Alibaba Overcomes Baidu in Chinese Digital Advertising

According to a new report from eMarketer, experts predict that the decline of Baidu in favor to Alibaba is due to the new market conditions in Chinese digital business. Alibaba has adapted fast to the last digital ads regulation and currently enjoys the leadership in terms of online advertising revenue.

The Chinese Internet landscape is characterized by the huge prominence of the three technology giants.

As you may know, Baidu is the largest player in China in digital advertising market, Alibaba is the Chinese eCommerce leader firm and alongside both, plays Tencent.

These Top 3 in digital industry are estimated to command a total of 60% in ad revenue in the present year, and amount around $42 billion.

What factors have led Baidu to its future decline?

Although currently Baidu still controls the largest share of the online advertising market, the success of the company in 2015 is far from repetition. Baidu’s share in China’s digital ad market is expected to drop to 21% in 2016, and forecasts are less positive for the coming year.

In early September, in the team we analyzed in our article “New Online Advertising Rules in China” the new online advertising regulation in China and its impact in all digital business with presence in China.

The Internet Ad Interim Measures is a new regulation prompted by the State Administration for Industry and Commerce of China. It arose from the Government’s claim by adopt new rules over online advertisement, at the time it was expected to impact on Chinese Digital Marketing as a whole.

As we mentioned before, some fields were subject to special regulation: healthcare, medicine, food and beverage. But new regulations also affect to Internet advertising practices with some other measures: it is required that all paid ads to be clearly marks in search results, prescription medication and tobacco ads have been forbidden and it is already mandatory to certain medical and health products.

From the beginning, these changes were identified by outside analysts as a serious handicap for the future of the company. As Shelleen Shum told,

“We think the impact will be larger on Baidu than on the other search engines given Baidu’s larger market share and its dominance in medical service ads.”

But the coming into force of the new rules, is not the only reason for its current decline. The lack of strong mobile devices is also affecting its ability to attract advertisers.

The main driver in the Chinese market is the mobile platform. As Lyu Ronghui said,

“Huge traffic is the bedrock of online advertising business. But unlike Alibaba and Tencent, which have numerous successful mobile products that can attract traffic from users. Baidu still lacks a new cutting-edge to help jumpstart its slowing traditional search business.”

Facing Baidu, Alibaba has surpassed its rivals taken advantage of the new conditions. As Shelleen Shum explains, its reinforcement is due to,

“Although also affected by the new regulations, Alibaba’s ad revenue, particularly from the mobile sector, shows no sign of abating thanks to the robust growth of its e-commerce retail business.”

Although at present Baidu controls 28% of the online ads marketing, Alibaba is expected to become the largest player in China’s digital advertising market before finishing 2016.

New rules in China

In China, digital landscape changes as faster than imaginable. There are plenty of creative ways to sell your services and products in China, but acting in the hand of a company based in the country, is always a big extra bonus for your business in China.

In search of a Digital Marketing & Ecommerce Agency?

Sources:

How to Promote your Business in China

How does Chinese Market work? How can companies promote themselves without Facebook and Google? How do people survive under huge competition there?

China is -still- a mystery for foreigners. The country means a huge cake, but before entering the market you will need to answer to this and other questions. To make it easier to you, in 2 Open we have taken a brief look of the Chinese market and done a list of the most basic tips you should consider before landing in China.

Gone wrong? It can go much worse

When many companies started their business in China for the first time, the things they used quite a lot in local made no sense in China.

Ebay is one of the biggest e-commerce platforms around the world and a perfect example to explain the experiences many foreign companies face in China. Due to its leadership, the company assumed that its landing in China would be no much different to that experienced in other countries, so in the beginning they refused to establish a partnership with JD.com. The company soon realized there were no more choice but to cooperate with them.

What are the most common problems that foreign companies face in Chinese territory?

Foreign enterprises in China often fall into the same shortcomings we analyze below. Let´s see:

First, Always try to show their high-end enterprise images

Foreign enterprises always show their best face: high-quality services, responsible attitude, respect to the customers… and so on. But in China, price is the key and can always be the KPI which attract the customers’ sight immediately.

Second, Focus on high-end target audiences but ignore the rapid growth of China

When companies like Blueberry entered China, they set the target group to those corporate users. As the earliest and past No.1 smart phone, Blueberry had already been famous in China. But within 7 years (2006-2013), they retreated from China and closed their Chinese official website.

When Huawei set off their business, what they did was to set the target audiences as all people who want smart phone. Since the average income of Chinese people is increasing, so that more and more can afford a smart-phone. Huawei was right about its strategy.

Third, Copy the promotion strategy directly to China

Many foreign companies would prefer to make a wonderful advertisement, an amazing poster and advertise in the subway stations, supermarkets… and everywhere. But they always find out that the ROI is quite low, since they might only get 1 customer for a 100 RMB budget. Does it outweigh? We don´t think so.

In China, since the civil quality is still on a shallow level, what the customers care most is whether they are interested in, but not what is a good design. That is why when Taobao.com stepped out their first step, they even promoted on some illegal websites which had huge traffics every day.

Fourth, Think too much about customers but ignore what the customers are thinking about ICQ. The instant messaging software also failed in China!

The U.S. companies are always stricts on protecting the users’ privacy. With such a policy, users can’t find the chat record if they log in on another PC, since the software will not memorize or save these records in order to protect the privacy to the most degree.

Its counterpart in China, Ma Huateng, found out this fault which doesn’t fit the Chinese users’ requirement. In response he created QQ, which is based on the technology of ICQ and make this software become the most-used IMS in China.

Fifth, Rely too much on the Western promotion ways, companies do not want to do things directly

E-mail, Mail and SMS promotion require low budget and have huge audience quantity. Well, they do not make sense in China. For many Chinese people, it is absolutely offensive if they receive advertisement in these channels since they have watched and received too many advertisements already. Moreover, for most Chinese these all are considered private.

They don’t like to be bothered by anything they don’t even know. In China, what people prefer is face to face, no matter if it is for sales promotion or negotiation. The Chinese only trust the people in real life. That’s why when Zhou Hongyi took the responsibility of Yahoo China, he fired all employees who only did E-mail promotion but never visited the clients.

What should you do, then?

First, Pay attention to Chinese culture

Chinese culture is totally different comparing with the Western cultures. Different political systems, different History, different religious beliefs. Thus, the culture strike shows extremely seriously in China.

Your company should do its best to avoid the culture strike and assume their role. We suggest you yo have a look to Lancôme experience in China.

Second, Explore the Chinese consumer behaviour and preferences

Knowing the Chinese consumer behavior and their preferences make the difference. What are the KPIs to attract them? What they care the most? What they pay less attention to? What channels they prefer to get promotion information?

All these questions need to be taken into account when setting up the marketing strategy in China.

Third, Know the correct channels

Due to the firewall in China, many foreign websites (Google, YouTube, Facebook, Twitter, etc.) are not allowed in the China mainland. Thus, use Chinese sources.

Fourth, Speak that language

Chinese people still prefer to speak Chinese. So, when doing business with them, try Mandarin: it is always more than welcome.

There are still lots of thing we need to explore and learn about China. In search of an Ecommerce and Digital Marketing Agency?

This article has been edited by Paula Vicuña, from 2 Open.

Is Sina Weibo On The Way Out?

There are plenty of Social Media platforms in China: while a few achieve great success, many succumb to a highly competitive scenario.

Result of its dynamism, it is essential to keep attention on the changes that China faces in the digital world.

From 2 Open, we have prepared a brief introduction about Weibo´s current situation.

Our goal is to give you some tips to fully understand what is going on with one of the biggest Chinese Social Media.

Do not hesitate to contact us for a more thorough analysis!

Weibo is a Social Media platform to produce, share and find out Chinese-language content.

As a leading platform, provides an easy way to express in real time and interact with people and corporations.

Its importance is not only due to its capacity to be an official/unofficial news source, but also because it allows people to express themselves in a public way.

The doomsayers come into the picture

Currently, Alibaba is the biggest Chinese e-commerce company: it provides C2C, B2C and B2B sales services via web portals, plus electronic payment services, a shopping search engine and data-centric cloud computing services.

Three years ago, Alibaba bought 18% stock of Weibo. Since then, several media have speculated that Weibo or even Sina might be acquired by Alibaba in a short time.

Encouraged by the rise of Wechat, many marketers have predicted the fall of Weibo. Well, the latest Earnings report proves they were wrong.

Is Weibo on the way out? Let the Earnings speak the truth

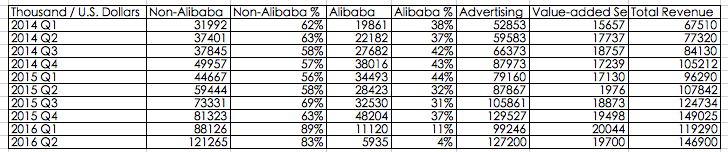

According to official Earnings Report of 2016 Q2 from Sina Weibo, the Net profit of 25.9 million dollars (net revenues of $ 146.9 million) increased 516% compared to the same period last year.

Moreover, Weibo 2016 Q2 data shows the Total revenue of Weibo is 146.9 million, including 127.2 million revenue from Advertising business, value-added services $ 19.7 million for value-added services.

Let’s review the users’ data on Weibo now

Monthly Active Users –MAU- is 282 million, increase 33% compared to the same period of last year. In addition, Daily Active Users –DAU- is 126 million with 36% increase compared to same period of last year.

Is noteworthy that 89% of them are mobile users.

The progress is closely related to their own media advantage

Three years ago, relying on its social communication advantages, Weibo attracted $ 600 million of Alibaba, while became an effective channel for celebrity campaigns, events, marketing and other commercial activities.

After that, Weibo focused on the advertising model. At the end, it decided to put aside Alibaba and manage the business alone.

In 2016 Q1, advertising investment from small and medium enterprises increased 147%. The quantity of SME’s and self-service advertisers reached 830K with 25% increase compared to previous quarter.

In 2016 Q1, investment in small and medium advertising revenue grew 147%, the number of SMEs and self-service advertisers reached 830,000 and a 25% increase the previous quarter.

Why both SMEs and big brands value Weibo a lot?

Both leverage it as an important channel frequently, specially because:

- Increase of traffic and users with 282 million MAU

- Optimized Algorithm of Ad Platform

- Active Internet Celebrities

- Live-streaming

The outbreak of short videos

We should add that speaking of its development path, the outbreak of short videos is also a milestone of growth of Weibo.

According to the 2016 Q2 Earning report, the playback amount of short videos on Weibo has increased 200%.

Meanwhile, the Internet celebrity economy is rapidly booming. Based on short videos, live-streaming broadcast and e-commerce, Weibo occupies the core position of social media with its incredible social power.

Margin improvement for future

The operating leverage will keep being prominent in the future. Based on the non-GAAP, the operating Margin rate of Weibo was 23.6% in the second quarter.

It is expected that the Weibo´s operating Margin rate could reach 25.2% in the third quarter, 23.4% in 2016 financial year, and 28.7% in 2017 financial year.

After seven years, Weibo proves to the world its strength and influence.

Do you still think Weibo is on the way out?

Our Digital Marketing and Ecommerce Agency have the experience of a team dedicated to know in depth the Chinese Social Media.

If you are looking to push your sales in China, do not hesitate to contact us.

Moreover, if you are interested in receiving to your mail the latest trends of Chinese Social Media, please suscribe to our monthly Newsletter!

This article has been edited by Paula Vicuña, from 2 Open.

Demand Side Platform in China

Overview of Demand Side Platform (DSP) in China

After arriving to China in 2012, DSP has gained popularity among advertisers due to its way of changing the traditional advertising buying model, from media buying to target audience buying. It lets advertisers see their ads performance more intuitively, allowing them to change promotion strategies more efficiently. As one of the main trends in the digital advertisement development , there is no doubt that DSP will play a more important role in China’s digital marketing scene.

What is DSP?

Demand side platform (DSP) is a system that provides the technology needed to unlock the value of real time bidding (RTB) information provided by ad exchanges. There are thousands of advertisers on the Internet trying to promote their products with high-quality media, precise target audience, optimized advertising strategies and high ROI (Return On Investment). In simple terms, DSP is a service platform for advertisers, in which they can set up target audiences, delivery area and biding price etc.

RTB and Ad exchange

Real time bidding (RTB) is a digital ad buying process that allows advertisers to evaluate and bid on individual impressions. Let us pretend that the Internet is a big cobweb, where users leave traces when they are surfing on it. By using this new technology, advertisers can take all this data into consideration, and then decide the site, placement and bidding price on each ad impression. Usually, this process is completed in 120 milliseconds.

Ad exchange is like an open online advertising marketplace that lets publishers and advertisers connect with each other. You could think of it as a stock exchange; however, it works by auctioning each impression to the highest bidder.

What are the advantages of DSP?

- Wide reach: There is no limit of time and space, advertisers can show their ads when they want to show them and to any target audiences.

- Low cost: Unlike traditional media ads, DSP uses programmatic buying and charges by CPC/CPM, which gives advertisers more flexibility with their budget.

- Specific target: With the Data Management Platform (DMP) of DSP, advertisers can easily target their potential audience according to different characteristics (like age, gender, place, income, etc), this makes advertising more accurate and cost-efficient.

Challenges of DSP development in China:

- Lack of transparency

Many Chinese DSPs do not provide full transparency and access to their platforms, which makes it hard for advertisers to understand and optimize their marketing strategies. Usually, they just provide a report for advertisers after one promotion. As a matter of fact, some DSPs cannot even guarantee the stability of the system because of the lack of technical ability.

- Quality of media resources is hard to define

Usually big publishers just release leftovers from their inventory to ad exchanges, while they build their own private exchanges with premium resources. For example, Baidu, Alibaba and Tencent all have their own private marketplaces, through which they sell these good ads resources to big clients at a higher price. So advertisers who want to work with DSP in China have to work very hard to find the high quality traffic.

- Accuracy of target audience is uncertain

Big companies like BAT (Baidu, Alibaba and Tencent) are reluctant to share their data, and there is no mature Data Management Platform (DMP) in China yet. So most DSP companies just gather data from their own ad network, third-party ad serving, or existing software, which makes the accuracy of target audience data rather doubtful.

What is a suitable DSP?

There are four features a good DSP should have:

- Appropriate RTB capability: A good DSP must be able to decide whether to participate in the auction and what is the biding price for each impression in real time.

- Appropriate directing capability: A good DSP should have a huge Data Management Platform (DMP), through which advertises can target potential audiences more precisely.

- Appropriate data analysis capability: Be able to provide, analyze and optimize reports for advertisers, which are the most valuable part of a good DSP.

- Appropriate technical capability: A successful campaign on real-time bidding (RTB) system depending mainly on the algorithm and matching model of a good DSP.

This article was edited by Andres Arroyo from 2Open.

References:

http://www.marketing-interactive.com/brief-guide-programmatic-ad-buying-china/

https://www.clickz.com/clickz/column/2282204/the-challenge-of-rtb-dsp-in-china