities.

After that, Weibo focused on the advertising model. At the end, it decided to put aside Alibaba and manage the business alone.

In 2016 Q1, advertising investment from small and medium enterprises increased 147%. The quantity of SME’s and self-service advertisers reached 830K with 25% increase compared to previous quarter.

In 2016 Q1, investment in small and medium advertising revenue grew 147%, the number of SMEs and self-service advertisers reached 830,000 and a 25% increase the previous quarter.

Why both SMEs and big brands value Weibo a lot?

Both leverage it as an important channel frequently, specially because:

- Increase of traffic and users with 282 million MAU

- Optimized Algorithm of Ad Platform

- Active Internet Celebrities

- Live-streaming

The outbreak of short videos

We should add that speaking of its development path, the outbreak of short videos is also a milestone of growth of Weibo.

According to the 2016 Q2 Earning report, the playback amount of short videos on Weibo has increased 200%.

Meanwhile, the Internet celebrity economy is rapidly booming. Based on short videos, live-streaming broadcast and e-commerce, Weibo occupies the core position of social media with its incredible social power.

Margin improvement for future

The operating leverage will keep being prominent in the future. Based on the non-GAAP, the operating Margin rate of Weibo was 23.6% in the second quarter.

It is expected that the Weibo´s operating Margin rate could reach 25.2% in the third quarter, 23.4% in 2016 financial year, and 28.7% in 2017 financial year.

After seven years, Weibo proves to the world its strength and influence.

Do you still think Weibo is on the way out?

Our Digital Marketing and Ecommerce Agency have the experience of a team dedicated to know in depth the Chinese Social Media.

If you are looking to push your sales in China, do not hesitate to contact us.

Moreover, if you are interested in receiving to your mail the latest trends of Chinese Social Media, please suscribe to our monthly Newsletter!

This article has been edited by Paula Vicuña, from 2 Open.

7 Facts You Need to Know About The Chinese Online Market

1. The Chinese online ecosystem is shaped by the actions of the B.A.T.

The B.A.T. is a group consisting of Baidu, Alibaba and Tencent. They are the dominant players in the Chinese online ecosystem. The dynamics of their competition and cooperation defines the boundary and possibilities of digital marketing and ecommerce in China. Each member of the B.A.T. dominates important segments of the online ecosystem: Baidu dominates the search engine market; Tencent is strong in social media, and Alibaba fiercely rules ecommerce. The results of this competition can provide inconveniences for online marketers. Baidu, for instance, is reluctant to direct search traffic to Tmall stores and pages, where in some cases a company will need special permission from Baidu to promote Tmall stores using Baidu’s Search Engine Marketing (SEM).

2. Baidu’s dominance in the search market

Baidu’s dominance in the Chinese search market means that most search engine related marketing activities requires the cooperation of Baidu to work. Baidu’s Search Engine Optimization (SEO) is different from Google’s SEO. Baidu still requires Meta data for proper indexing and it prioritizes loading speed quite heavily. Setting up SEM accounts with Baidu can either be an easy task that lasts for several working days or an excruciatingly slow and cumbersome process, which might take months to complete. This depends on the involved company’s policy match with Baidu’s requirements. There is also a minimum investment requirement for setting up an account. These can range from as low as 6,000 RMB to as much as 500,000 RMB depending on the type of account that is being opened. One of the most important aspects of Baidu’s listing is the absence of brand protection. This means that brand keywords can be bought by any paying parties willing to buy them. This might lead to unfair price based competition between official suppliers and the unofficial ones, or even from someone that sells fake products through proper channels.

3. Wechat is not just a messaging app; it is a lifestyle app that defines online interaction in China

It is hard not to know about Whatsapp, Facebook, Twitter or Instagram in 2016, yet many are not familiar with Wechat if they live outside of China. Many foreigners regard Wechat as a Chinese version of Whatsapp but it is far from just a messaging app. To be more precise, Wechat combines the function of many known social media sites and utility apps. Users can chat, post their photos, sell items, make online payments, book a ride, buy transportation tickets, invest their money, and more. In addition to being used as a private app, it’s becoming more and more popular in the work place, mainly used for communications. With so many diverse functions and over 600 million registered users, marketers naturally want to use Wechat as a channel to communicate to their target audience. Wechat offers the possibility of a one on one customer service; creating customized functions to improve the brand experience. However, with the Wechat craze comes the high costs of Wechat marketing. Posting merketing content on a big account with upwards of 100,000 followers can cost as much as 80,000 RMB.

4. The Chinese consumer has embraced ecommerce faster than most markets

The rise of ecommerce in China surprised many outside observers. Many consumers born in the 80’s and 90’s have fully embraced the concept of ecommerce as the main way to purchase items. Anything from daily necessities to premium products can be purchased. The Chinese consumer responds well to online promotions and acceptance of new brands, however, most of them are still price sensitive. Foreign brands selling in the Chinese market to the Chinese consumer are less likely to be successful offline due to the high cost of real estate. Platforms such as Tmall and Jing Dong and vertical e-store are the best way to sell to consumers in China. Ecommerce events such as 11.11 are already a cultural phenomenon in China where the total transactions can be above 11 billion USD in one day.

5. China has one of the most highly regulated online environments in the world

China is one of the fastest growing online markets yet it is one of the most regulated ones. Traffic data going in and out of the country is heavily censored and is significantly slower than domestic traffic. This means that local hosting might be necessary for optimum speed. To publish a website, a company is required to obtain the Internet Content Provider (ICP) license to publish any content online. China has a very strict advertising law. Multinationals are regularly hit with fines for violating the law and some fines can go up to 100 million RMB. It is critical to study the proper regulations and laws before entering the Chinese market to prevent future risks and losses.

6. Mobile is not the future; it’s already the dominant traffic in China

In recent years, PC traffic has been decreasing 15% every year, whereas mobile traffic has been increasing as much as 20% in the same time frame. Many online retailers are reporting that most buyers are using their mobile phones to buy items online. Conversion for mobile traffic is also higher than PC traffic in many cases. This is due to the high penetration rate of smartphones as well as user reliance on mobile devices for online payments. It is easier for users to pay online with mobile phones than it is with their PC. Traditionally, consumers would use their PC to do extensive research before buying online. However, with improved mobile connectivity and mobile optimized websites, many consumers are abandoning PC and in some cases only uses PC for work related activities. The pay-per-click for mobile traffic can create as much as 300% higher than PC traffic in some industries, mainly due to limited advertising space and high demand.

In recent years, PC traffic has been decreasing 15% every year, whereas mobile traffic has been increasing as much as 20% in the same time frame. Many online retailers are reporting that most buyers are using their mobile phones to buy items online. Conversion for mobile traffic is also higher than PC traffic in many cases. This is due to the high penetration rate of smartphones as well as user reliance on mobile devices for online payments. It is easier for users to pay online with mobile phones than it is with their PC. Traditionally, consumers would use their PC to do extensive research before buying online. However, with improved mobile connectivity and mobile optimized websites, many consumers are abandoning PC and in some cases only uses PC for work related activities. The pay-per-click for mobile traffic can create as much as 300% higher than PC traffic in some industries, mainly due to limited advertising space and high demand.

7. Local content through local perspective

The Chinese market is still flooded with marketing contents that are just a direct translation from their original language. Some branding videos of multinational companies do not have Chinese voice-overs, only Chinese subtitles. While these contents do not necessarily fail to communicate their intended message, most have drastically reduced their effectiveness and recall rate due to being less relevant. In order to communicate effectively, companies need to dig deep to find relevant messages and hire local content producers as a bridge to effectively communicate to their Chinese consumers. This is especially relevant when publishing materials online, where the Chinese consumer expects instant gratification, not a bad translation.

This article was edited by Andres Arroyo Olson from 2Open.