TMALL SUPERMARKET, LA “AUTOPROMO” DENTRO DE LOS MEDIOS B2C DEL GRUPO ALIBABA

“Tmall Supermarket” es una tienda dentro de Tmall bajo marca Tmall, que pertenece a Alibaba y con un modelo de negocio que puede variar entre la venta b2b a Alibaba y el producto en depósito. Ha llegado ya a suponer el 50% del GMV de Tmall y el 50% del tráfico.

Xiaohongshu was taken off the shelves for one month in the application store. Does it affect users and brands?

Xiaohongshu was taken off the shelves for one month in the application store. Does it affect users and brands?

A six-step strategy to find Blue Ocean for eCommerce in China

In previous years, this type of products was very easy to find, and it was relatively easy to set up a new product line. However nowadays, eCommerce is becoming more and more popular in China. Thus, it is more and more difficult to find Blue Ocean products without extensive data mining. Now, let’s look at a six-step strategy to find Blue Ocean for eCommerce in China.

WeChat “Mini Program” Opens a New Door to Chinese eCommerce

China’s Tencent WeChat has already become far more than a social networking platform for Chinese people. Users can order food or a taxi, book a hotel, purchase a flight ticket, etc. all through WeChat’s “Wallet” feature. Now, another powerful new feature, “Mini Program” keeps users within WeChat ecosystem even longer.

What Is “Mini Program”? What Functions Does It Have?

Mini Program is a mobile phone application that can be used without downloading and installation. This feature essentially offers miniature, low-memory “apps” within the WeChat app itself. You can open Mini Programs immediately by scanning a QR code, or by searching it. Because it embodies the idea of “use as you go”, Mini program will be ubiquitous, available at any time,

There are various mini programs that help you to achieve different functions, which allow users for online shopping and a wide range of other offline services. For example, purchase movie tickets, queue for restaurants, order a meal, checking stock market information, hotel booking, use Mobike, order a taxi, purchase flight tickets, online shopping, etc. Some of the top mini programs are those that share discount coupons, create surveys, track bus schedules, check best prices, check air quality, and filter photos.

What Can We Get From Mini Program?

From Users Perspective:

1. Suitable for low frequency services. Users open Mini Programs while using the service, and switch it off upon finishing. It doesn’t occupy the memory of mobile phone. This characteristics of “use as you go” satisfies users’ need on many low frequency services, such as buying tickets and hotel booking.

2. The off-line value of Mini Programs is noteworthy. Because the demand for off-line service is “quick”, “flexible”, “use it and drop it“. For example, ordering dishes in restaurants by simply scan a QR code. You can access to their Mini Program to start ordering immediately. No need to wait for the waiters coming to your table.

3. Satisfy personalised requirement in special scenarios. For example, Using Mini Program to watch movies, without the trouble of downloading different video players mobile APP each time. Therefor, the user experience is not broken.

From A Business Perspective:

The real value and purpose of mini programs is in advancing O2O transactions and interactions, essentially connecting WeChat and the real world in more effective ways. Taking restaurants as an example, it is relatively unrealistic for restaurant owners to make a mobile APP. Now consumers only need to scan a QR code, so they can access Mini Programs, to instantly see menu, and start ordering and paying for their bill. Moreover, By tracking users consumption data, it also allows business owners to easily understand users’ consumption habits and preferences, make targeted recommendation, induced purchase, membership discount and so on.

Mini programs and a presence on WeChat are arguably more important and effective than an organization’s official website. Brand marketing and communication can be developed within the mini programs and link directly to official accounts.

With mini programs constantly growing, WeChat has become more than a simple platform for social media and mobile services. It is a well-designed, leading platform for the Chinese eCommerce market, to promote their brand. We believe that, WeChat mini program presents a great opportunity to intelligently brand, adapt, and be successful in the Chinese market.

Cross-border on Chinese eCommerce Platforms

More than 14,500 foreign brands from 63 countries are selling on Chinese eCommerce platforms, and more than half of these brands have their presence on Tmall International platform. Two major reasons for this emergence of foreign brands on Chinese eCommerce platforms are: growing demand of foreign products, and relaxed policies on consumers purchasing personal items from foreign website.

A New Retail Era Is Coming to China

In an survey conducted by JD.com, about 90% of participants are willing to increase their spending on high-end products by at least 5%, with nearly 60% of them willing to increase their spending by more than 10%. Data shows that non-necessities products page views increased significantly higher than daily necessities products.

Content Marketing Strategy in China

There are powerful platforms to create a vibrant content market in China, you can see exciting new developments everywhere. These platforms have different strengths, areas of focus, and, often, geographic priorities. For marketers, this fragmentation increases the complexity of the content marketing strategy in China and requires significant resources and expertise, including a network of partners to help guide the way.

Happy Double 11: Time to go shopping!

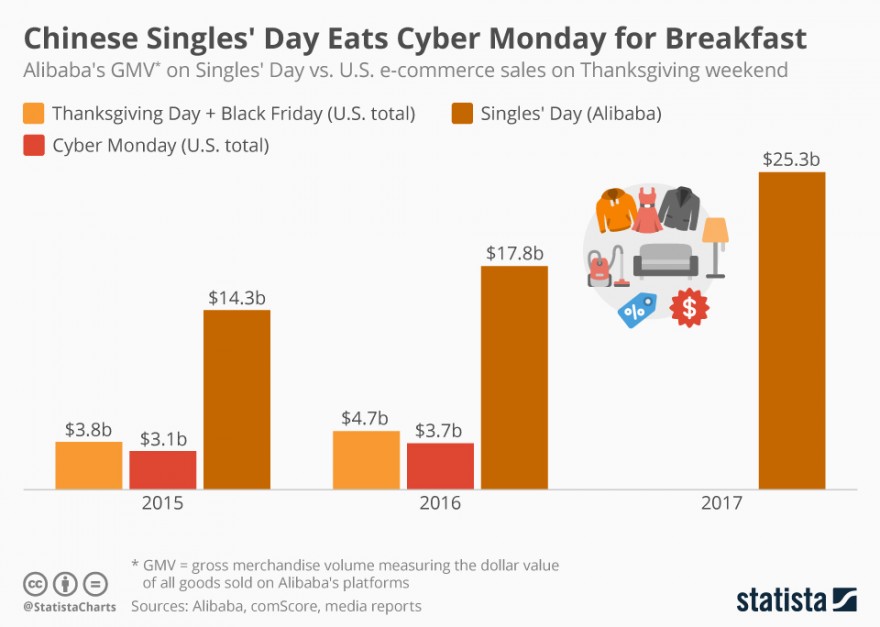

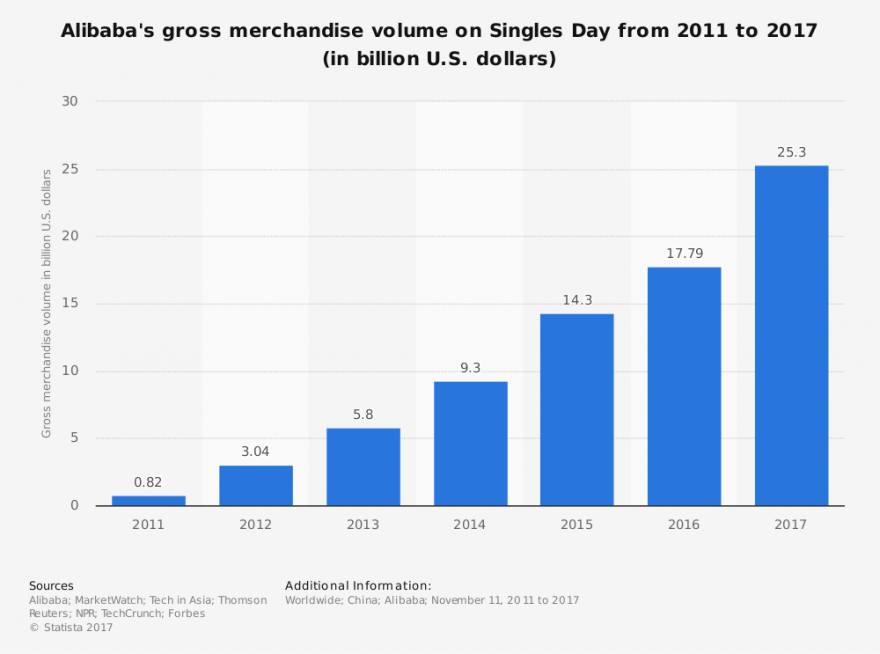

This year, Alibaba’s Singles Day Shopping Festival (also rebranded as double 11 Global Shopping Festival) entered into the ninth year. In 2009, retailer Alibaba turned the day into Chinese version of Black Friday. And eight years later, November 11, is becoming the biggest 24-hour online shopping festival on earth. Sales from Alibaba’s one day event has nearly doubled those from Black Friday and Cyber Monday in the US combined.

“Retail as entertainment” is one of the hallmarks of Singles Day. Alibaba is creating new sales record each year since 2009. In October last year, Jack Ma put forward the concept of “new retail”, which uses big data to seamlessly integrate online and offline activities. At zero hour on the day of November 11, consumers from China and other countries were all rushing in. Within 24 hours, they splurged on record-breaking $25 billion of purchases, a nice 40% increase from last year. As Alibaba’s CMO Dong Benhong said, not only we create consumer miracles, more importantly, the massive orders, the enormous amount of consumer data is captured. These real numbers provide data support for our next year’s business plan.

Here are some mind-blowing figures that sum up 2017’s Singles Day Global Shopping Festival:

$25.3 billion sales within 24 hours.

Alibaba smashing its own record from 2016 ($17.8B in year of 2016). The number reached as high as $5 billion in the first 15 minutes. In comparison, the total sales of Black Friday and Cyber Monday combined in the U.S. was only $6.79 billion in 2016. Behind this number, Focusing on providing a personalised experience and intelligent recommendations for consumers may have contributed to their success. Alibaba also said it had turned 100,000 physical shops around China into “smart stores” for this year’s global shopping event.

15 million products listed.

Over 60,000 global brands participated on this year’s “shopping party”. Familiar brand names such as Lululemon, Nike, Gap, Mac, and Macy’s. Products from US, Australia, Germany and South Korea were among most loved by Chinese consumers. In regards to what consumers actually bought on the day, baby milk powder, diapers, multivitamins, and other wellness related products were on the top of many people’s shopping list. As it is well known that health and safety are the top concerns of Chinese consumers.

90% mobile transactions

1.48 billion transactions were processed by Alipay, with 90% were done through mobile phone and tablets. Last year, mobile payments already accounted for 82% of Singles Day’s sales. In comparison, only about 30% of shoppers on Black Friday used mobile payments last year. China’s mobile payment system is more sophisticated and way ahead of many western countries. A great majority of Chinese consumers leapfrogged the era of desktop computers, moving straight to smartphones/tablets. It allows them to embrace Alipay’s convenience when making purchases through their devices.

Summary

What truly sets the Single Day Shopping Festival is how Alibaba is leveraging its innovative technology combined with the scale of Alibaba’s entire ecosystem. It brings the future of retail in reality for Chinese consumers. With global trade closer than ever before, there has never been a better time to learn from the increasingly innovative retail landscape in China and to embrace the opportunities it presents.

The total retail market in China was nearly $5 trillion in 2016. By 2020, China will account for about 60% of global e-commerce. For consumer products companies, winning China means win the world!

Finally, here is a famous quote from Jack Ma, Alibaba’s founder. “Today‘s competition is brutal, tomorrow is even more brutal, but the day after tomorrow is beautiful. Most businesses die tomorrow night and can’t see the sunrise of the day after.”

Chinese traveling user generated content platforms: Mafengwo vs Qyer

” 世界那么大,我想去看看 ” ( There is such a big world that I would like to see it all ) is a sentence once written as the reason for resignation and later suddenly became a buzzword on Chinese social network.

These years, more and more Chinese prefer independent travels to package tours. Especially, the grown up 90s generation, who are highly individualized and strong-minded, has become the main E-consumers of those traveling user generated platform such as Mafongwo and Qyer.

For example, Miss Xian, a traveling platform user from the 90s generation living in Guangzhou, China, gave up package tours for more alternatives a couple years ago. She had already stepped in South East Asia, America and Europe. Her preference is well organized in-depth trip with her family. Since her husband is too busy to do the planning, Miss Xian is responsible for handling it all. “Every time I am planning for a trip, I need some suitable travel platforms which offer practical and comprehensive reference for my destination. These years, I have been using mostly Qyer and Mafongwo interchangeably.” she said.

WHAT ARE MAFENGWO AND QYER EXACTLY?

Mafengwo : A Dream Realizer Started With A Community

In 2006, Chen Gang and LV Gang who worked in Sina and Sohu respectively set up this online travel community for their interest in traveling around and sharing travel pictures. 10 years ago, when independent travel was still a niche, mafengwo.cn accumulated users and contents through word-of- mouth. In 2010, they officially started commercializing mafengwo.cn. Apart from traditional OTA mode, they wanted to earn profits from existing contents directly.

By 2017, mafengwo.cn has gained over 100 million members, 80% of them are from mobile apps “ Mafengwo Independent Travel “. By Oct. 2016, according to the second quarter financial results of OTAs (Online Travel Agency) , Ctrip, Qunar, Tuniu, the top OTAs in China, were all in varying degrees of financial loss, while mafengwo.cn announced a turn from loss to profit eventually.

Nowadays, mafengwo.cn has become an UGC (user-generated content) platform where Chinese can share photos, travel notes, journals and Q&A online. It targets Chinese domestic users and independent travelers who need tourist reference, destination ranking lists and other recommended to-do things for their trip planning. Right now, 3,000 journals, 5,000 Q&A, 10,000 comments, 100,000 footprints are generated daily.

Nowadays, mafengwo.cn has become an UGC (user-generated content) platform where Chinese can share photos, travel notes, journals and Q&A online. It targets Chinese domestic users and independent travelers who need tourist reference, destination ranking lists and other recommended to-do things for their trip planning. Right now, 3,000 journals, 5,000 Q&A, 10,000 comments, 100,000 footprints are generated daily.

Moreover, it integrates resources contributed by users to make travel advice books among global destinations. Those books have been downloaded over a hundred million times.

Qyer : A Digital Bible for Chinese Backpackers

There are many other similar small-sized UGC communities in China market but a well-known competitor within Tourism Community category is Qyer.

At the very beginning, Qyer was set up by Xiaoyi in a dorm room. He was an international student studying in Hamburg, Germany in 2004. Once, after he got stolen at the airport while he was traveling in Europe, he became a real backpacker with very little money to survive. Then, he set up Qyer as a forum to better help oversea students share their experience, advices and wise tips of saving money during the trip. Then, Qyer started accumulating useful tips on the platform and became more and more popular in China. Within four years, Qyer had gained more domestic than oversea users. Therefore, Qyer moved back to China in 2008 and received strategic investment from Alibaba in 2013.

At the very beginning, Qyer was set up by Xiaoyi in a dorm room. He was an international student studying in Hamburg, Germany in 2004. Once, after he got stolen at the airport while he was traveling in Europe, he became a real backpacker with very little money to survive. Then, he set up Qyer as a forum to better help oversea students share their experience, advices and wise tips of saving money during the trip. Then, Qyer started accumulating useful tips on the platform and became more and more popular in China. Within four years, Qyer had gained more domestic than oversea users. Therefore, Qyer moved back to China in 2008 and received strategic investment from Alibaba in 2013.

Right now, Qyer aims at making oversea traveling more convenient and cost-effective for Chinese. Meanwhile, it does offer information for domestic destinations but these contents usually do not show up on its homepage.

Right now, Qyer aims at making oversea traveling more convenient and cost-effective for Chinese. Meanwhile, it does offer information for domestic destinations but these contents usually do not show up on its homepage.

WHAT ARE THE DIFFERENCES BETWEEN MAFONGWO.CN AND QYER?

The intriguing fact is mafengwo.cn and Qyer seem to intentionally keep in balance in the market. Mafengwo.cn puts more effort on domestic traveling, while Qyer mainly focus on travelling abroad. There is even a viral saying among the users: “Choose Mafengwo in-bound, Qyer out-bound”

In conclusion:

Traveling users generated content platform is difficult to develop and gain profit. It requires long-term user loyalty and content accumulation without guarantee for commercialization. But the potential of the UGC-big data commercial mode has already headed above water. With the huge amount of contents generated by users such as different links between accommodation reservations, attractions and dining recommendations, these data value mining is essential for breaking the barrier upstream and downstream. The one that’s faster to complete model transformation will be the winner.

Comparison/Platforms |

Mafengwo |

Qyer |

Traffic & loyalty |

More traffic and relies more on search engine optimization (SEO marketing). |

Less traffic but more users’ loyalty since the demand frequency of overseas traveling is less than domestic traveling.Qyer’s strategy is based on a “members get members” type of expansion. |

Targets |

Both target youngsters between 18 and 35 who prefer independent travel. Qyer also targets backpackers. |

|

Focus |

Mafongwo.com focuses on users sharing by creating topics and activities to encourage users to post their journals |

Qyer emphasizes user-to-user communication by operating its forum and offering appealing interactive promotions both online and offline.For instance, Qyer has already launched Q-homes in Chiangmai (Thailand) and Tokyo (Japan), which are offline bases offering Chinese-speaking comprehensive services. |

Functions |

The main functions are similar. They both offer travel journals, tips books, Q&A, top destinations and commercial functions.But Qyer has developed several apps for users convenience, such as ” 行程助手 ” (Itinerary Assistant), which helps users to make a detailed itinerary by automatic generation and manual setting. It collaborates with Booking.com( a hit for overseas accommodation reservations) for users to simply add reservations in the itinerary or book directly from Booking.com. Transportation settings and automatic distance calculation are also included in the sites. Moreover, it provides 2 ways to output itinerary: (1) A document fits with Visa requirements (2) A huge PDF itinerary books including all the photos or tips, details of each chosen accommodation reservations, transportation, attractions and restaurants. |

|

Home Page quality |

Update more often |

Update less often and there are even some journals from last year. |

[recent_posts count=”3″ date=”true” thumbnail=”true”]

A Cashless wind blowing in the Fashion world in China

Recently, Wechat Pay and the leading fashion retail group Inditex have reached agreement on collaboration . 7 brands of Inditex: Zara, Bershka, Pull and Bear, Massimo Dutti, Stradivarius, Oysho and Zara Home with around 600 offline shops in China mainland announced to access WeChat payment formally.

Since then, it will no longer be necessary for customers to bring cash while they are shopping in these stores. They can now pay by scanning QR code through WeChat payment, enjoying the ” no cash ” convenience in Fashion shopping.

By the beginning of 2017, the amount of purchases in fashion industry through WeChat Pay had attained a year-on-year growth of 9.5 times. The fashion industry became one of the most rapid growing industries. So far, except for Inditex, WeChat payment has also covered Lane Crawford, Longchamp, UNIQLO, H&M, GAP, Hot wind, Meters Bowne and etc.

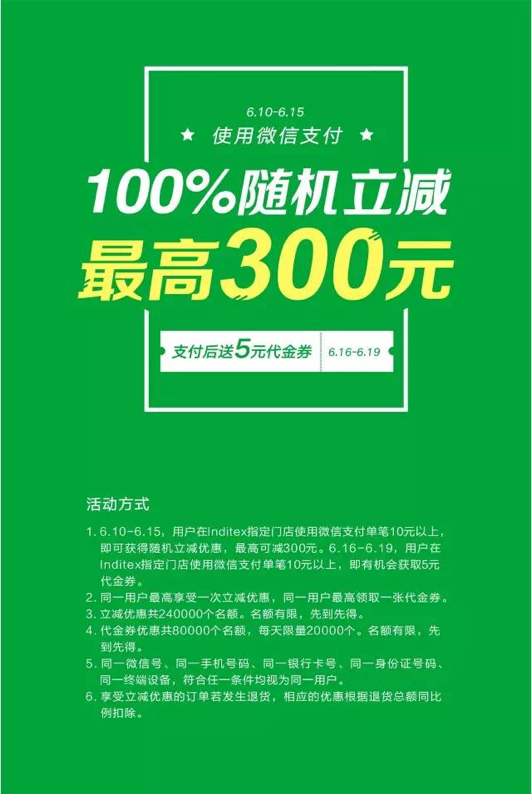

At the same time, in this cooperate Inditex group, a new promotion activity has been carried out —— Random cashback + Cash coupons.

Activity Details :

- From June 10 to June 15, customers using WeChat Pay to pay more than 10 RMB per purchase in one of Inditex designated shops can get a random price cut up to 300RMB.( Each customer has maximum one chance of the price cut ) During the weekend ( June 10 to June 11) after 6pm, customers can also get one random red envelop bonus . ( Each customer has maximum one chance of getting the bonus each day during the weekend )

- From June 16 to June 19 , customers using WeChat Pay to pay more than 10RMB per purchase in one of the Inditex designated shops would have chances to win 5 RMB coupon. ( Each customer has maximum one chance of getting the coupon. Coupons’ valid duration is June 2- to July 3.

- The quota of price cut is 240,000. First come, first served.

- The quota of coupons is 80,000. 20,000 quotas for each day. First come, first served.

By outputting developed business solution to push forward the industry transformation, WeChat Pay will have more cooperation with more fashion brands in the future.

[divider style=”single” border=”small”]If you have any questions about selling in China, Contact us!!