Can Specialist Retailers Survive against Alibaba and Amazon?

It is said that whoever hits first, hits twice. Some days ago, Zalando signed a partnership with its biggest competitors, Amazon and Alibaba. Far from thinking that they were wrong, we feel confident about the future of these new alliances between Europe, China and United States.

Zalando was founded in Berlin (Germany) in 2008. Born as an European electronic commerce company, the brand already holds the leadership as the largest online fashion retailer, while also has become the second largest group in Ecommerce in European region.

Zalando was founded in Berlin (Germany) in 2008. Born as an European electronic commerce company, the brand already holds the leadership as the largest online fashion retailer, while also has become the second largest group in Ecommerce in European region.

Although originally its activity was focused in marketplaces, in 2010 Zalando starts its jump into developing and selling its own brands. Online selling shoes, clothes and fashion items constitute the core of the company, under a cross-platform perspective.

A step to break: boundaries to online shopping

Even if such perspective still remains today, observers enjoy its dramatic effects: to an unique Refund – Return policy in retail and a highly attractive shipping, have joined an effective logistic management and a recent prospection in offline context.

Although timidly, its development in the offline environment constitutes a new movement to establish its brand in the retail market and its visibility on some physical multibrand markets in Germany. To this point is joined an attractive shipping policy that enhances its appeal to the consumer: it is fast, secure and in case the users feel dissatisfied with their purchase, they have the chance to return them within 90 days.

Even if its payment and reimbursed model is constantly criticized for its high risk, it is also truth that this pillar has become an emblem for Zalando, its trademark and distinction over its competitors.

Zalando pushes online to grow

The company shows a steady growth in its presence in Europe, while designing its jump to the international area. The future seems promising according to their latest analysis prospects, with a year revenue growth close to 20%.

This rise is the result of three main reasons:

- Its total adaptation to mobile user experience: U-commerce is the new king in sales –check our articles “How to Take Advantage of the Latest E-commerce Revolution? U-commerce Trend” and “5 Things to Avoid When Doing Business in China” to discover a bit more!–

- Mobile purchases are already more than half of its sales

- A wide range of products and therefore, a great audience to address

- Its advantage of using a vast network of online platforms

A twist to Ecommerce

The desire of the Group is boosting its international sales and take advantage of the huge possibilities that the electronic market and their highly developed logistics presents to them.

To achieve its goals, Zalando has woven alliances with the giants of E-commerce: Amazon and Alibaba. Although its presence on Tmall is expected for the coming months, its bet for B2C trade -previously discussed by us in our article “Do Other Ecommerce Platforms Stand a Chance Against Tmall?”- some steps further on international distribution are already in discussion.

It is worth noticing that this giant enterprises are transforming traditional business into a new business model. Digital Marketing and Ecommerce helps to create new partnership systems for other companies around the World, and it will become more and more important in the following years.

In search of a Digital and Ecommerce Company? If you have any question or require any information about our services,

Sources:

Why China E-commerce Goes So Fast?

All of us are very well aware of the magnitude of the Chinese online market and, although it is currently the largest Ecommerce market in the world, it is also the most changeable one.

From 2 Open, we want to enable your approach to China giving you some practical guidelines about the current state of Ecommerce in China.

Understanding what is happening in China needs time and a constant willingness to learn: sometimes its fast evolution makes it hard to follow the new trends, other times foreigners just find an incomplete analysis.

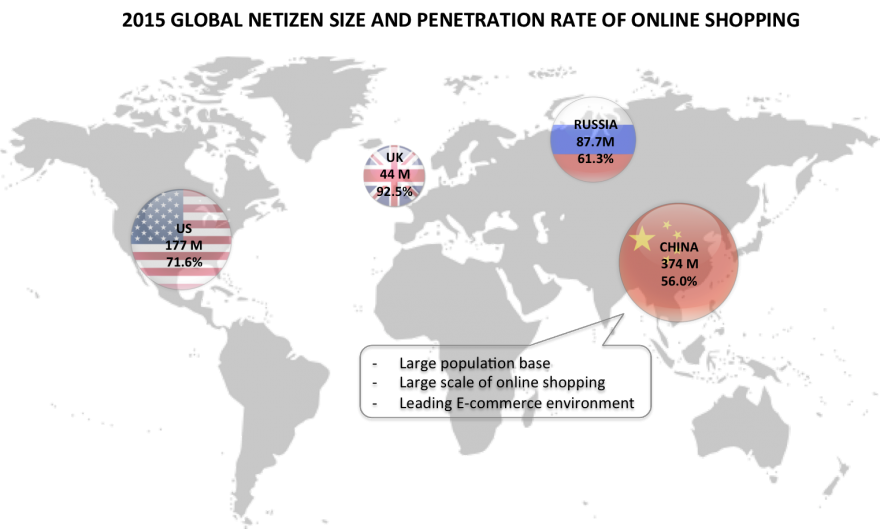

According to the analysis report done by Data Center of China Internet -from now on DCCI-, China has currently taken the first place as the greatest E-commerce country in the world, while the online shopping penetration rate of China is in the second place after United States.

The result of China E-commerce indicates the Chinese economic keystone in recent years, also their development trend of commerce in the future.

As a result, in 2 Open we strongly believe there are more opportunities in the future for E-commerce development.

There are a range of factors we should take into consideration in our approach to the country:

E-commerce market is booming, due to the existence of multiple factors which stimulate the development

In 2015 in China, penetration rate of online shopping reached to 56%. This means there is a huge space to further development comparing with the most-developed countries, and a great opportunity to companies coming to China.

Although there are many factors which are promoting the trend, the main reasons can be summarized in a set of main points:

- Population: Until June 2015, China has 668 million netizens, 594 million mobile phone users and 374 million online shoppers. This leads us to a great size of online shoppers and a strong demand in domestic market.

- Policy: China and its Government have adapted many strategies and measures to promote the E-commerce development. It is a fact that the confluence of two forces have achieved incredible results in recent times.

- Technology: The mature E-commerce relating technologies facilitates the promotion of various industries, especially those related to the Big Data, Internet security, Online payment and Mobile technology. A niche market that is worthy.

- Enterprise: Internet companies have finally joined and distribute to the whole industry, so the result has been that most of the traditional E-commerce companies are transforming to the New Model. Thanks to it, the industry chains of BAT (Baidu, Alibaba, Tencent) cover a large area in China and it is expected to keep growing in future.

- Ecological Integration: The whole industry is getting into a mixture between online and offline industry. Take a look to Alibabas example: they have relied on the industry chain of E-commerce to integrate video, games, travel, finance and other fields into a complete unity. That is the future!

- Basic Infrastructure: Internet infrastructure develops rapidly, especially the Mobile Internet. But also 4G is changing the scene: in the end of July 2015, China 4G accumulated more than 250 million users and 4G base stations were over 1.53 million, of which the construction of TD-LTE base stations were over 1 million. Nowadays, 4G smart phone has already accounted for 82.7% of the domestic smartphone market and seems there is still a gap to fill.

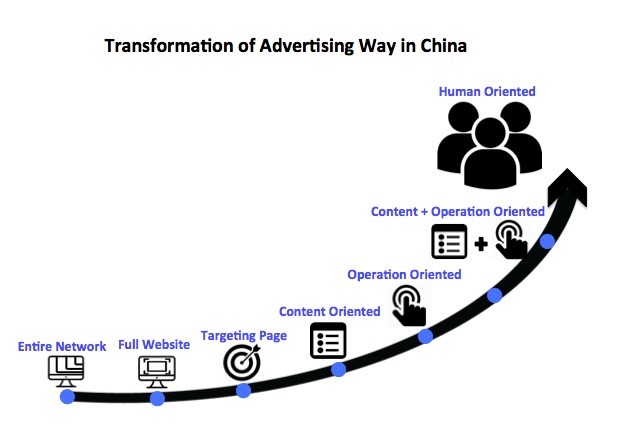

Accommodating to the human-oriented strategy, the E-commerce marketing gets a standout result

With the diversification of E-commerce, the elements influence on the marketing result also became complicated, thus the marketing KPIs should be clear for the marketing themes and goals.

E-commerce marketing has changed from past into a new model of advertising, which is accommodated to the Internet users.

The Model of procedural purchase facilitates the result of advertising, optimizing the convention, and achieves 3 times of ROI:

- The user is the focus: Advertisement position of E-commerce marketing is transforming into human-oriented.

- Procedural purchase is pushing E-commerce marketing into OTG (On-The-Go) model.

Rapid growth of mobile terminal and Big Data brings more commercial values

Now in China Ecommerce market, users, marketing and advertisement investors are in favor of mobile terminal. With the development of mobile technology, the traditional business was greatly impacted.

¿The result? Big Data sharing connects user, product and service together; each data channel communicate with others can release a higher-value data stream.

Vigorously develop of the “festival event”

In recent years, the festival promotion has become an important way of arresting customers. Since November 2011, it has already turned into a battle for the Chinese leading E-commerce companies.

But also the advantage of big data sharing and innovated technology did a tremendous support in the precise marketing and advertisement.

Take Tmall as an example: in 2015, the turnover of Tmall reached ¥57.1 billion just in one day. A huge amount that can still increase.

The tremendous transformation that China lives, cannot be understood without experiencing it by firsthand.

From 2 Open, we have a global perspective and the expertise any company thinking on coming to China needs to develop its business in the country.

If you are looking to take advantage of Chinese Ecommerce, we will be happy to help you.

This article has been edited by Paula Vicuña, from 2 Open

Is Latin America a Strategic Spot for the Chinese market?

Over the last fifteen years, Chinese Government has experienced an increasing attention on the possibilities that Latin American market can provide to them.

This article seeks to shed light on the current situation between both regions, and their future possibilities.

According to Chinese policy, in recent years the country has developed a new global strategy: Africa, Latin America and the Caribbean have become as key-players on its rise to the international scene.

Since 2000, China has settle its action on bilateral free trade agreements and loan commitments. Despite its evolution, the role assumed by China is yet far from a real partnership with Central and South America.

In future, commerce and investment will be the basis for establishing a lasting partnership and a socio-economic development in manufacturing, labor, services and financial support.

Which are the main factors that define their relationship?

The relationship is based on three basic purposes:

- Political Relations:

China has currently become a permanent observer in the Organization of American States and a member of the Inter-American Development Bank. The country also participates actively in the Economic Commission for Latin America and the Caribbean.

In addition, China has signed free trade agreements and institutional arrangements with some of the regional countries.

- Economic Relations:

China plays a leading role in the future economic scene in the region. Latin America exports to China are raw materials, such as minerals, ores, oil seed, meat, cooper and soybeans.

Economic Relations are mostly conducted by Chinese Public Sector: Trade, Investment and Financing enhance the mutual cooperation and the collaboration is constantly increasing.

The Chinese investment effort has been particularly strong in two important fields: Energy and Infrastructure.

- Cultural Relations:

Chinese cultural expansion is closely linked of their latest conception of International Relations based on pragmatism and soft power.

In recent years, many Confucius Institutes have started their activity in Latin America, but also Spanish language has experimented a huge growth in China: educational and cultural exchanges are on the rise.

Is there ROOM ENOUGH for a common trade based on high value-added?

Latin America suffers from a scarce innovative effort, while China struggles to turn its economic system into an innovation model, highly rooted in the high value-added.

ICT-based services, Information technology and also Ecommerce are expected to grow in Latin America. The Global trends in Crossborder Ecommerce will be a challenge to the international integration of Latin America and a great opportunity for MSMEs.

Are you already familiarized with Crossborder Ecommerce and B2B, B2C, C2C, B2G and C2B Models? In search of an Ecommerce Consultancy Agency?

From 2 Open we can help you develop your business and to boost your company into International Sales.

How to take advantage of the latest E Commerce revolution? U-Commerce trend

Nowadays, we all are very well aware of the importance of Ecommerce on current business.

E-Commerce has been a great revolution for companies and customers, helping the exchange of goods and services without geographical barriers via Internet.

With most of famous brands selling via e-Commerce and the development of B2B, B2C and C2C markets, the last revolution has come to stay: the Mobile Commerce or better known, M-Commerce.

But, What do we mean when we talk about M-Commerce?

The increase of the usage of smartphones and tablets and the growth of its capabilities, lead to a higher percentage of the population using technological devices to purchase their goods or services. According to the increase of the demand and in order to take advantage of this new trend, Companies have already identified the need to adapt their ways of selling to the portable devices.

China, the biggest consumer via E-Commerce country and a technologically advanced market, is a good example to put into consideration: the Retail and C2C ecommerce sales have grown from the 9% to the 55.5% since 2013.

This information show us that nowadays, most of the C2C Chinese customers prefer to use the mobile device than their PCs or laptops.

Omnichannel Marketing, What´s its purpose?

At the same time, to E-Commerce has joined a new feature: the existence of the multichannel approach to sales, or “Omnichannel”.

This channel is looking for the continuous shopping experience of each customer. The aim of the Omnichannel Marketing is offering a continuous experience to the user, independent from the device or channel chosen.

In practice, this leads to a complete integration between phones, tablets and computers and it requires the combination of an anthropological and technological strategy in approaching the users in a smarter way.

From the combination of all this, arises the U-Commerce concept.

What is U-Commerce or Ubiquitous Commerce?

If we simplify, we would say that we are talking about U-Commerce when E-Commerce is based in the customer experience.

The user must be in the center of all Companies’ strategies. Those Companies using U-Commerce must be able to provide personalized service to their clients from the information they get from mobile devices and PC-s.

The keys are: customizing and navigation experience created in cooperation with the User.

How is this possible?

It is obvious that the technological development is responsible for this change and makes necessary to pay attention to the internal customer databases.

Companies must try to find out common interests between potential clients who visit their EShops, considering each potential customer as unique and with their own preferences and priorities.

Efforts should be directed to avoid high rates of leads who finally give up navigating in the last purchasing phase, and reach around 60-70%.

This is the crucial reason for companies to invest their efforts and resources in understanding the customers and their behavior: to boost sales.

A lack of privacy: How companies use data?

U-Commerce uses personal information in order to provide a personalized service. A big number of customers feel disrespectful that a company can get their personal information and manage it as they want. Therefore, we must emphasize the benefits that the data can bring to the user and treat delicately the data we are able to collect.

Times are changing and the number of E-Commerce consumers is increasing exponentially and also the M-Commerce is growing very fast.

It’s important to face it and consider user’s needs, their preferences and desires. So companies must rechange strategies and adapt to the new eCommerce “revolution”.

Are you thinking about improving the user experience and exploit the advantages that the use of Online Marketing gives us?

Come to us, We are expecting you!

This article has been edited by Paula Vicuña, from 2 OPEN.

Do other e-commerce platforms stand a chance against Tmall?

All of us are very well aware of the magnitude of the Chinese online market and, although it is currently the largest e-commerce market in the world, most of the market share is owned by the Chinese e-commerce giant Alibaba. Nevertheless, there are some other companies that also want their piece of the pie and with their vertical e-commerce platforms they are starting to put up a fight. This article will focus mainly on those vertical platforms that constitute an important part of the diverse Chinese e-commerce environment.

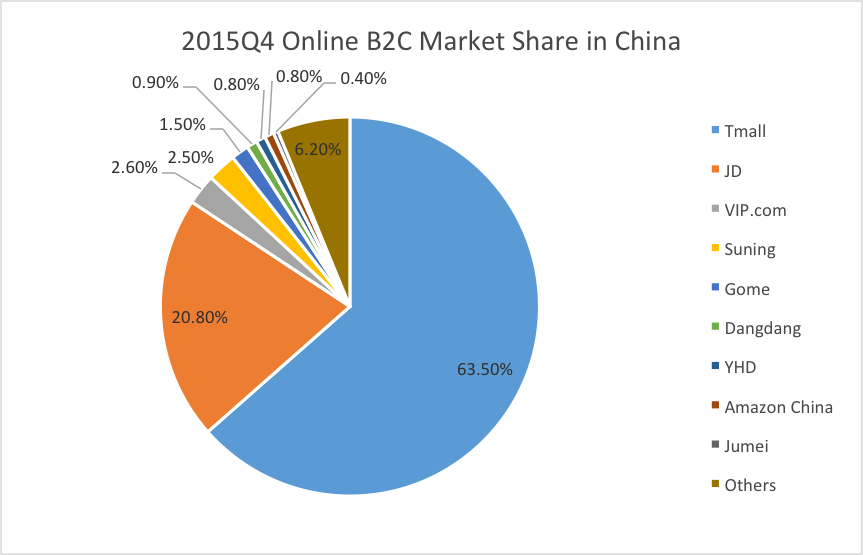

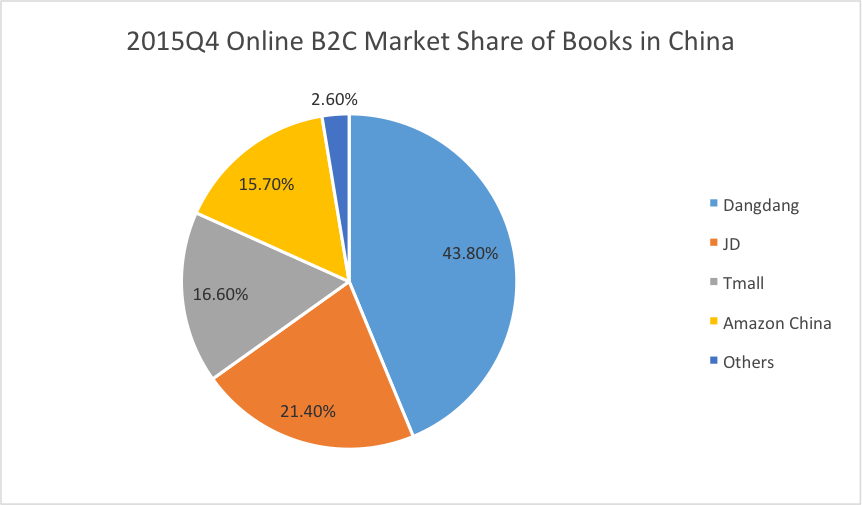

In the 4th quarter of 2015 China’s online transactions surpassed 644.38 billion RMB, the pie chart shown bellow contains the market share of the top ten Chinese e-commerce platforms:

Before we continue, we first have to clarify the concept of vertical e-commerce. In this context, vertical refers vendors that offer goods and/or services that are specific to an industry or customers with specific needs. A vertical e-commerce platforms could be a independent brand or a specified category within a wide range of products such as clothes, 3C (computer, communication, and consumer electronics) products, cosmetics, etc.

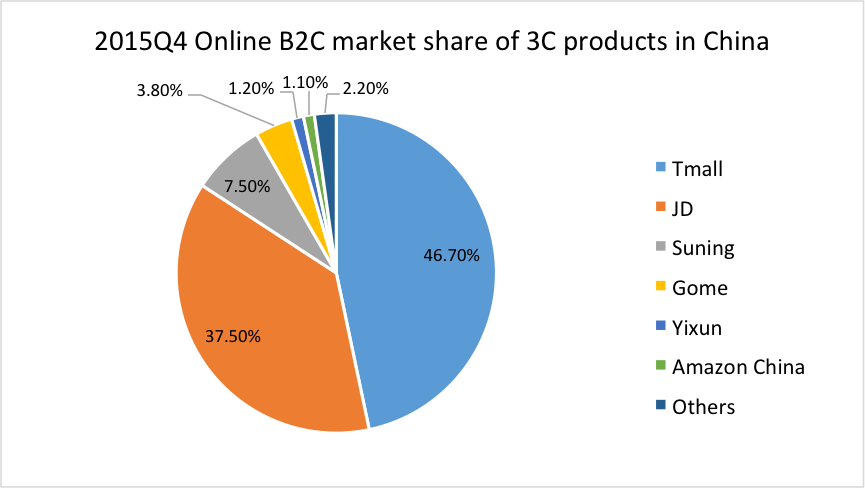

If you already have a basic understanding of the Chinese e-commerce market, then you are probably familiar with JD.com. Currently the second e-commerce platforms in China after Tmall (owned by Alibaba Group), JD.com started as a 3C products vertical B2C website. Now, let us take a look at the market share of 3C products in China B2C online market:

Although Tmall is still on the first spot, the difference in market share of JD.com is considerably higher than with regular products. Tmall and JD.com combined own more than 80% of the Chinese 3C products market. Suning, on the 3rd spot, and Gome, on the 4th, both also started specializing in 3C products, however, nowadays they have also diversified their range of products. At the end, it seems that there are no actual vertical platforms anymore.

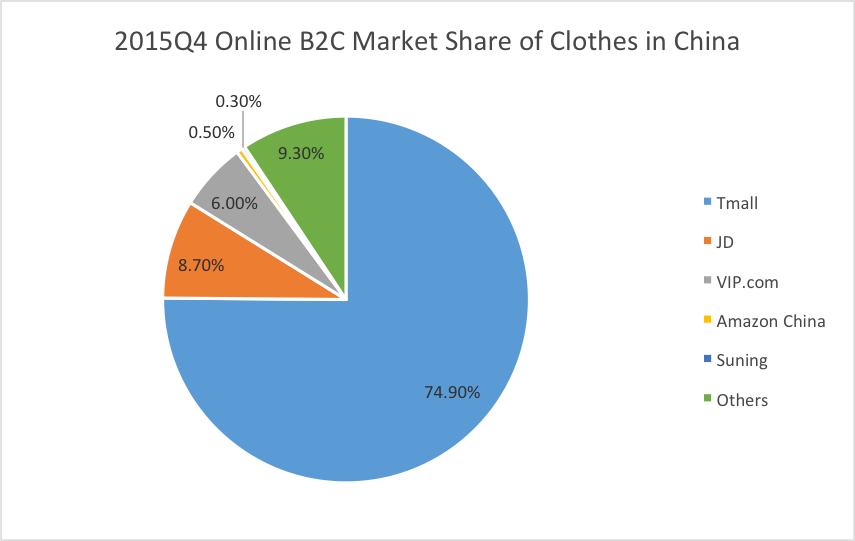

To study the online market, we cannot miss the biggest category, clothes. In the 4th quarter of 2015, the total transaction of clothes is 235.57 billion Yuan, market share is shown below:

In this case, Tmall is leading with an absolute advantage of almost 3/4 of the market share. In this category, JD has 8.7% of the market share, VIP.com has 6%, and surprisingly others do not even have 1% individually, so from the big picture the vertical market for clothes is not active enough.

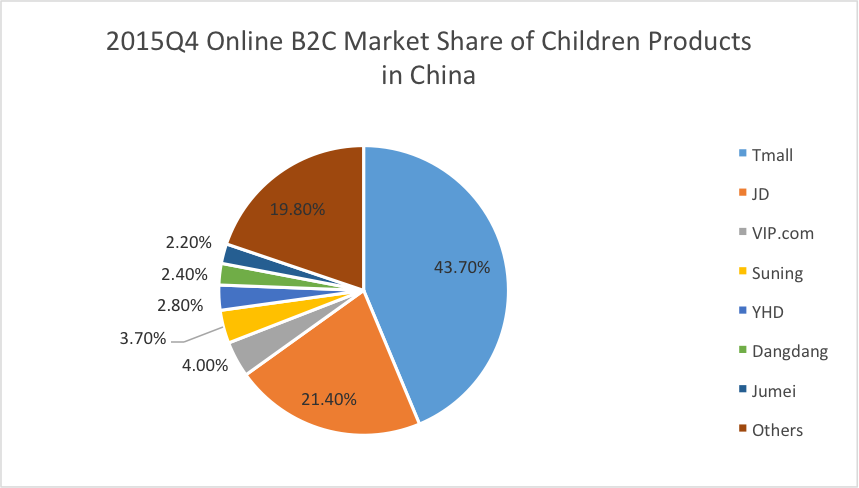

Another category that has had such a rapid growth we cannot ignore is the maternal and children products. Shown below is a pie chart containing China’s maternal and children products market share figures of major competitors in the last quarter of 2015:

The most noticeable difference in comparison with other categories is the porcentage own by other platforms that adds up to almost 20 %. Although Mia, Beibei, Babytree and others are in that 20% it is still a big figure. In this category Tmall and JD.com own less than 70 % of the Chinese clothing market, so we can say, to some extend, that there is still space for vertical players.

The next category is books and, even though the books total transaction was just 5.31 billion Yuan, the market share gives us a slice hope of competing with general platforms, in this case Dangdang is leading with 43.8%, and Tmall is only on the 3rd spot, just after JD.com.

Finally, we cannot say all vertical online platforms are dead in China just because most of the categories are gloomy, there are still some worth a try, and you just need to know enough about the current situation. If you don’t, luckily you saw this article, and you know 2open can always help you to find the right channels. So don’t hesitate, contact us now!

All in all, even though Tmall dominates in the Chinese market, there is still space for other platforms to flourish. Vertical e-commerce platforms seem to be the wisest option, specify in a certain category, gather information about the current situation in the Chinese market, and carry out your business plan. If you need further information about the market, would like to help you find the right channels, or want us to set up your business in China, do not hesitate in contacting us. Our group of specialists will happily assist you.

This article was edited by Andres Arroyo Olson from 2 Open.

References.

All products data from

http://www.analysys.cn/yjgd/17684.shtml

3C data from

http://www.analysys.cn/yjgd/17676.shtml

Clothes data from

http://www.analysys.cn/yjgd/17678.shtml

Children products data from:

http://www.analysys.cn/yjgd/17680.shtml

Books data from: