Nutrexpa Experience in China: Business Tips

Nutrexpa was not only one of the first Western companies operating in China in the early eighties, but also a perfect example to explain the hurdles that any company faces in its landing to China.

Nutrexpa paved the way and others followed its footsteps. Its story is an example of tenacity and adaptability to a country that was not what it is today. Many of its experiences are likely to be applied to any company that considers China.

Keep reading!

Find the proper battle buddy. Be aware of market dynamics!

In the early eighties, it was impossible to land in the country without the assistance of a local partner and the Chinese authorities.

After over three years of negotiations between the company and the local authorities, the emergence of a suitable local partner –Li Bank-, contributed to the establishment of an alliance, and the subsequent creation of a Joint-Venture.

A tip! This first stage requires flexibility and guangxi. Negotiations with local authorities and the Chinese bureaucracy are not always easy -although is improving every day! -, and finding a proper partner can be difficult.

Do not lose your patience and keep working on building a suitable partnership. It´s worthy!

Sometimes in China, your product will turn into another

After inaugurating in 1990 its factory in Tianjin, Nutrexpa would focus on prospecting of its target market, and also in adaptive demands that China demanded of its product. There, Nutrexpa started producing soluble and powder cocoa drinks.

Nutrexpa had all the ballots to fail on its arrival in China

The biggest pitfall were the eating habits: no milk or cocoa were consumed in China.

How to overcome such a hurdle?

– First, the company took advantage of an extrinsic condition: in the early nineties, the Chinese Government launched a powerful awareness campaign about the importance of milk intake in children. So, stay tuned! Opportunities come and leave!

–Second, Nutrexpa made a big effort to get a closer approach to the taste of their potential customers. To do so, they devised some specific tastes to their products: strawberry, banana and vanilla. Adapt!

–Third, Nutrexpa invested huge amounts on nationwide coverage advertising campaigns –around € 10/12 million per year- , especially on television. This effort managed to position the brand as a product fully recognized in big cities but also among Tier 2 and Tier 3. Now replace TV and imagine the endless possibilities of digital marketing on advertising nowadays!

–And last but not least, the company decided to create a Chinese distinctive brand. It dropped its popular brand name –Cola Cao– to become GaoLeGao, whose literal meaning is tall and jolly.

Choosing GaoLeGao was a marketing tool by itself: the election of positive attributes in a children’s product, makes easier its choice to the detriment of other similar products.

Years later, the company would challenge itself over again with the introduction of Nocilla… in a country in which bread was not consumed.

An another tip! Adapt your products and services to the market. If the name of your brand, colors or labeling are inadequate, change them!

Also never forget registering the name of your brand in Chinese and in your own language! Product customization, labelling and marketing are crucial!

success is sometimes highly unexpected

Despite being widely accepted, the product never reached another audience than children. Neither GaoLeGao nor Nocilla were the most successful.

Surprisingly, Nutrexpa discovered that its Star-product in China was… Phoskitos! Its commercialization never fit in with major purposes of Nutrexpa; after almost thirty years, they took the decision of selling the company and leave China.

What can we learn from the experience of Nutrexpa in China?

When Nutrexpa came to China, there were no previous examples. Fortunately, we are in 2016 and your company has the advantage of landing in the country in the hands of an agency specialized in Chinese business development.

Visit us and boost your sales in this giant we call China!

Do other e-commerce platforms stand a chance against Tmall?

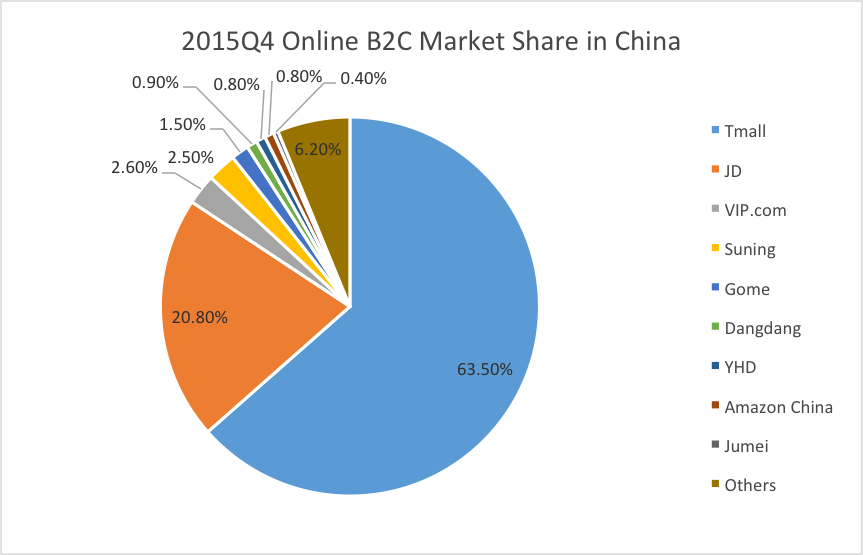

All of us are very well aware of the magnitude of the Chinese online market and, although it is currently the largest e-commerce market in the world, most of the market share is owned by the Chinese e-commerce giant Alibaba. Nevertheless, there are some other companies that also want their piece of the pie and with their vertical e-commerce platforms they are starting to put up a fight. This article will focus mainly on those vertical platforms that constitute an important part of the diverse Chinese e-commerce environment.

In the 4th quarter of 2015 China’s online transactions surpassed 644.38 billion RMB, the pie chart shown bellow contains the market share of the top ten Chinese e-commerce platforms:

Before we continue, we first have to clarify the concept of vertical e-commerce. In this context, vertical refers vendors that offer goods and/or services that are specific to an industry or customers with specific needs. A vertical e-commerce platforms could be a independent brand or a specified category within a wide range of products such as clothes, 3C (computer, communication, and consumer electronics) products, cosmetics, etc.

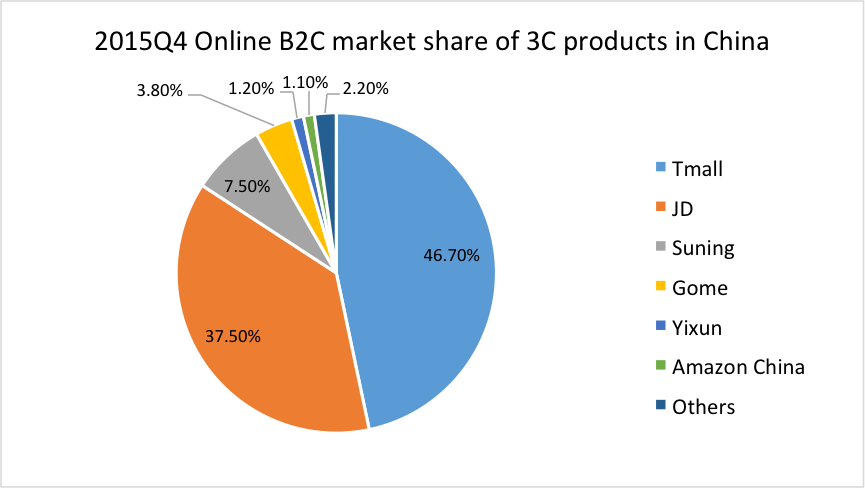

If you already have a basic understanding of the Chinese e-commerce market, then you are probably familiar with JD.com. Currently the second e-commerce platforms in China after Tmall (owned by Alibaba Group), JD.com started as a 3C products vertical B2C website. Now, let us take a look at the market share of 3C products in China B2C online market:

Although Tmall is still on the first spot, the difference in market share of JD.com is considerably higher than with regular products. Tmall and JD.com combined own more than 80% of the Chinese 3C products market. Suning, on the 3rd spot, and Gome, on the 4th, both also started specializing in 3C products, however, nowadays they have also diversified their range of products. At the end, it seems that there are no actual vertical platforms anymore.

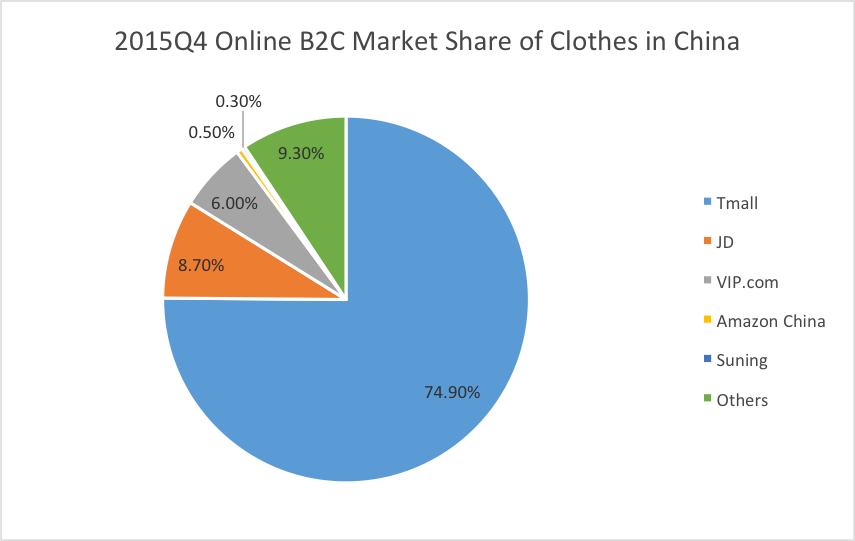

To study the online market, we cannot miss the biggest category, clothes. In the 4th quarter of 2015, the total transaction of clothes is 235.57 billion Yuan, market share is shown below:

In this case, Tmall is leading with an absolute advantage of almost 3/4 of the market share. In this category, JD has 8.7% of the market share, VIP.com has 6%, and surprisingly others do not even have 1% individually, so from the big picture the vertical market for clothes is not active enough.

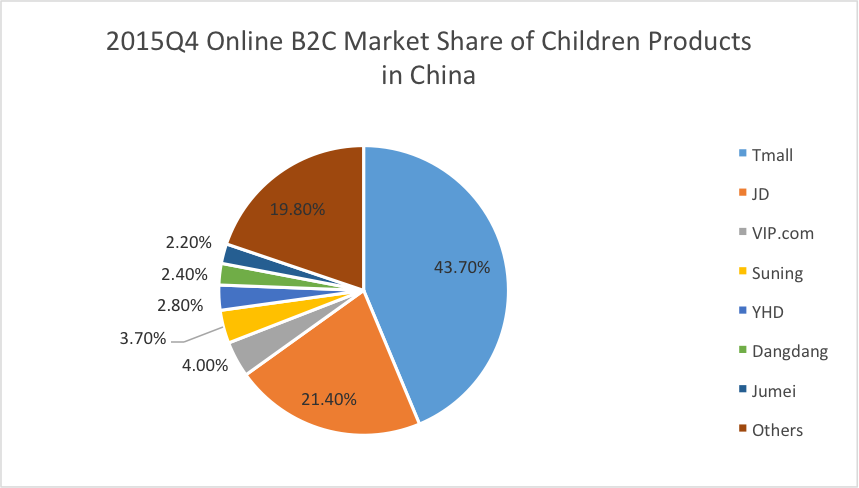

Another category that has had such a rapid growth we cannot ignore is the maternal and children products. Shown below is a pie chart containing China’s maternal and children products market share figures of major competitors in the last quarter of 2015:

The most noticeable difference in comparison with other categories is the porcentage own by other platforms that adds up to almost 20 %. Although Mia, Beibei, Babytree and others are in that 20% it is still a big figure. In this category Tmall and JD.com own less than 70 % of the Chinese clothing market, so we can say, to some extend, that there is still space for vertical players.

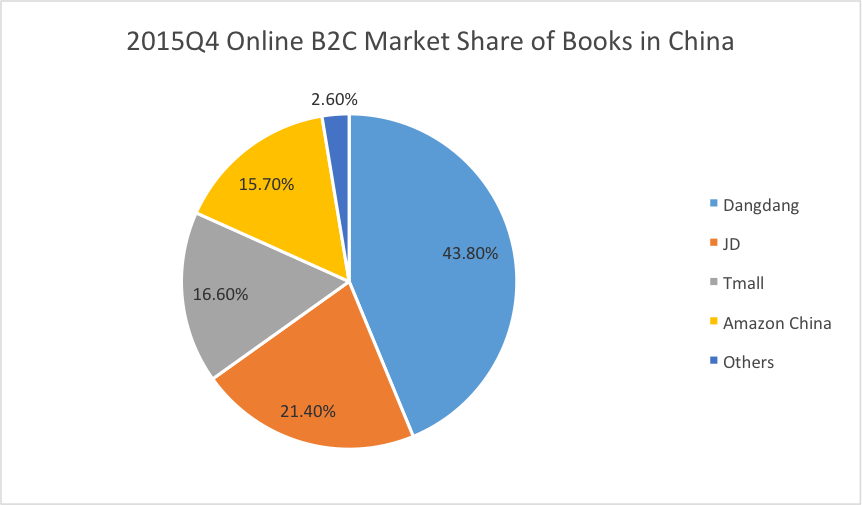

The next category is books and, even though the books total transaction was just 5.31 billion Yuan, the market share gives us a slice hope of competing with general platforms, in this case Dangdang is leading with 43.8%, and Tmall is only on the 3rd spot, just after JD.com.

Finally, we cannot say all vertical online platforms are dead in China just because most of the categories are gloomy, there are still some worth a try, and you just need to know enough about the current situation. If you don’t, luckily you saw this article, and you know 2open can always help you to find the right channels. So don’t hesitate, contact us now!

All in all, even though Tmall dominates in the Chinese market, there is still space for other platforms to flourish. Vertical e-commerce platforms seem to be the wisest option, specify in a certain category, gather information about the current situation in the Chinese market, and carry out your business plan. If you need further information about the market, would like to help you find the right channels, or want us to set up your business in China, do not hesitate in contacting us. Our group of specialists will happily assist you.

This article was edited by Andres Arroyo Olson from 2 Open.

References.

All products data from

http://www.analysys.cn/yjgd/17684.shtml

3C data from

http://www.analysys.cn/yjgd/17676.shtml

Clothes data from

http://www.analysys.cn/yjgd/17678.shtml

Children products data from:

http://www.analysys.cn/yjgd/17680.shtml

Books data from: