Chinese traveling user generated content platforms: Mafengwo vs Qyer

” 世界那么大,我想去看看 ” ( There is such a big world that I would like to see it all ) is a sentence once written as the reason for resignation and later suddenly became a buzzword on Chinese social network.

These years, more and more Chinese prefer independent travels to package tours. Especially, the grown up 90s generation, who are highly individualized and strong-minded, has become the main E-consumers of those traveling user generated platform such as Mafongwo and Qyer.

For example, Miss Xian, a traveling platform user from the 90s generation living in Guangzhou, China, gave up package tours for more alternatives a couple years ago. She had already stepped in South East Asia, America and Europe. Her preference is well organized in-depth trip with her family. Since her husband is too busy to do the planning, Miss Xian is responsible for handling it all. “Every time I am planning for a trip, I need some suitable travel platforms which offer practical and comprehensive reference for my destination. These years, I have been using mostly Qyer and Mafongwo interchangeably.” she said.

WHAT ARE MAFENGWO AND QYER EXACTLY?

Mafengwo : A Dream Realizer Started With A Community

In 2006, Chen Gang and LV Gang who worked in Sina and Sohu respectively set up this online travel community for their interest in traveling around and sharing travel pictures. 10 years ago, when independent travel was still a niche, mafengwo.cn accumulated users and contents through word-of- mouth. In 2010, they officially started commercializing mafengwo.cn. Apart from traditional OTA mode, they wanted to earn profits from existing contents directly.

By 2017, mafengwo.cn has gained over 100 million members, 80% of them are from mobile apps “ Mafengwo Independent Travel “. By Oct. 2016, according to the second quarter financial results of OTAs (Online Travel Agency) , Ctrip, Qunar, Tuniu, the top OTAs in China, were all in varying degrees of financial loss, while mafengwo.cn announced a turn from loss to profit eventually.

Nowadays, mafengwo.cn has become an UGC (user-generated content) platform where Chinese can share photos, travel notes, journals and Q&A online. It targets Chinese domestic users and independent travelers who need tourist reference, destination ranking lists and other recommended to-do things for their trip planning. Right now, 3,000 journals, 5,000 Q&A, 10,000 comments, 100,000 footprints are generated daily.

Nowadays, mafengwo.cn has become an UGC (user-generated content) platform where Chinese can share photos, travel notes, journals and Q&A online. It targets Chinese domestic users and independent travelers who need tourist reference, destination ranking lists and other recommended to-do things for their trip planning. Right now, 3,000 journals, 5,000 Q&A, 10,000 comments, 100,000 footprints are generated daily.

Moreover, it integrates resources contributed by users to make travel advice books among global destinations. Those books have been downloaded over a hundred million times.

Qyer : A Digital Bible for Chinese Backpackers

There are many other similar small-sized UGC communities in China market but a well-known competitor within Tourism Community category is Qyer.

At the very beginning, Qyer was set up by Xiaoyi in a dorm room. He was an international student studying in Hamburg, Germany in 2004. Once, after he got stolen at the airport while he was traveling in Europe, he became a real backpacker with very little money to survive. Then, he set up Qyer as a forum to better help oversea students share their experience, advices and wise tips of saving money during the trip. Then, Qyer started accumulating useful tips on the platform and became more and more popular in China. Within four years, Qyer had gained more domestic than oversea users. Therefore, Qyer moved back to China in 2008 and received strategic investment from Alibaba in 2013.

At the very beginning, Qyer was set up by Xiaoyi in a dorm room. He was an international student studying in Hamburg, Germany in 2004. Once, after he got stolen at the airport while he was traveling in Europe, he became a real backpacker with very little money to survive. Then, he set up Qyer as a forum to better help oversea students share their experience, advices and wise tips of saving money during the trip. Then, Qyer started accumulating useful tips on the platform and became more and more popular in China. Within four years, Qyer had gained more domestic than oversea users. Therefore, Qyer moved back to China in 2008 and received strategic investment from Alibaba in 2013.

Right now, Qyer aims at making oversea traveling more convenient and cost-effective for Chinese. Meanwhile, it does offer information for domestic destinations but these contents usually do not show up on its homepage.

Right now, Qyer aims at making oversea traveling more convenient and cost-effective for Chinese. Meanwhile, it does offer information for domestic destinations but these contents usually do not show up on its homepage.

WHAT ARE THE DIFFERENCES BETWEEN MAFONGWO.CN AND QYER?

The intriguing fact is mafengwo.cn and Qyer seem to intentionally keep in balance in the market. Mafengwo.cn puts more effort on domestic traveling, while Qyer mainly focus on travelling abroad. There is even a viral saying among the users: “Choose Mafengwo in-bound, Qyer out-bound”

In conclusion:

Traveling users generated content platform is difficult to develop and gain profit. It requires long-term user loyalty and content accumulation without guarantee for commercialization. But the potential of the UGC-big data commercial mode has already headed above water. With the huge amount of contents generated by users such as different links between accommodation reservations, attractions and dining recommendations, these data value mining is essential for breaking the barrier upstream and downstream. The one that’s faster to complete model transformation will be the winner.

Comparison/Platforms |

Mafengwo |

Qyer |

Traffic & loyalty |

More traffic and relies more on search engine optimization (SEO marketing). |

Less traffic but more users’ loyalty since the demand frequency of overseas traveling is less than domestic traveling.Qyer’s strategy is based on a “members get members” type of expansion. |

Targets |

Both target youngsters between 18 and 35 who prefer independent travel. Qyer also targets backpackers. |

|

Focus |

Mafongwo.com focuses on users sharing by creating topics and activities to encourage users to post their journals |

Qyer emphasizes user-to-user communication by operating its forum and offering appealing interactive promotions both online and offline.For instance, Qyer has already launched Q-homes in Chiangmai (Thailand) and Tokyo (Japan), which are offline bases offering Chinese-speaking comprehensive services. |

Functions |

The main functions are similar. They both offer travel journals, tips books, Q&A, top destinations and commercial functions.But Qyer has developed several apps for users convenience, such as ” 行程助手 ” (Itinerary Assistant), which helps users to make a detailed itinerary by automatic generation and manual setting. It collaborates with Booking.com( a hit for overseas accommodation reservations) for users to simply add reservations in the itinerary or book directly from Booking.com. Transportation settings and automatic distance calculation are also included in the sites. Moreover, it provides 2 ways to output itinerary: (1) A document fits with Visa requirements (2) A huge PDF itinerary books including all the photos or tips, details of each chosen accommodation reservations, transportation, attractions and restaurants. |

|

Home Page quality |

Update more often |

Update less often and there are even some journals from last year. |

[recent_posts count=”3″ date=”true” thumbnail=”true”]

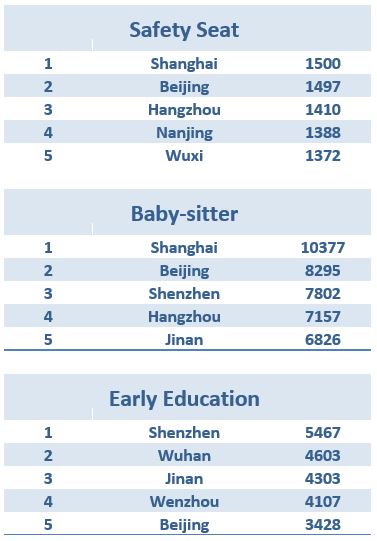

Chinese mother & baby industry is booming

A Glance Embraced the Consumers of Mother & Baby Products

Mother & Baby industry is well-known as a “sunrise” industry, and with the full liberalization of China’s second child policy, the birth rate of Chinese children will face ushered in a new peak, bringing prosperity to mother and baby industry. Instead of talking about the macro market and the brands perspective, let’s take a glance from the point of view of consumers today.

2016 Mother & Baby Products Consumption Ranking Per Capita (RMB)

The avg. monthly spending on Mother & Baby products is 3,000 RMB. In Yangtze River Delta Area, the avg. spending is 5-10% higher. Many mothers spend 1,000 to 2,000 RMB more for their 2nd baby than their first one.

The avg. monthly spending on Mother & Baby products is 3,000 RMB. In Yangtze River Delta Area, the avg. spending is 5-10% higher. Many mothers spend 1,000 to 2,000 RMB more for their 2nd baby than their first one.

The buying time for those mothers with 2nd child is different from shopping for their 1st kid. In general, mothers start purchasing products 4-5 months in advance when they are with the 1st child. However, for the mothers with their 2nd baby, they are concentrating on purchasing in the last month of their pregnancy.

The online platforms and offline vertical shops provide more purchasing channels to mothers to buy proper products for their babies. It is feasible to pick up the products offline after ordering online as well.

The richer purchasing channels, the diversity of products, consumers start taking initiative to search and research products are the reflections of the consumption upgrade of Mother & Baby industry. These are the reasons why the industry is getting more and more mature in China market now.

2 OPEN can help you to enter the Chinese market through Ecommerce and Digital Marketing. Contact us to see if we can fit your needs.

Source: CBNweekly

5 Bugs To Avoid When Doing E-Commerce In China

Have you ever tried to build a new overseas brand and fail in your attempt? In any approach to China, foreign brands often make some common mistakes when trying to sell their products in China mainland. Although such misconceptions are not exclusive to online environment, we will focus on those that particularly affect your approach to e-commerce in China. China is already the world’s first e-commerce market.

Are you going to miss its enormous potential?

First bug: China is mobile, and you better record it

It is not the first time we tell you this, and for sure it won´t be the last. As we mention before in our article “How to Take Advantage of the Latest Ecommerce Revolution?”, Ecommerce has been a great revolution for both companies and customers.

Nowadays, Chinese prefer to use their mobile devices rather than their laptops and according to the new trend, companies have already starting to adapt themselves to portable devices. Moreover, those companies using U-commerce are focused on improving the customer experience through customizing and navigation created in cooperation with the User.

Second bug: E-commerce may be an asset in your country, but in China is irreplaceable

We cannot fail to mention Frank Lavin, CEO of Export Now, when he says,

“In China, Ecommerce is the cake.”

This may mean that you will need to adapt your business to the new environment. Do not expect it to be China who suits you, this does not work this way.

Remember that whoever hits first, hits twice. Embrace e-commerce as the enabler of your business it is, and take advantage of the immense benefits that electronic commerce can bring to your company to start selling around the World!

Third bug: Social Media is there to stay. Register your account and start moving!

Surely you’ve never heard the words Baidu, WeChat and Weibo… and let us tell you that you have a huge problem in China.

Not only around the 93% of the online searches in China are done in their own search engines –Have you ever heard Google does not work in China?– but also about a 68% of the customers take a look on the official Social Media account before buying.

Do not miss the opportunity to have a voice in that huge chicken coop is the network, start developing a tailored communication strategy for your brand and gain your piece of the cake!

Fourth bug: Domestic and lazy thinkers, or how the triumph from a day doesn’t make it daily

Do you think you will keep doing in China pretty much the same things you were doing before and as a result you will achieve success?

A basic rule you should never forget again is, no matter the experience and the many different markets in which you have entered before, is that new horizons always implies a new starting on your understanding of the target, so we definitely encourage you to start a market analysis.

Will your brand be competitive in China?

Do you offer something different regarding your competitors?

Is there a suitable market niche in the country ?

These and a thousand more questions require a prior discussion, keeping in mind that China should not be underestimated: the country enjoys some peculiarities you definitely must know before starting your landing.

We strongly recommend you seek assistance from professionals focused on the Chinese market, in order to enhance your chances of success in the country.

Fifth buf: Do not try to do everything by yourself, ask for advice

We are not tired of saying it, and will do so again: China is not a flat road. Do not try to embark on this mission unaccompanied, but pick very well with whom.

Look for complementary partners interested in joining forces, go to Government agencies dedicated to external actions and internationalization and definitely search for specialized agencies in the country to start outsourcing some tasks.

Already in search of a consulting expert in digital marketing and e-commerce? You have come to the right place.

China And The Ripple Effect On The Global Stage

What are the risks that could arise from the economic slowdown in China? How does China affect to other countries? Since starting its market reforms almost thirty years ago, China´s currently economy cannot be ignored.

Even if China has not left behind its centrally-planned economy yet, it has introduced some big measures to turn into a market-based country. Such efforts have resulted in a huge GDP growth and has lead the country to reach all the Millennium Development Goals by 2015.

Currently China has become the second largest economy in the world, but deals the first in the ranking by the quantity of goods and services produced. Moreover, according to the expectations published by the International Monetary Fund (IMF) for the present year, China will be responsible of the 18% of the entire World economic activity.

If to all this we add the expectations of its huge and richer population, its rapid change on production models and its consequent role on the World stage, we can conclude that the importance of China in the world has become a matter of vital importance in today’s global interregional balance.

But its big hits cannot make us forget that China still remains a developing country, and as we have mentioned before on our article “Ten Challenges on Chinese Future“, not only market reforms are incomplete, but also it has huge challenges ahead which must start to face.

After the financial crisis of 2008, neither the business community nor Governments have fully restored their confidence on the global economy. The doubts about the economic bonanza and the future role of Western countries have underestimated the increasing influence capacity of China in the international arena, while doubts have generated certain fear of a possible blowout of the country.

Trade effects are a game changer

The channels through which China affects the global economy can be summarized on:

- Decrease in trade and exchange rates

The Chinese leadership on trade makes hard not to affect global demand. China’s import volumes keep growing, but less than expected. This becomes a huge problem to those countries dependent on Chinese exports: raw materials are highly susceptible of the slowdown.

This effect creates a bidirectional paradox: China affects the world as much as the world affects China.

Although there has been much speculation about a possible future depreciation of the RMB in order to relaunch Chinese exports, in the team we believe that a currency war is currently off the table.

- Oil lower prices and commodities

The latest drops in oil prices are caused by the lack of confidence on Chinese economy. Its weakness has led to enormous imbalances on exporting countries of crude oil and raw materials: Russia, Brazil, OPEC countries and the U.S. still suffer for it. China’s falling demand has greatly contributed to the new situation and with it, deflation has knocked on the door.

However, according to the latest analysis made by the IMF, the negative effects are supplemented by growth in the purchasing power of the population. The Organization still thinks that lower prices on commodities have a positive effect on general economy.

- Monetary and inflation policies

The recent affordability of RMB should not make us forget that Chinese weakness can lead to a global new paradigm surrounded by deflation and debt. Once again, lower prices stimulate consumption, and this leads to boost demand, bigger sales and prosperity. Lower prices have become the stimulus of global economy.

- Cultural hegemony

Even if the Western countries have underestimated China’s rise, the consequences can already be seen. Although Cultural power follows to Economy and Politics, China already shows its increasing political and cultural power on international arena: mandarin language and Chinese diplomacy have become a key to Government policy.

Its empowerment is more visible in East Asia, but runs fast around the rest of the world. We have started living in a China-centrism, in which global power gravitates around Chinese policy.

Nowadays, confidence in the global economy is vital for prosperity but unpredictable. The ripple effect that is lived in the global area, is greater than ever.

Understand this huge spider web which is China, seize opportunities to launch your business and boost your sales, are our goals.

In search of a Digital Marketing Consultancy? Interested on Chinese Ecommerce?

Visit us on 2 Open. We would love to hear from you!

10 Challenges On Chinese Future

Any approach to Chinese landscape ends falling into the same debate: Will China evolve or break over the next years?

Although experts do not agree (And neither do we!), in the team we believe it is important to name some of the most immediate challenges ahead for China.

Current challenges are also the challenges of the future

When we talk about China, no one agrees. The huge boost experienced by China in the last thirty years has not buried the doomsayers who year after year have sown doubts about the future of China. Faced with them there are some enthusiasts who proclaim that the next world leadership belongs to China. Who has the reason? Not everything is white, not everything is black. Both sides are right.

Reforms, Where to start? Ten points to keep in mind

China is characterized by the dynamism that has developed in recent years. In order to ensure the future growth of the country, Chinese authorities must address some issues of particular importance:

First, Local Government Debt:

Local and regional government debt have been a terrible headache for analysts. We would like to underline the explanation Nicholas Zhu, senior analyst at Moody’s, gave,

“For the local government direct debt, we believe the government is finding a handle by capping it at 16 trillion yuan ($2.45 trillion) overall and improving the structure by swapping some existing debt into bonds at lower cost and longer maturity.”

However, in recent times the central bank started to allow qualified individual investors to buy and sell the bonds through commercial banks.

Second, Reform State Companies:

The Government is attempting to reform the state-owned sector while continuing to maintain its currently control. To do this, some different attempts have been made, such as: mixed formulas, restructuring, mergers, open up protected service sectors to private and foreigners, them all focused on enhancing their competitiveness and autonomy on private-sector markets.

Third, Liberalize the Financial Sector:

Financial liberalization is a key in Chinese reform, and it is closely linked to the privatization phenomenon itself. Both reforms will be needed to maintain Chinese growth, and facilitate the creation of jobs and the reliably channels credit to companies. The success of economic reforms carried out, will be a determining point of stabilization or social destabilization, and are a sensitive issue in governmental action. As the country opens its doors further, as the former Australian ambassador to China, Geoff Raby said,

“Equally China will be more open to capital inflows.”

Fourth, Investment:

Investment in China is drived by Foreign Direct Investment, as a key which gives advantages to the supplier and also to the host. Moreover, is a thermometer of the future of the business, and China has already started to capitalize its benefits. At the same time, FDI depends on some key – factors:

- Capital Availability: China is already the world’s largest recipient of foreign capital.

- Competitiveness: Rests on the country’s capacity to develop its infrastructure, resource availability, productivity and workforce skills.

- Regulatory environment: A difficult legal doctrine and excessive regulation, have been a serious handicap for investment in China. Things are changing, but it is still far to be as it should be.

- Openness to trade –especially international one.

Fifth, Deflation:

To achieve the Chinese structural goals, it is a necessary condition that the country’s growth rate is maintained over 5 years above 6.5%. Moreover, in China Dollar strength prevents avoid closing 2016 with deflation, and has contributed to high capital outflows in recent years.

Sixth, Chinese Demand for Hard Commodities:

A very important point to consider for countries that produce raw materials as iron, copper or aluminum. Its prices will drop sharply as long as its demand will go slower. This expectation is opposed to food, which will keep increasing due to the growth of Chinese middle class.

Seventh, Manufacturing:

China´s export competitiveness are based on three main principles: low unit – labour costs and interested rated, and an undervalued yuan. Due to the paradigm shift, it is expected that China’s strength at this point has begun to crack; an opportunity for others countries after all!

Eighth, Innovation:

Over the past five years, China has promoted with great vehemence its innovative sector. The technical, economic and human development are impressive, especially its efforts in Science & Technological graduates. According to Mckingsey Global Institute,

“China must generate two to three percentage points of annual GDP growth through innovation, broadly defined. If it does, innovation could contribute much of the $3 trillion to $5 trillion a year to GDP by 2025.”

Nineth, Environment:

China lives in a permanent Environmental crises: air and water pollution, deforestation and desertification, biodiversity, high rates of cancer and the growth of a middle-class who is adopting a Western –style consumer patterns have become a huge problem for future. China needs to change the course of its current model. Therefore, he has embraced renewable energy.

Tenth, Consumption:

We cannot talk about Environment without mention Consumption. The sharp increase of in domestic consumer patterns and the Chinese middle-class prosperity, will need of a sustainable and growing consumer economy based on the need of big service sector reforms.

Companies must be ready. How to be competitive in China?

The rapid evolution of the world stage precludes long-term estimates. Having an updated database and the example of a specialized agency, is always a clear advantage in any approach to the market, but even more in China. It has never been enough for global business to know what is coming, but also knowing how to take advantage of every opportunity that arises in the market.

In search of a specialist Agency in the Chinese environment? Are you interested on Digital Marketing and Ecommerce?

New Online Advertising Rules in China

New online advertising regulation in China will impact all digital business with presence in China. Here we bring you an analysis overview to start adapting to the new trend in advertisement.

It would be after the death of a college student who took part in an experimental health treatment found in Baidu, when popular pressure would force the Government to begin an ads regulatory change.

The Internet Ad Interim Measures, a new regulation prompted by the State Administration for Industry and Commerce of China, went into effect in September 1st. Therefore, it arises from the Government’s claim by adopt new rules over online advertisement: email, paid searches, embedded links, images, and videos are already subject to the new law. Its aim is avoiding the spread of misleading advertisements on the Net, and correct the prevailing liberality so far.

The new online advertising regulations are expected to impact on Chinese Digital Marketing as a whole: social media, search engines, apps and electronic commerce in the country will have to move under the new guidelines.

A step closer to the uses and customs in Western advertisements

For the first time in China, the new measure features a specific definition of Internet advertising; often, foreigners suffer from a lack of legislative safety in China. Therefore, conceptualization is a step forward to define clearly not only the concept, but also its extension:

“Internet advertising is advertisements that directly or indirectly sell commercial goods or services through the websites, web pages, internet applications and other forms of Internet media including text, images, audio, video and etc.”

Moreover, the regulation comes to underline its main purpose:

“To protect the legitimate rights and interests of consumers, and promote the healthy development of the Internet advertising industry.”

In what fields are these changes applicable? What changes will take place after its implementation?

The regulation is particularly focused on a list of fields described below:

-Healthcare and medicine

-Food and beverage

The main measures to be starting to apply can be summarized as:

–First, the Law requires to place the word “advertisement” in a prominent position and clearly distinguishable at first sight.

–Second, every field subject of special regulation needs a previous review and an approval process by authorities.

–Third, online advertisements for prescription medicine is banned. A special measure in health products is also extended to medicines, pesticides or medical supplies.

–Fourth, tobacco online ads are also banned.

–Fifth, any paid search results, links or content must be clearly identified by the word “advertisement”.

–Sixth, users should not only have the choice to close an ad, but also this has to be easy to them.

–Seventh, paid links and contents must be clearly detailed at a glance.

–Eighth, any attached ad and/or promotional links to an email should have been allowed previously.

–Ninth, any misleading and/or false ad is considered illegal from now on.

Who is especially affected by the new regulation?

Under this measure, the biggest impact falls on the largest Internet companies in China. Baidu and Bing should apply new restrictions on ads; it should not be forgotten that, much of the incomes of Baidu, Weibo or Alibaba come advertising.

But also traditional Social Media must change. WeChat or Weibo offer paid content; as we mention before, pop-ups, ads or links should be first permitted, which will force companies to evolve the way advertising is offered to Chinese users. Seems marketers should start creating better ads, or contravening the prevailing legislation with all the penalties that that means.

There are plenty of creative ways to sell your services and products in China. In search of a Digital Marketing Agency?

How to Leverage Chinese Ecommerce to Become a Top 10: The Rise of Zara

Some months ago, we identified some Insights on ZARA in the Chinese digital market that came to underline its first steps on Chinese Ecommerce and the main reasons which led the company to choose Tmall as its official flagship store.

Zara´s stay in China began ten years ago and would not be long before the Management decided to set up its own online shopping website The Zara China and publish an M-shop called Zara.

What has been the result of the policy undertaken in recent years?

The unstoppable rise of Zara

After its landing in Shanghai, Zara currently counts with 182 stores in China. The brand is undergoing a process of rapid expansion, but gradual: after settling in major cities, continues to expand its business model in medium-sized cities –Second and Third Tier cities-.

The expansion of Zara in China occurs while increasing its international presence; the company is already present in 90 countries with a network of 2.170 stores…and there are still much more worlds to conquer.

In a curious twist of fate, while Zara undertakes an ambitious international growth -focused on Asia-, some others Chinese counterparts are the ones which starts their landing in Europe. It is especially noteworthy the case of Chinese Mulaya. Born in a spirit reminiscent of Zara, it advances rapidly in the West as a flagship Chinese in women’s clothing.

Ten years to become one of the 10 most recognized brands by Generations Y & Z

It would be this August when the Chinese RTG Consulting launched its latest study 2016 RTG Brand Relevance Report. The Report comes to underline the relevance that some brands reach between so-called Generation Y and Generation Z in China, their consumer behavior and lifestyles.

Surrounded by Chinese –Xiaomi, AliPay, Wechat, Taobao- and some others well-known international brands –Apple, Adidas, Nike, Uniqlo, H&M, Converse, New Balance-, Zara has entered into the Top 10, after becoming the sixth Most Recognized brand in China for the generation under 36 years.

But results are better for the Spanish company when we dive into Clothing brands. If we look at the survey results, we find that young Chinese place Zara as the second most-recognized brand in their industry, just behind Adidas.

China is already the second most important market thanks to ECOMMERCE

Its huge success in China is due to the combination of three main factors we describe below more in detailed:

- Zara offers a constant renewal and an affordable luxury as concept.

- Zara decided to start playing at the Chinese ecommerce scene by the hand of Tmall.com, instead of trying to build its own infrastructure to cover the entire Chinese market.

- Its Electronic commerce policy not only supports the growth of its own Digital industry, but also the Company growth as a whole: it has become a safe way to promote the brand in places where physical presence does not yet exist.

After going through critical situations in its implementation process in China, the company has adapted to the specific conditions of the market to which it is addressed. Zara not only has understood that nowadays, any approach to the Chinese territory must have a policy consistent with the preferences of the target population and be brave and fast to react to local consumer tastes, but also that Ecommerce has become the board in which the battle occurs, an step into future and the key that makes the difference.

All we can we do for you

Inevitably, the present is already future and both are settle on the virtual world. Knowing the ins and outs of the digital industry, take advantage of Ecommerce for the growth of our business and not give up a proactive marketing policy are the keys for successful development in the country.

In the company, we have the experience of an expert team. We are used to deal with the constraints of the Chinese market and we seize opportunities.

Let us team together. Visit us in 2 Open.

How to Promote your Business in China

How does Chinese Market work? How can companies promote themselves without Facebook and Google? How do people survive under huge competition there?

China is -still- a mystery for foreigners. The country means a huge cake, but before entering the market you will need to answer to this and other questions. To make it easier to you, in 2 Open we have taken a brief look of the Chinese market and done a list of the most basic tips you should consider before landing in China.

Gone wrong? It can go much worse

When many companies started their business in China for the first time, the things they used quite a lot in local made no sense in China.

Ebay is one of the biggest e-commerce platforms around the world and a perfect example to explain the experiences many foreign companies face in China. Due to its leadership, the company assumed that its landing in China would be no much different to that experienced in other countries, so in the beginning they refused to establish a partnership with JD.com. The company soon realized there were no more choice but to cooperate with them.

What are the most common problems that foreign companies face in Chinese territory?

Foreign enterprises in China often fall into the same shortcomings we analyze below. Let´s see:

First, Always try to show their high-end enterprise images

Foreign enterprises always show their best face: high-quality services, responsible attitude, respect to the customers… and so on. But in China, price is the key and can always be the KPI which attract the customers’ sight immediately.

Second, Focus on high-end target audiences but ignore the rapid growth of China

When companies like Blueberry entered China, they set the target group to those corporate users. As the earliest and past No.1 smart phone, Blueberry had already been famous in China. But within 7 years (2006-2013), they retreated from China and closed their Chinese official website.

When Huawei set off their business, what they did was to set the target audiences as all people who want smart phone. Since the average income of Chinese people is increasing, so that more and more can afford a smart-phone. Huawei was right about its strategy.

Third, Copy the promotion strategy directly to China

Many foreign companies would prefer to make a wonderful advertisement, an amazing poster and advertise in the subway stations, supermarkets… and everywhere. But they always find out that the ROI is quite low, since they might only get 1 customer for a 100 RMB budget. Does it outweigh? We don´t think so.

In China, since the civil quality is still on a shallow level, what the customers care most is whether they are interested in, but not what is a good design. That is why when Taobao.com stepped out their first step, they even promoted on some illegal websites which had huge traffics every day.

Fourth, Think too much about customers but ignore what the customers are thinking about ICQ. The instant messaging software also failed in China!

The U.S. companies are always stricts on protecting the users’ privacy. With such a policy, users can’t find the chat record if they log in on another PC, since the software will not memorize or save these records in order to protect the privacy to the most degree.

Its counterpart in China, Ma Huateng, found out this fault which doesn’t fit the Chinese users’ requirement. In response he created QQ, which is based on the technology of ICQ and make this software become the most-used IMS in China.

Fifth, Rely too much on the Western promotion ways, companies do not want to do things directly

E-mail, Mail and SMS promotion require low budget and have huge audience quantity. Well, they do not make sense in China. For many Chinese people, it is absolutely offensive if they receive advertisement in these channels since they have watched and received too many advertisements already. Moreover, for most Chinese these all are considered private.

They don’t like to be bothered by anything they don’t even know. In China, what people prefer is face to face, no matter if it is for sales promotion or negotiation. The Chinese only trust the people in real life. That’s why when Zhou Hongyi took the responsibility of Yahoo China, he fired all employees who only did E-mail promotion but never visited the clients.

What should you do, then?

First, Pay attention to Chinese culture

Chinese culture is totally different comparing with the Western cultures. Different political systems, different History, different religious beliefs. Thus, the culture strike shows extremely seriously in China.

Your company should do its best to avoid the culture strike and assume their role. We suggest you yo have a look to Lancôme experience in China.

Second, Explore the Chinese consumer behaviour and preferences

Knowing the Chinese consumer behavior and their preferences make the difference. What are the KPIs to attract them? What they care the most? What they pay less attention to? What channels they prefer to get promotion information?

All these questions need to be taken into account when setting up the marketing strategy in China.

Third, Know the correct channels

Due to the firewall in China, many foreign websites (Google, YouTube, Facebook, Twitter, etc.) are not allowed in the China mainland. Thus, use Chinese sources.

Fourth, Speak that language

Chinese people still prefer to speak Chinese. So, when doing business with them, try Mandarin: it is always more than welcome.

There are still lots of thing we need to explore and learn about China. In search of an Ecommerce and Digital Marketing Agency?

This article has been edited by Paula Vicuña, from 2 Open.

Infographic: 10 Things You Need To Know To Build a Chinese Website

A picture is worth a thousand words

After the great success achieved by our two articles 10 Things You Need To Know To Build a Chinese Website (I) (II), in the team we have thought it would be a good idea to summarize and turn them into an infographic.

We hope you enjoy it as much as we enjoyed its elaboration 🙂

Are you looking for a digital marketing and ecommerce agency?

Visit us. Let´s have a talk!

Nutrexpa Experience in China: Business Tips

Nutrexpa was not only one of the first Western companies operating in China in the early eighties, but also a perfect example to explain the hurdles that any company faces in its landing to China.

Nutrexpa paved the way and others followed its footsteps. Its story is an example of tenacity and adaptability to a country that was not what it is today. Many of its experiences are likely to be applied to any company that considers China.

Keep reading!

Find the proper battle buddy. Be aware of market dynamics!

In the early eighties, it was impossible to land in the country without the assistance of a local partner and the Chinese authorities.

After over three years of negotiations between the company and the local authorities, the emergence of a suitable local partner –Li Bank-, contributed to the establishment of an alliance, and the subsequent creation of a Joint-Venture.

A tip! This first stage requires flexibility and guangxi. Negotiations with local authorities and the Chinese bureaucracy are not always easy -although is improving every day! -, and finding a proper partner can be difficult.

Do not lose your patience and keep working on building a suitable partnership. It´s worthy!

Sometimes in China, your product will turn into another

After inaugurating in 1990 its factory in Tianjin, Nutrexpa would focus on prospecting of its target market, and also in adaptive demands that China demanded of its product. There, Nutrexpa started producing soluble and powder cocoa drinks.

Nutrexpa had all the ballots to fail on its arrival in China

The biggest pitfall were the eating habits: no milk or cocoa were consumed in China.

How to overcome such a hurdle?

– First, the company took advantage of an extrinsic condition: in the early nineties, the Chinese Government launched a powerful awareness campaign about the importance of milk intake in children. So, stay tuned! Opportunities come and leave!

–Second, Nutrexpa made a big effort to get a closer approach to the taste of their potential customers. To do so, they devised some specific tastes to their products: strawberry, banana and vanilla. Adapt!

–Third, Nutrexpa invested huge amounts on nationwide coverage advertising campaigns –around € 10/12 million per year- , especially on television. This effort managed to position the brand as a product fully recognized in big cities but also among Tier 2 and Tier 3. Now replace TV and imagine the endless possibilities of digital marketing on advertising nowadays!

–And last but not least, the company decided to create a Chinese distinctive brand. It dropped its popular brand name –Cola Cao– to become GaoLeGao, whose literal meaning is tall and jolly.

Choosing GaoLeGao was a marketing tool by itself: the election of positive attributes in a children’s product, makes easier its choice to the detriment of other similar products.

Years later, the company would challenge itself over again with the introduction of Nocilla… in a country in which bread was not consumed.

An another tip! Adapt your products and services to the market. If the name of your brand, colors or labeling are inadequate, change them!

Also never forget registering the name of your brand in Chinese and in your own language! Product customization, labelling and marketing are crucial!

success is sometimes highly unexpected

Despite being widely accepted, the product never reached another audience than children. Neither GaoLeGao nor Nocilla were the most successful.

Surprisingly, Nutrexpa discovered that its Star-product in China was… Phoskitos! Its commercialization never fit in with major purposes of Nutrexpa; after almost thirty years, they took the decision of selling the company and leave China.

What can we learn from the experience of Nutrexpa in China?

When Nutrexpa came to China, there were no previous examples. Fortunately, we are in 2016 and your company has the advantage of landing in the country in the hands of an agency specialized in Chinese business development.

Visit us and boost your sales in this giant we call China!