Is Sina Weibo On The Way Out?

There are plenty of Social Media platforms in China: while a few achieve great success, many succumb to a highly competitive scenario.

Result of its dynamism, it is essential to keep attention on the changes that China faces in the digital world.

From 2 Open, we have prepared a brief introduction about Weibo´s current situation.

Our goal is to give you some tips to fully understand what is going on with one of the biggest Chinese Social Media.

Do not hesitate to contact us for a more thorough analysis!

Weibo is a Social Media platform to produce, share and find out Chinese-language content.

As a leading platform, provides an easy way to express in real time and interact with people and corporations.

Its importance is not only due to its capacity to be an official/unofficial news source, but also because it allows people to express themselves in a public way.

The doomsayers come into the picture

Currently, Alibaba is the biggest Chinese e-commerce company: it provides C2C, B2C and B2B sales services via web portals, plus electronic payment services, a shopping search engine and data-centric cloud computing services.

Three years ago, Alibaba bought 18% stock of Weibo. Since then, several media have speculated that Weibo or even Sina might be acquired by Alibaba in a short time.

Encouraged by the rise of Wechat, many marketers have predicted the fall of Weibo. Well, the latest Earnings report proves they were wrong.

Is Weibo on the way out? Let the Earnings speak the truth

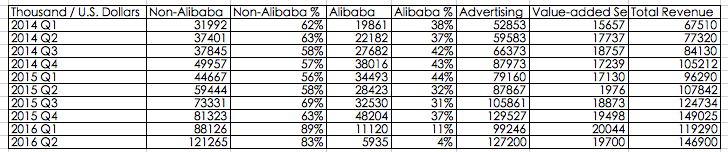

According to official Earnings Report of 2016 Q2 from Sina Weibo, the Net profit of 25.9 million dollars (net revenues of $ 146.9 million) increased 516% compared to the same period last year.

Moreover, Weibo 2016 Q2 data shows the Total revenue of Weibo is 146.9 million, including 127.2 million revenue from Advertising business, value-added services $ 19.7 million for value-added services.

Let’s review the users’ data on Weibo now

Monthly Active Users –MAU- is 282 million, increase 33% compared to the same period of last year. In addition, Daily Active Users –DAU- is 126 million with 36% increase compared to same period of last year.

Is noteworthy that 89% of them are mobile users.

The progress is closely related to their own media advantage

Three years ago, relying on its social communication advantages, Weibo attracted $ 600 million of Alibaba, while became an effective channel for celebrity campaigns, events, marketing and other commercial activities.

After that, Weibo focused on the advertising model. At the end, it decided to put aside Alibaba and manage the business alone.

In 2016 Q1, advertising investment from small and medium enterprises increased 147%. The quantity of SME’s and self-service advertisers reached 830K with 25% increase compared to previous quarter.

In 2016 Q1, investment in small and medium advertising revenue grew 147%, the number of SMEs and self-service advertisers reached 830,000 and a 25% increase the previous quarter.

Why both SMEs and big brands value Weibo a lot?

Both leverage it as an important channel frequently, specially because:

- Increase of traffic and users with 282 million MAU

- Optimized Algorithm of Ad Platform

- Active Internet Celebrities

- Live-streaming

The outbreak of short videos

We should add that speaking of its development path, the outbreak of short videos is also a milestone of growth of Weibo.

According to the 2016 Q2 Earning report, the playback amount of short videos on Weibo has increased 200%.

Meanwhile, the Internet celebrity economy is rapidly booming. Based on short videos, live-streaming broadcast and e-commerce, Weibo occupies the core position of social media with its incredible social power.

Margin improvement for future

The operating leverage will keep being prominent in the future. Based on the non-GAAP, the operating Margin rate of Weibo was 23.6% in the second quarter.

It is expected that the Weibo´s operating Margin rate could reach 25.2% in the third quarter, 23.4% in 2016 financial year, and 28.7% in 2017 financial year.

After seven years, Weibo proves to the world its strength and influence.

Do you still think Weibo is on the way out?

Our Digital Marketing and Ecommerce Agency have the experience of a team dedicated to know in depth the Chinese Social Media.

If you are looking to push your sales in China, do not hesitate to contact us.

Moreover, if you are interested in receiving to your mail the latest trends of Chinese Social Media, please suscribe to our monthly Newsletter!

This article has been edited by Paula Vicuña, from 2 Open.

How to optimize traffic within 1688.COM to obtain leads?

Interested in the B2B market? This article is for those currently interested in launching a B2B ecommerce initiative!

Following our instruction of How to Sell B2B Online in China, from 2 OPEN we will guide you on the most famous Chinese B2B platform –1688.COM, to obtain leads for your company, giving you the basic information to learn how to deal with traffic.

In order to develop your sales in a business-to-business, it is important to analyze which actions can be done to improve your company results.

From 2 Open, we have listed for you some of the key-factors to make it easier your landing on B2B. With our help, your company will take a huge advantage of this big chance on Chinese market!

WHAT IS 1688.COM?

Alibaba is currently the biggest Chinese eCommerce company. It dominates the Chinese online marketing in various aspects and includes on its services: online transactions, payments, promotion, service and communication.

In order to focus on B2B market, Alibaba created a portal for domestic B2B trade in China, 1688.COM. In 2013, 1688.COM launched a direct channel that is responsible for $30 million in daily transaction value.

After 14 years development, now Alibaba leads B2B into the full digitalization in China and it is responsible of the great revolution B2B has experienced in China.

HOW TO USE 1688.COM?

As the domestic B2B portal in China, 1688.COM has millions of vendors but does not support English version for foreign users.

In order to improve your position and make you easier, from 2 OPEN we will give you the specific information of acquiring traffic within 1688.COM.

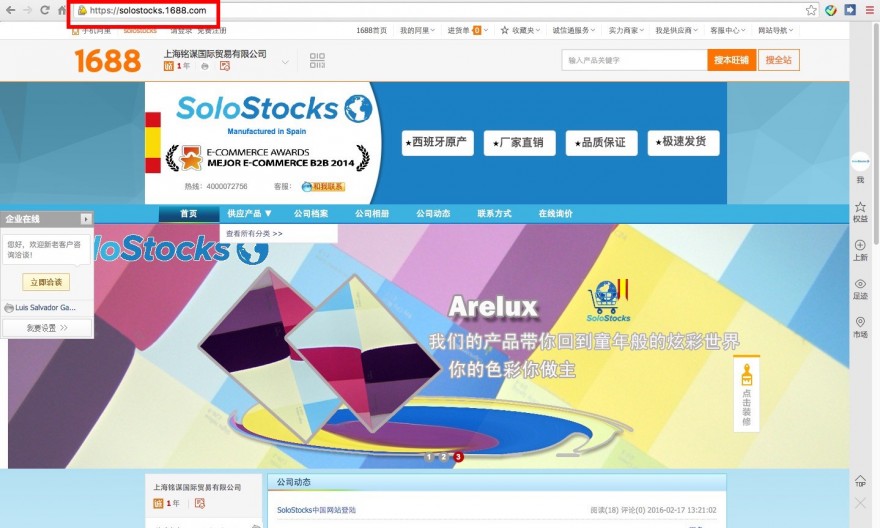

To provide an accurate sketch for you and due to its importance, we have chosen Solostocks as the example below:

- First, Go to the homepage of 1688.COM:

- Second, Create Solostocks’s online shop in 1688.COM

After the registration, you can access it with Solostocks.1688.com.

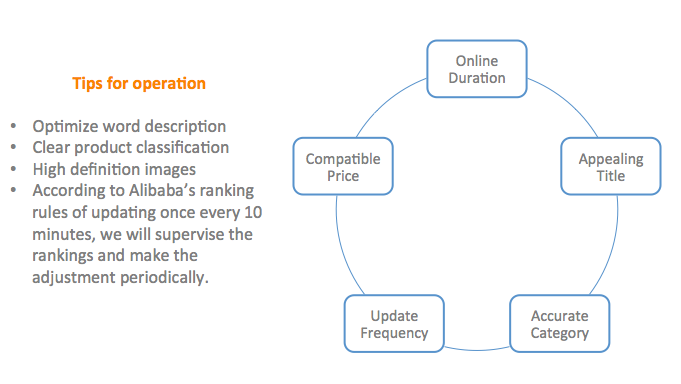

- Third, Optimization:

When the online shop settles down, we can optimize the traffic through strategies within Solostocks.1688.com. The internal optimization of the online shop could bring your company more traffics and leads.

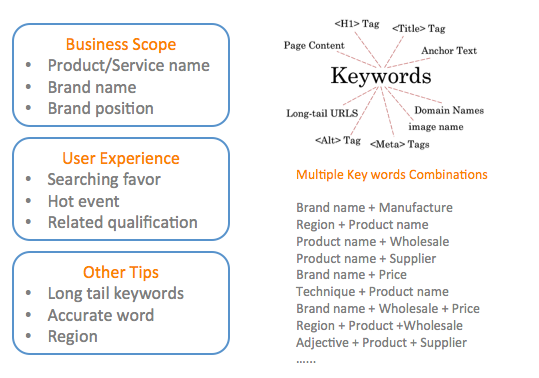

From 2 OPEN, we suggest you six strategies to apply to leads generation, such as:

- Product release:

In proper way, product release can fulfill the product category and increase Page View (PV).

Product quantity is not the key point for B2B selling but is the product category, title and description. Remember the more detailed the information is, the more opportunities for searching there will be.

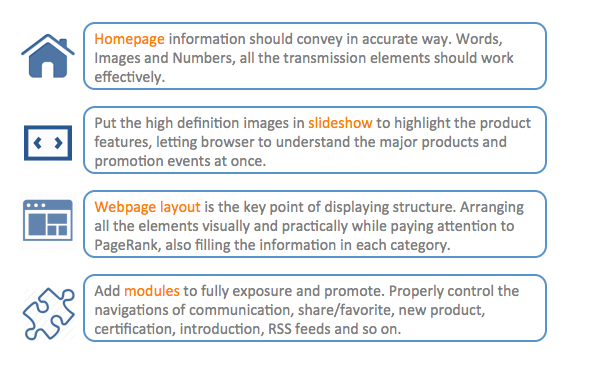

- Shop decoration:

Shop decoration is aiming to provide a good visibility to viewers: useful information in organization will fully convey to viewers and improve the CTR also display structure has to be recognizable and practical.

Key modules include logo, navigation, introduction, display, share/favorite, communication etc.

- Text content:

Text content includes all the product descriptions and introductions.

It is crucial to pay attention to Key-words combination: they will be the best SEO to boost traffics: the more key words are recorded, more exposures there will be.

Refined and targeted content can also lift the ranking and improve the user experience.

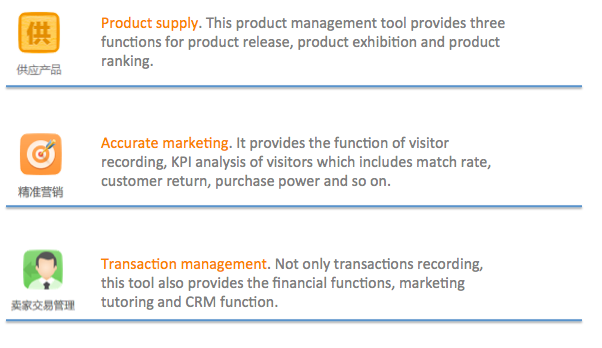

- Tool assistance:

Tool assistance from 1688.COM’s back office can facilitate Solostocks.1688.com promotion. It contains various functions to assist the system management, which provides a better performance in internal optimization.

Tools for managing product, KPI, finance, transaction and marketing would optimize the operation.

Here we explain you three detailed functions which we consider especially important:

By the way, there are a plenty other tools provided by 1688.COM that you can find. You just need to discover them all and find the one which better suits you!

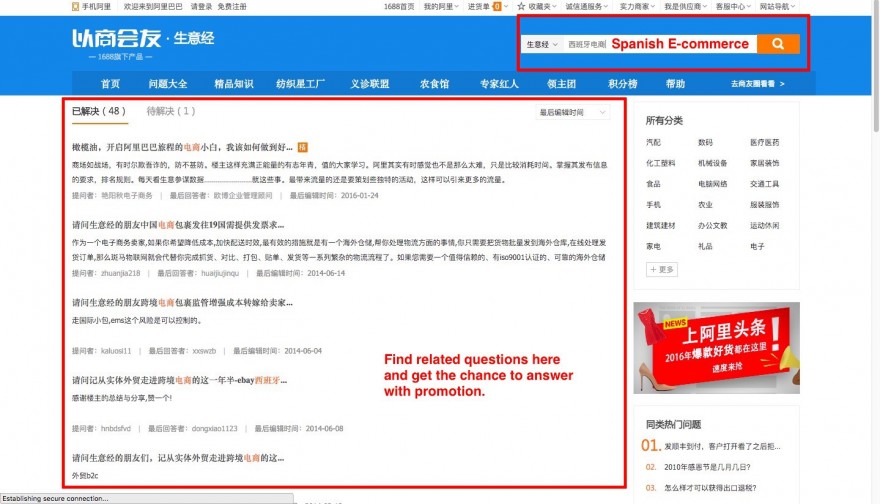

- Secondary platform:

The secondary platform of 1688.COM is called baike.1688.com. It is professional and dedicated to provide customers the solutions and commercial knowledge in business by means of questions and answers to solve business problems.

In this business platform, users can get connections and share their experiences. Do not forget to:

– Use proper key words to find out the related questions

– Answer professionally to promote Solostocks.1688.com

– Enhance the account activity and develop the business

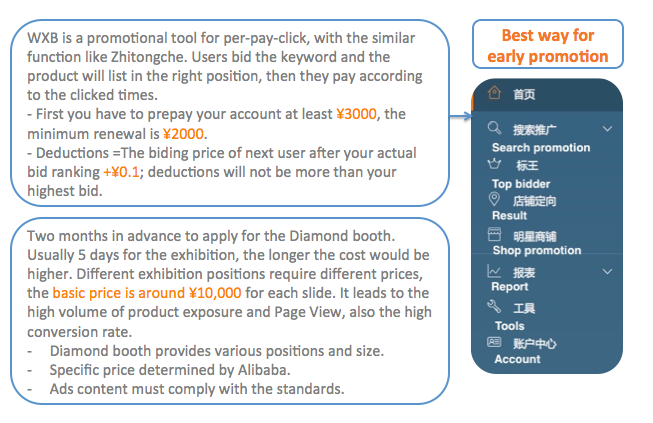

- Paid service:

Paid service in 1688.COM can effectively promote the brand and product in bidding ranking.

The most popular ways of SEM in 1688.COM are WXB (pay-per-click) and Diamond Booth (slideshow on the homepage). Both of them strongly facilitate the brand and product promotion in direct way.

Actually, 1688.COM provides various means for sellers to promote its sales. Here we summarize some main tips to implement the internal optimization in a comprehensive way to obtain the best results!

- Information sufficiency

Make sure the sufficient and high quality information can be provided to browsers.

- Effective transmission

Transfer the product or brand information in all directions to browsers accurately and immediately.

- Qualified images

High definition pictures can highlight the brand quality also beatify the online shop.

- Customer service

Keep the effective communication and CRM during the whole sales process.

- Ranking optimization

Paid service can provide the better performance in brand exposure by bidding ranking.

If you are interesting in doing B2B in China through a more native approach, 1688.COM would be the most effective and direct way to help you face to the Chinese customers.

Still interested?

Keep checking our blog and contact us if you have any questions. 2 OPEN will happily assist you!

This article was edited by Paula Vicuña.

How to Sell B2B Online in China

Last week we were in an event in Valencia organized by our partner, the Valencia Chamber of Commerce, in which we shared our knowledge about the B2B online business development in China in front of a full auditorium.

We were glad to share the “stage” with 2 of our best clients:

– Amvos Consulting: leading digital marketing agency in Europe and South America

– SoloStocks: best B2B online platform in Spain currently present in over 12 countries in Europe and South America

And that is what we talked about:

– WHICH ARE THE MAIN ONLINE B2B PLATFORMS IN CHINA?

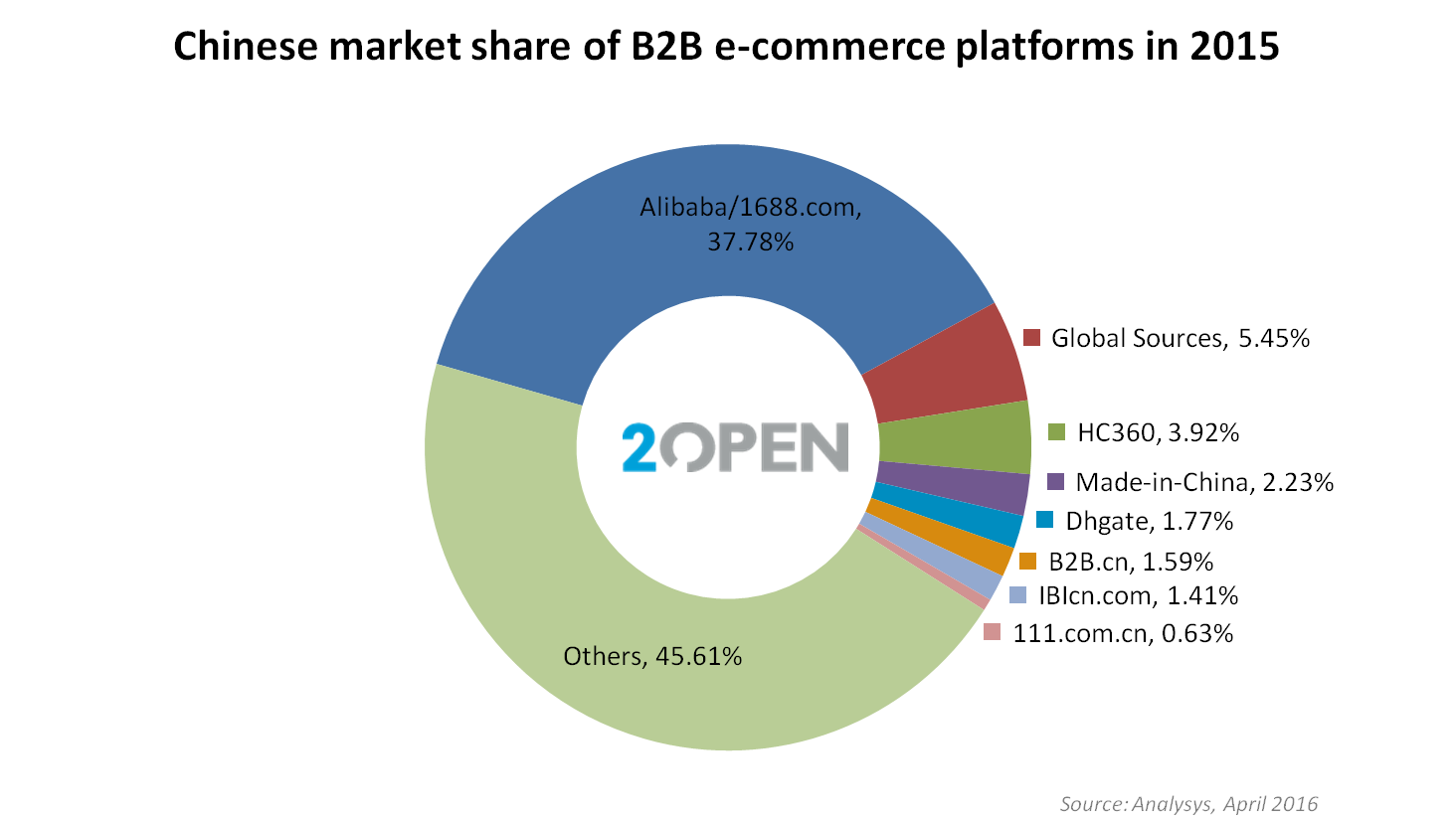

As we can see in the top image chart, the clear winner in the B2B Chinese market is Alibaba with its domestic platform 1688.com which absorbs 37.78% of the market share as per April 2016, followed far behind by Global Sources (5.45%), HC360 (3.92%), Made-in-China (2.23%) and DHGate (1.77%).

– Alibaba.com/1688.com: Alibaba.com is the leading platform for cross-border wholesale trade, serving millions of buyers and suppliers around the globe and 1688.com is the main B2B marketplace for domestic China trade among small and medium enterprises.

– Global Sources: It is a leading B2B media company and a primary facilitator of trade with Greater China. More than 1 million international buyers, including 95 of the world’s top 100 retailers, use these services to obtain product and company information to help them source more profitably from overseas supply markets and generate sales leads and win orders from buyers in more than 240 countries and territories.

– HC360: is the third most important domestic B2B e-commerce operator in the People’s Republic of China. With its professional information services and advanced internet technologies, it has established a reliable demand and supply platform for SMEs, and has been providing them with complete business solutions over the past 22 year.

– Made-in-China: was developed and is operated by Focus Technology Co., Ltd. Focus Technology, is a world leading B2B portal, specializing in bridging the gap between global buyers and quality Chinese suppliers.

Since China’s policy of reform and economic openness, the B2B traditional model unlocked unprecedented levels of growth and development. With the Internet booming and the transition of trade models taking place, most industries have enrolled in the online B2B revolution to develop their brand. For this reason, hundreds and hundreds of new B2B platforms are born trying to differentiate from each other and creating that way an unparalleled war. And we see new attempts to get to the top of this pyramid, day in and day out, as they all want to get a piece of the huge cake.

– BUT, WITH SO MANY OPTIONS… HOW CAN I CHOOSE THE RIGHT PLATFORM?

We list for you the key factors that should be taken into account in order to select the best platform for your brand to sell your products in a business-to-business model in China:

– Establishments costs: Lower implementation costs through simple installation and integration and unproblematic expansion options. The vast majority of wholesale online trading platforms in China are “free” to use. You can create your own shop and list your products. That way you have your own B2B storefront in China; but how will your products get noticed within the others? All these places provide different visibility packages. Call it gold member, golden supplier or whatever other name you can imagine; the important thing here is to compare these packages and what is exactly what they offer.

– Volume: What is the number of suppliers and competitors? What is the traffic volume generated in the platform? In this area, 1688.com is the clear winner from both sides. Anyway, there are also other vertical platforms that might be worth checking.

– Chinese partner: In order to create a shop and list your products in any Chinese domestic B2B platform, you will need to go hand in hand with a Chinese partner as you cannot use your foreign business licence to sell products within greater China. Here it appears the classic dilemma: Chinese partners are usually very opaque and don’t like to share any kind of information. 2 Open, as a Chinese and Spanish company, can be the right Chinese partner with modern European-style management and creates a totally transparent relationship with its customers. We want to succeed with you and not the other way around.

– Promotional tools: It is important to analyze which actions can be done in order to get more traffic to your shop. The most of them offer performance marketing actions in a CPC or CPM model, both for keyword optimization and display actions. The prices are usually high and a study should be done to assure that the ROI is the right one.

1688.com Homepage

In 2 Open, we usually recommend to do a market research that can lead us to take the best informed decisions: channel/s, range of prices, target audience, marketing budget and promotional efforts, potential return of investment, etc.

In another post we will show you how to optimize traffic within 1688.com to obtain more leads, so keep checking our blog and contact us if you have any questions. 2 Open can help you succeed in the Chinese B2B online world!

10 things you need to know to Build a Chinese Website (Part 1)

When planning to enter the Chinese market, one of the main points in every marketing plan should be the creation of a website that focuses on the Chinese consumer.

Naturally, there are some questions that come to mind…

- What are the differences between a western and an eastern website?

- What are the aspects that I have to keep in mind in order to trying to attract Chinese consumers?

- Would it be a good idea to just duplicate and translate my current content?

All of the above can be summarised in one question; what do I need to do in order to create a great website that will have the potential to reach the 675 million China internet users?

In this series of posts, we will try to give you some tips that will help you create a website for the Chinese market that will appeal to Chinese consumers and also match the style, tech and literary attributes of eastern consumers.

1 – Chinese Web Design – What the …???

When we look at a Chinese website, the first feeling we get is confusion… Language, structure, content … We can´t find anything similar to Western websites based (lately) on cleanliness and simplicity. Our China web design must be adapted not to our tastes, it must match Chinese consumer design taste.

If you have not navigated through Chinese websites maybe you don´t completrly understand what I mean. You´ll see easily the difference with these two examples. Taobao and Ebay, two B2C marketplaces (or C2C) from east and west.

China Web Design Example – Taobao Home Page

Western Web Design Example – Ebay Home Page

Can you appreciate the difference in style, design, structure? I bet you do…

We can see a lot of information on Chinese site in contrast to the cleanliness and simplicity of the western site.

Our experience creating websites for the Chinese market has shown us some key points to understand and get advantage:

- Chinese websites use many more elements and are much more colorful than Western.

- Chinese language is different. It seems obvious… but there are things we have to consider about Chinese language such as:

- There is not a capital letter in Chinese

- There are no spaces between characters

- Chinese characters are far more dense than our letters

- Chinese sites use a lot of animation, flashing texts and banners. This is clearly the opposite to our western websites where movement is disappearing. The reason can be it’s much harder to grab attention using fonts in Chinese than it is with western languages.

2 – User experience… Do they have any good one?

We have just seen as websites in China seem much more complex than we are used to. We might think that the user experience will be a nightmare, but Chinese user is so accustomed to information under this structure as we are to the western structure.

Chinese user is concerned about usability and user experience, but is used to webpages so busy usually does not care how the site looks. However the trend is towards simplicity and clarity on web pages. In a more European style.

Where is (link) Wally?

Some of the highlights on Chinese websites regarding to navigation are:

- Chinese websites have a big number of links, however Chinese users do not like this system. This can be given by the low load speed internet in China.

- All this links use to open in other new windows. Why? Again it’s mainly an issue of speed. Internet access in China is generally slow, users have gotten used to opening new links while waiting for a page to load.

- Keyword search box as a navigate tool. Link system is not comfortable for users because they can be lost due to the big amount of links. For this reason, on Chinese websites keyword searches have to be really efficient, and the search bar must be top accessible.

3 – Hosting & ICP. DIstance matterS

The one who said that, in internet there is no distance, did not know about China. If you are not (legal and/or physical) in Mainland China, easy staff like finding the right hosting can became a little bit more complicated.

Let´s start from the beginning, one of the most common questions when we are going to create a China site is should we host our website within or outside China? Is there is a big difference? The answer is very clear, as far as possible we should try host the web in Chinese Mainland, and we will try to explain why.

China network structure is not the best, which makes the websites loading speed not the most appropriate. By hosting our web outside China this problem becomes much more serious.

Okay, so we are clear, we should host our website in China, now what? We must apply for a number of ICP (Internet Content Provider) to the Ministry of Industry and Information Technology of China. This is the ICP license that will allow our site to stay in Mainland China. Only companies with a physical presence in China can apply for this license (which usually see in the footer of the sites, as in our case).

For companies that do not have a legal entity in China, we do recommend looking for hosting solutions in Hong Kong, which can limit the problem of loading speed and make our site more accessible for the Chinese user.

Now that we talk about speed, even though the main problem affecting the same be the hosting (inside or outside) there are also other factors that can make our web go slower (and we have seen that it is a key point in China) as can be:

• Website images are not size optimized

• Poorly code in our website

• Low hosting quality (even inside Mainland China)

• Our site is using services blocked in China (Google Fonts, Google Maps, Twitter, Facebook, etc…) which prevents the page from loading

4 – Did you say… services blocked? … the Chinese Great Firewall

China not only has a huge physical walls to defend themselves (in the past). China also has a large digital wall, the Great Firewall. Originally known “Golden Shield Project” but ironically nicknamed Great Firewall, it is a censorship and surveillance project initiated by the Chinese Ministry of Public Security in 2003.

This project acts as a digital censor and block all websites that do not meet the content requirements that marks the Chinese government.

Here you can see some more information about how the censorship works.

Among other things, Chinese Internet censorship censored webpages that have content that include; news sources cover topics considered that are defamatory against China: such as police brutality, Tiananmen Square protests of 1989, freedom of speech, Taiwan Government, Dalai Lama or the Tibet Independence Movement International …

These sites are banned or are indexed to a lesser degree, if at all, by some Chinese search engines and have significant impact on search results.

As a result of this control in China they are blocked pages as usual for us as Google, Twitter or Facebook (it does no matter how much Mark go jogging in Tiananmen). Although great firewall control is easy to jump (using a VPN, for example) the difficulty of accessing these pages has made their use and popularity is low.

Stop laughing Mark. It´s not gonna happen

This means we need to be very careful with our website content, try to be sure to avoid Great Firewall content restrictions and not to use third party banned platforms like Google (Google Maps, Google Fonts), Facebook or Twitter.

5 – New Players & New Rules

So, no Facebook or twitter, how am I going to promote my website? China has a digital ecosystem different of everything we are use to. Surely you’re wondering how you survive without some of the usual promotional tools. Natural positioning in Google, PPC Adwords campaigns, promotion of content on social networks like Facebook or Twitter …

In China you will find new players who have occupied these gaps and in some cases, created new niches. These new players have taken advantage of the absence of foreign competition (Facebook, Google …), its adaptation to Chinese culture and peculiarity and in some cases even a strong government support.

These actors we found some “copycat“, certified copies of known systems, such as:

- Baidu, the Chinese search engine par excellence (suspiciously similar to Google)

- Weibo, the microblogging service (suspiiiiciouuusssslyyy similar to Twitter)

- Youku, video service (guess who it is similar?)

We also have WeChat, the jewel of the crown and the mobile app (almost an OS) that includes messaging, payments, calls, moments … and which we discussed in detail in another post.

For our website to be inside China digital life it must be adapted to the rules of these actors, common in the dailylife of the Chinese consumer.

So, who are the big guys that you need to be friend of?

As soldiers in a war, most of these tools fall into three large “armies”. These three groups are known as the BAT and are in constant battle to dominate the Chinese digital ecosystem.

Who is going to win this war?

In short, Baidu holds commanding market share over search. Alibaba holds to the same power over e-commerce. Tencent is the dominant player in social media. But they are constantly trying to invade their territory, in a very interesting war for any fan marketing.

One of the commonalities of the BAT is a full support of the government, together with its dominant position in the market, makes this status quo is difficult to change.

What does it means for our website? We need to adapt our communication to this new players, generating our social media activity through Wechat, optimizing our SEO for Baidu or 360, uploading our videos in Youku, adding sharing actions in our content with Chinese social platforms… anything we use to do in our occidental site does not help us here and can be even negative for our goals. As we have seen, if we keep on using tools like Facebook (post sharing options for example) we can be blocked by the Great Firewall.

Do you want to know more? Sure? CHECK THE SECOND PART OF THIS POST HERE

References:

http://www.china-briefing.com/news/2015/05/22/best-practices-launching-china-website.html

https://econsultancy.com/blog/67466-why-do-chinese-websites-look-so-busy/

http://www.latmultilingual.com/build-localized-chinese-website/

Sources:

http://www.freepik.com/free-vector/screen-with-a-website-and-icons_847180.htm

http://www.freepik.es/vector-gratis/trabajador-llorando_834598.htm

Do other e-commerce platforms stand a chance against Tmall?

All of us are very well aware of the magnitude of the Chinese online market and, although it is currently the largest e-commerce market in the world, most of the market share is owned by the Chinese e-commerce giant Alibaba. Nevertheless, there are some other companies that also want their piece of the pie and with their vertical e-commerce platforms they are starting to put up a fight. This article will focus mainly on those vertical platforms that constitute an important part of the diverse Chinese e-commerce environment.

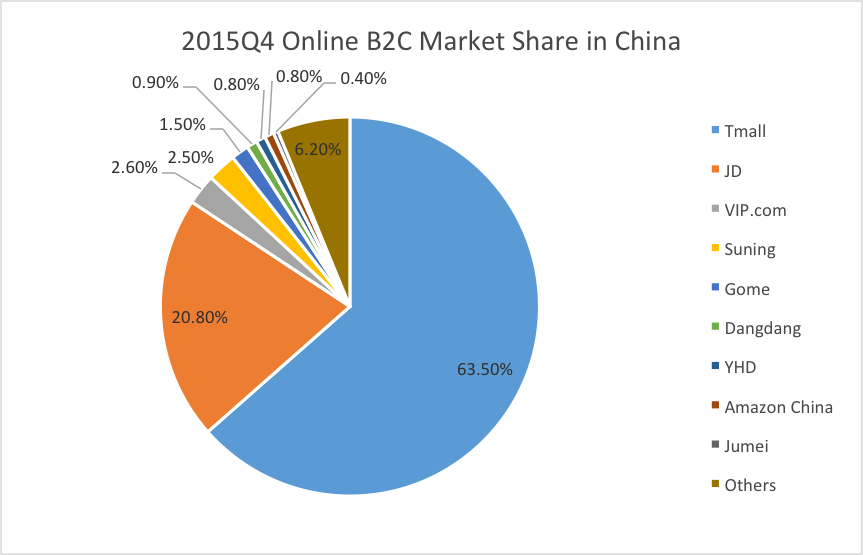

In the 4th quarter of 2015 China’s online transactions surpassed 644.38 billion RMB, the pie chart shown bellow contains the market share of the top ten Chinese e-commerce platforms:

Before we continue, we first have to clarify the concept of vertical e-commerce. In this context, vertical refers vendors that offer goods and/or services that are specific to an industry or customers with specific needs. A vertical e-commerce platforms could be a independent brand or a specified category within a wide range of products such as clothes, 3C (computer, communication, and consumer electronics) products, cosmetics, etc.

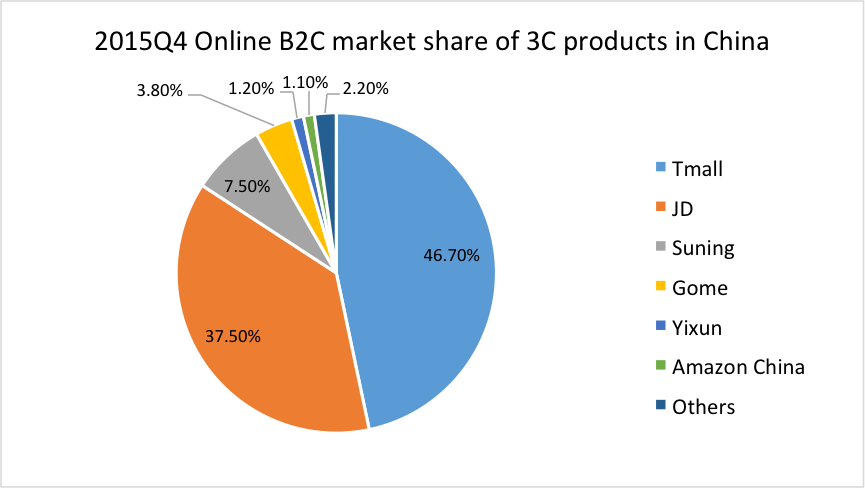

If you already have a basic understanding of the Chinese e-commerce market, then you are probably familiar with JD.com. Currently the second e-commerce platforms in China after Tmall (owned by Alibaba Group), JD.com started as a 3C products vertical B2C website. Now, let us take a look at the market share of 3C products in China B2C online market:

Although Tmall is still on the first spot, the difference in market share of JD.com is considerably higher than with regular products. Tmall and JD.com combined own more than 80% of the Chinese 3C products market. Suning, on the 3rd spot, and Gome, on the 4th, both also started specializing in 3C products, however, nowadays they have also diversified their range of products. At the end, it seems that there are no actual vertical platforms anymore.

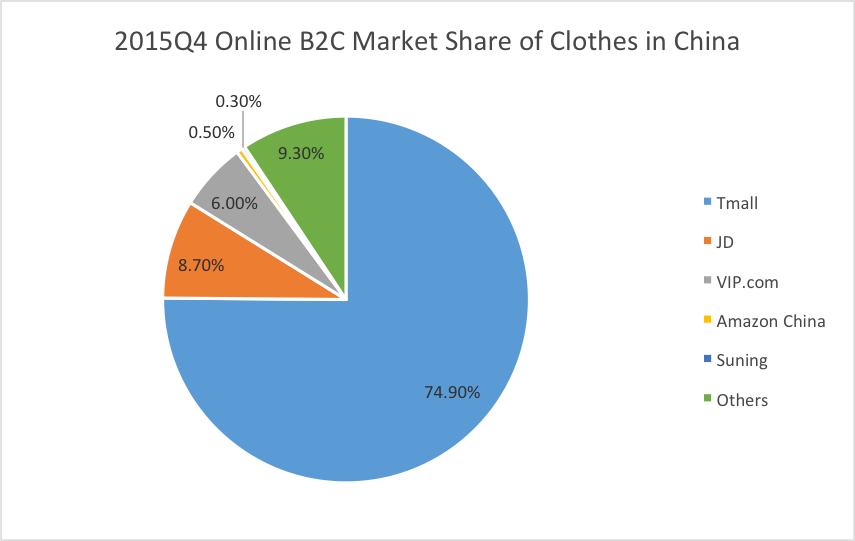

To study the online market, we cannot miss the biggest category, clothes. In the 4th quarter of 2015, the total transaction of clothes is 235.57 billion Yuan, market share is shown below:

In this case, Tmall is leading with an absolute advantage of almost 3/4 of the market share. In this category, JD has 8.7% of the market share, VIP.com has 6%, and surprisingly others do not even have 1% individually, so from the big picture the vertical market for clothes is not active enough.

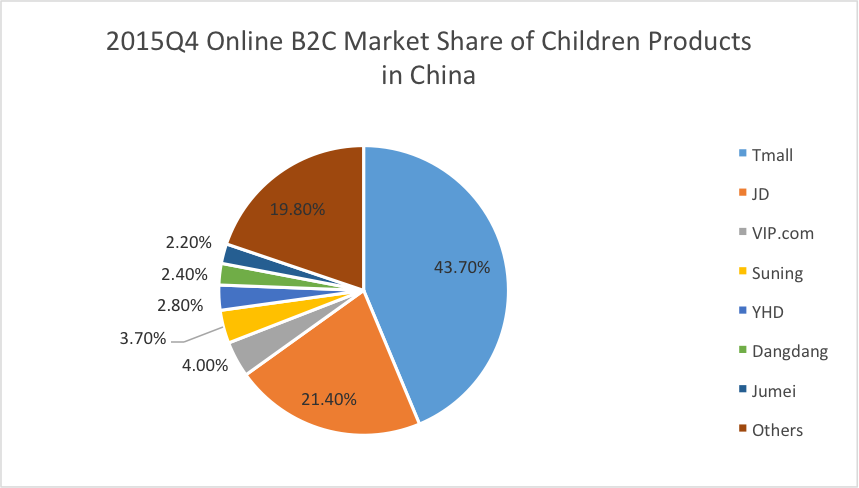

Another category that has had such a rapid growth we cannot ignore is the maternal and children products. Shown below is a pie chart containing China’s maternal and children products market share figures of major competitors in the last quarter of 2015:

The most noticeable difference in comparison with other categories is the porcentage own by other platforms that adds up to almost 20 %. Although Mia, Beibei, Babytree and others are in that 20% it is still a big figure. In this category Tmall and JD.com own less than 70 % of the Chinese clothing market, so we can say, to some extend, that there is still space for vertical players.

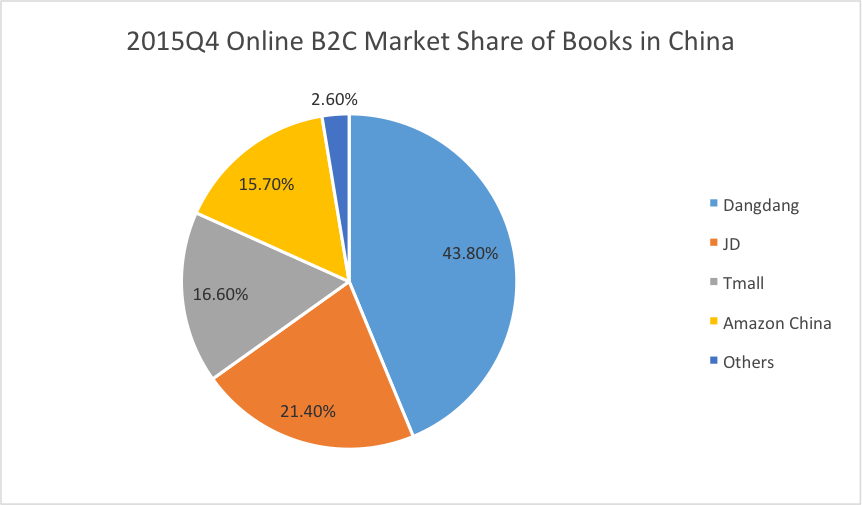

The next category is books and, even though the books total transaction was just 5.31 billion Yuan, the market share gives us a slice hope of competing with general platforms, in this case Dangdang is leading with 43.8%, and Tmall is only on the 3rd spot, just after JD.com.

Finally, we cannot say all vertical online platforms are dead in China just because most of the categories are gloomy, there are still some worth a try, and you just need to know enough about the current situation. If you don’t, luckily you saw this article, and you know 2open can always help you to find the right channels. So don’t hesitate, contact us now!

All in all, even though Tmall dominates in the Chinese market, there is still space for other platforms to flourish. Vertical e-commerce platforms seem to be the wisest option, specify in a certain category, gather information about the current situation in the Chinese market, and carry out your business plan. If you need further information about the market, would like to help you find the right channels, or want us to set up your business in China, do not hesitate in contacting us. Our group of specialists will happily assist you.

This article was edited by Andres Arroyo Olson from 2 Open.

References.

All products data from

http://www.analysys.cn/yjgd/17684.shtml

3C data from

http://www.analysys.cn/yjgd/17676.shtml

Clothes data from

http://www.analysys.cn/yjgd/17678.shtml

Children products data from:

http://www.analysys.cn/yjgd/17680.shtml

Books data from:

All you need to know about Ecommerce in China

The first quarter of 2016 is already behind us, are you still figuring out how to start your e-commerce business in China? For some of us e-commerce still feels like a new business model, however, China has long passed this stage, various data suggests that it has already become a traditional industry in China. Traditional or not, let us sort out the current e-commerce situation and forecast its areas of development.

Ecommerce is on its way to become a traditional industry in China

Ten years ago the ecommerce in China was brand new. Taobao was the most popular C2C online platform. At that time, people who had the technical skills and knowledge of search engines could get over 80% of return of investment on a Taobao shop. Nowadays, Taobao offers more than 1 billion products, has over 10 million sellers, and around 320 million active users. These huge numbers only come from one of Alibaba Group’s marketplace so you might be able to reckon the whole picture. After ten years high-speed development, China’s ecommerce is not a new industry anymore; its development is now as mature as the real estate or the catering industry.

Traditional industry vs Ecommerce

In recent years, the traditional industry has been strongly affected by the online market, some companies have managed to adapt their business to the new online scene, but some have failed at this task. This trend of transitioning from offline to online businesses will speed up this year, and although there are currently more traditional businesses than online ones, online businesses will eventually catch up.

It seems that both business models cannot co-exist, however, if the resourceful traditional industry would explore Chinese digital marketing and ecommerce solutions, they would be able to achieve better results with half the effort.

Develop a 020 (Online-to-Offline) business model

In coming years, online retailing will be a fully integrated part of the market, it will help companies grow, and sale more efficiently. On the other hand, they will also have to implement the offline part of it, a successful integration of a good O2O business will, without a doubt, thrive in market. Suning began handling deliveries for Alibaba, in order to push Tmall Supermarket into the massive market, and Jingdong is promoting Jingdong Daojia, all the actions from the leading Ecommerce companies indicate that the O2O model is inevitable to come.

Ecommerce in the rural areas

Last year ecommerce in rural areas had a rapid development. Alibaba made a long-term project to promote online shopping in order to expand its business coverage. The central government formally issued a document to help the promotion of rural ecommerce and facilitate the integration of online and offline. Alibaba, Jingdong and Suning are also pushing the development of ecommerce in rural areas so we should expect an huge increase this year.

Great development of CBEC (cross-border ecommerce)

Over the past 2 years, CBEC has become one of the most popular business models in China. It has given import business a lot of opportunities; moreover, since the Chinese middle class has grown considerably (first place in the world with over 100 million), it turns out to be a very profitable business. The main consumers are people between the ages of 30-40 and have great acceptance for foreign products, this will bring a lot of overseas ecommerce companies into the Chinese market.

Here at 2Open we specialize in ecommerce and digital marketing. Our goal is to understand our clients business needs in order to provide the best possible services. If you have any questions or require any information about our services, please do not hesitate in contacting us, our group of specialists will happily assist you.

This article was edited by Andres Arroyo Olson from 2Open.

Online to Offline (O2O) in China

E-commerce has grown internationally over the past few years; China is one of the countries with the fastest e-commerce growing market, Alibaba has become the largest business-to-business (B2B) platform in the world. Tmall is the largest business-to-customer (B2C) website in Asia, with more than 90 billion RMB in revenue recorded on Nov 11, 2015(China’s “Singles Day”). Despite their success, return rates have also grown accordingly. Compared with offline physical shops purchases, online shops experience a higher rate of refunds and exchanges. The lack of the buyer experience is perhaps the biggest weakness of e-commerce, that is the main reason why the online to offline (O2O) business strategy was created.

O2O is a business model where companies attract potential buyers to their physical stores through online marketing strategies. These strategies often consist in in-store pick up of items purchased online as well as offering the option of buying or experiencing the items directly at the store.

Fast moving consumer goods do not really have to offer the buyer experience since they are expected to sell quickly and for a low price, this is the main reason why O2O does not really suit this field. Durable consumer goods, like clothing, seem to have a huge potential, they are probably the best candidates for the implementation of O2. Let us say, for instance, that you would like to buy a new camera, you compare all the features of several models online, experience them in physical shops and then after you finally decided the model, you would simply place order online for a reasonable price. Everything fits perfectly. There has been an ongoing talk about this for years, Manufacturers know this, they would like to see this, but unfortunately results are not ideal.

Why is it so difficult for O2O commerce to evolve? Who has the advantages to start implementing an O2O business model? Should large Manufacturers, like those who own multiple shops, implement it? Should offline chain shops do it? Logistics companies? Online platforms? These are questions that have to be discussed. Let us talk about these one by one.

Most Manufacturers with lots of physical shops operate offline, they usually carry out the traditional business scheme; they manage shops and focus resources on shops rather than the end users. Very few manufacturers have their own Customer Relationship Management (CRM) system for consumers, and even when they do, what happens to the employees at the shops? Sales volumes usually measure commissions and performance for employees, however with an O2O business model it makes it harder for manufacturers to keep track of their physical shops and employees performance. No companies have solutions for this, so employees in physical shops resist O2O, so for manufactures O2O is harder to be executed.

In the case of offline chain shops, employees manage products rather than sell them directly, and they have CRM systems for most of the consumers. The real problems these companies face is related to online traffic, do their offline consumers also have the habit of buying online? Even if they do, do they know the chain shops started an online business? Despite the attractiveness of implementing a fully online business, they are still more likely to succeed with a O2O business model. Suning is a real life example of this, with thousands of offline physical shops of household appliances, also expanding its categories one store at a time, and being the third in the Chinese E-commerce field. Their market share is a little more than 3%, far behind the first two companies, O2O is the trend but there is still a long way to go.

What about Logistics companies? Logistics means warehouses and more detailed consumer data; this is the main advantage here. SF-express started Hi-ke in 2014; the goal was to steal market shares from online platforms like Tmall and JD with SF-express’ logistics. This resulted in a lack of experience for consumers and complex order placing procedures.

Online platforms should also implement O2O for one reason, to keep the current e-commerce market share. Tmall and JD just started this; we will have to wait to see how it works out. Their weakness is still the lack of physical shop operation experiences.

O2O needs someone who can successfully implement the business model, in China currently there has been no one who had manage to do this, it seems that what the market needs is a pioneer in this field, future is bright, and the market gap is there, let us wait and see who will rise up.

This article was edited by Andres Arroyo Olson from 2Open.

7 Facts You Need to Know About The Chinese Online Market

1. The Chinese online ecosystem is shaped by the actions of the B.A.T.

The B.A.T. is a group consisting of Baidu, Alibaba and Tencent. They are the dominant players in the Chinese online ecosystem. The dynamics of their competition and cooperation defines the boundary and possibilities of digital marketing and ecommerce in China. Each member of the B.A.T. dominates important segments of the online ecosystem: Baidu dominates the search engine market; Tencent is strong in social media, and Alibaba fiercely rules ecommerce. The results of this competition can provide inconveniences for online marketers. Baidu, for instance, is reluctant to direct search traffic to Tmall stores and pages, where in some cases a company will need special permission from Baidu to promote Tmall stores using Baidu’s Search Engine Marketing (SEM).

2. Baidu’s dominance in the search market

Baidu’s dominance in the Chinese search market means that most search engine related marketing activities requires the cooperation of Baidu to work. Baidu’s Search Engine Optimization (SEO) is different from Google’s SEO. Baidu still requires Meta data for proper indexing and it prioritizes loading speed quite heavily. Setting up SEM accounts with Baidu can either be an easy task that lasts for several working days or an excruciatingly slow and cumbersome process, which might take months to complete. This depends on the involved company’s policy match with Baidu’s requirements. There is also a minimum investment requirement for setting up an account. These can range from as low as 6,000 RMB to as much as 500,000 RMB depending on the type of account that is being opened. One of the most important aspects of Baidu’s listing is the absence of brand protection. This means that brand keywords can be bought by any paying parties willing to buy them. This might lead to unfair price based competition between official suppliers and the unofficial ones, or even from someone that sells fake products through proper channels.

3. Wechat is not just a messaging app; it is a lifestyle app that defines online interaction in China

It is hard not to know about Whatsapp, Facebook, Twitter or Instagram in 2016, yet many are not familiar with Wechat if they live outside of China. Many foreigners regard Wechat as a Chinese version of Whatsapp but it is far from just a messaging app. To be more precise, Wechat combines the function of many known social media sites and utility apps. Users can chat, post their photos, sell items, make online payments, book a ride, buy transportation tickets, invest their money, and more. In addition to being used as a private app, it’s becoming more and more popular in the work place, mainly used for communications. With so many diverse functions and over 600 million registered users, marketers naturally want to use Wechat as a channel to communicate to their target audience. Wechat offers the possibility of a one on one customer service; creating customized functions to improve the brand experience. However, with the Wechat craze comes the high costs of Wechat marketing. Posting merketing content on a big account with upwards of 100,000 followers can cost as much as 80,000 RMB.

4. The Chinese consumer has embraced ecommerce faster than most markets

The rise of ecommerce in China surprised many outside observers. Many consumers born in the 80’s and 90’s have fully embraced the concept of ecommerce as the main way to purchase items. Anything from daily necessities to premium products can be purchased. The Chinese consumer responds well to online promotions and acceptance of new brands, however, most of them are still price sensitive. Foreign brands selling in the Chinese market to the Chinese consumer are less likely to be successful offline due to the high cost of real estate. Platforms such as Tmall and Jing Dong and vertical e-store are the best way to sell to consumers in China. Ecommerce events such as 11.11 are already a cultural phenomenon in China where the total transactions can be above 11 billion USD in one day.

5. China has one of the most highly regulated online environments in the world

China is one of the fastest growing online markets yet it is one of the most regulated ones. Traffic data going in and out of the country is heavily censored and is significantly slower than domestic traffic. This means that local hosting might be necessary for optimum speed. To publish a website, a company is required to obtain the Internet Content Provider (ICP) license to publish any content online. China has a very strict advertising law. Multinationals are regularly hit with fines for violating the law and some fines can go up to 100 million RMB. It is critical to study the proper regulations and laws before entering the Chinese market to prevent future risks and losses.

6. Mobile is not the future; it’s already the dominant traffic in China

In recent years, PC traffic has been decreasing 15% every year, whereas mobile traffic has been increasing as much as 20% in the same time frame. Many online retailers are reporting that most buyers are using their mobile phones to buy items online. Conversion for mobile traffic is also higher than PC traffic in many cases. This is due to the high penetration rate of smartphones as well as user reliance on mobile devices for online payments. It is easier for users to pay online with mobile phones than it is with their PC. Traditionally, consumers would use their PC to do extensive research before buying online. However, with improved mobile connectivity and mobile optimized websites, many consumers are abandoning PC and in some cases only uses PC for work related activities. The pay-per-click for mobile traffic can create as much as 300% higher than PC traffic in some industries, mainly due to limited advertising space and high demand.

In recent years, PC traffic has been decreasing 15% every year, whereas mobile traffic has been increasing as much as 20% in the same time frame. Many online retailers are reporting that most buyers are using their mobile phones to buy items online. Conversion for mobile traffic is also higher than PC traffic in many cases. This is due to the high penetration rate of smartphones as well as user reliance on mobile devices for online payments. It is easier for users to pay online with mobile phones than it is with their PC. Traditionally, consumers would use their PC to do extensive research before buying online. However, with improved mobile connectivity and mobile optimized websites, many consumers are abandoning PC and in some cases only uses PC for work related activities. The pay-per-click for mobile traffic can create as much as 300% higher than PC traffic in some industries, mainly due to limited advertising space and high demand.

7. Local content through local perspective

The Chinese market is still flooded with marketing contents that are just a direct translation from their original language. Some branding videos of multinational companies do not have Chinese voice-overs, only Chinese subtitles. While these contents do not necessarily fail to communicate their intended message, most have drastically reduced their effectiveness and recall rate due to being less relevant. In order to communicate effectively, companies need to dig deep to find relevant messages and hire local content producers as a bridge to effectively communicate to their Chinese consumers. This is especially relevant when publishing materials online, where the Chinese consumer expects instant gratification, not a bad translation.

This article was edited by Andres Arroyo Olson from 2Open.

General situation of fake products in China

It is common knowledge that fake products are everywhere in China, from large cities like Shanghai to remote small towns in Western China and, not surprisingly, online markets are not the exception, even though there is a lack of acknowledgment from their part, it seems that fake products are a part of China whether we like it or not.

The online market giant Alibaba group was sued in the U.S. regarding fake products regulations. According to Jack Ma, the founder of Alibaba, his company spends over one hundred million RMB each year on actions against counterfeit goods. The situation has improved considerately over the past few years, some shops have even been closed down due to this sort of issues. 2Open, as a company who deals everyday with marketing and e-commerce, is used to supervise online sales in China for many clients and the number of shops selling a certain brand with an unbelievably lower price has decreased noticeably in comparison with last year. There is still a lot of work to do, but exactly what types of products are more likely to be faked?

SHENZHEN, CHINA – AUGUST 04: (CHINA OUT) Police officers deal with fake brand-name items at a shop on August 4, 2014 in Shenzhen, China. Shenzhen police seized a large number of fake brand-name items, like Hermes, Gucci, Rolex, Chanel, Prada, Miumiu, and so on, worth 5,000,000 yuan (810,000 USD). (Photo by ChinaFotoPress/ChinaFotoPress via Getty Images)

The most common faked goods are well-known brands, such as Nike, Adidas, Louis Vuitton, Gucci, etc. If a new brand wants to enter China, it will seldom encounter issues regarding fake products. In this situation, just a small budget is needed for online marketing which could be used for setting up a shop on www.taobao.com, putting online Ads or even buying key words on search engines, all of which can have a positive effect and lead buyers to get to know your brand. Since you are the shop owner and the only supplier at this moment, the buyer will come to you directly; no other shops will take potential buyers from you.

Let us say your brand successfully entered the Chinese market, perhaps one day someone will start faking and selling your products, but how would this affect your brand? Some argue that this is just indicator of the success and popularity that your product has had in the Chinese market and that there are no reasons to be worried. Experts agree that there is plenty of space in the market for both parties; a lot of people prefer to buy original products for a higher price than fake ones for a lower one. Counterfeiting could be considered a promotion activity for a brand, after all, if you are confident about your products, put money into marketing, let people know about it, you will get money back, no doubts about it, but how is the future looking for fake goods?

According to Xinhuanet, the General Administration of Quality Supervision, Inspection and Quarantine (AQSIQ) has gathered around four giant e-commerce platforms: Alibaba, Jingdong, Suning, Yihaodian to sign a cooperation agreement which will help to release inspection results of the fulfillment of product quality commitment. AQSIQ has developed a search platform of inspection of product quality, which will be put online for public use around March 15, 2016.

Fake products problems continue to plague the development of e-commerce. Jingdong and Alibaba have been fighting a war these days, accusing each other of not making efforts to end the fake goods. The offline scene does not look very bright either, street shops are now going through a rough time these days, people are getting used to purchase everything online, from groceries to electronics, during the singles day alone (Nov. 11, 2015) Taobao reached a sales volume of 91,217,017,615 RMB.

It is an Internet Era, no doubt about it, and counterfeit goods should not represent any obstacle if one should intent entering the Chinese market. A smart digital marketing strategy, like the one 2Open offers, can get your brand the recognition it deserves.

Let us know what you think in the comments below.

This article was edited by Andres Arroyo from 2Open.