Barcelona, 27th, Madrid, 29th of june, Valencia 4th of july 2017. Events on China Ecommerce and Digital Marketing

In the coming weeks there will be 2 events where we will be participating. If you are interested in the topic, you are welcome to join and participate.

The Lean Approach to Selling Online in China

In conclusion, start selling in China with 2Open in a record time. Most of the actual medium sized cannot, literally, afford to wait for bureaucratic complexities, licenses, or customs.

The Wrong Approach To the Chinese Market

Even the best consulting firm of the world will not be able to predict in a perfect accuracy whether your business will or will not succeed in China; the only way is to come and try.

2open.biz got spanish national TV recognition

2open.biz was recognized by RTVE, Spanish National Radio and TV, in the category of “internationalization”.

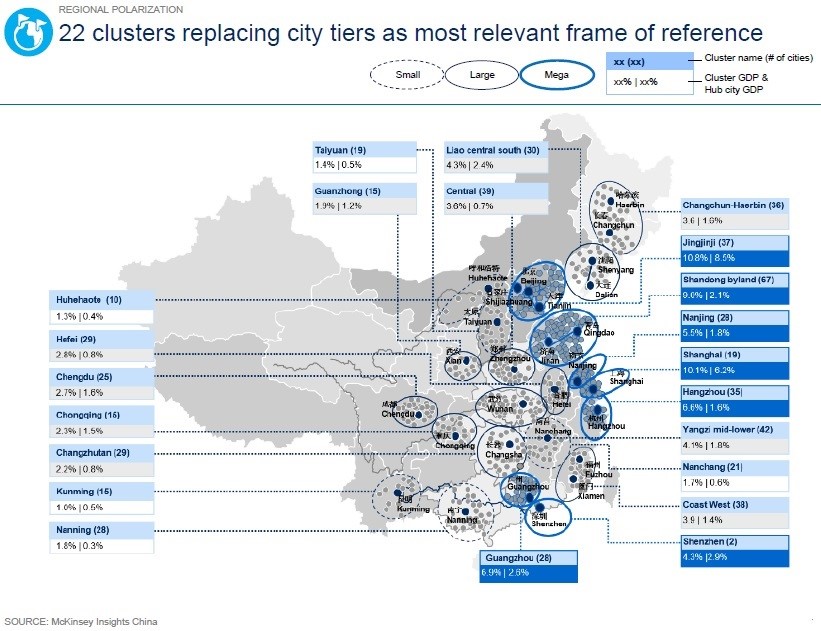

How to Target Clusters to Sell in China?

When talking about selling in China, the Chinese regional polarization becomes a relevant frame of reference. How to deal with such a vast country which could be considered a continent in itself?

In any process of business development in the Chinese territory, companies face the same fundamental problem. Even if there is not a single answer, these three below are constantly repeated.

First, the Company lacks totally of any real knowledge about China. Intuition is not a pray and you would be wrong.

Doing business in China by making a North-South East-West division is not useful, neither the best solution. Split the territory geographically will drive you towards more inaccuracies. To give you an idea, Guangzhou and Shenzhen belong both the south but they barely share any similarity.

Guangzhou is traditional Cantonese speaking city with a strong rooted culture. Meanwhile, Shenzen is more cosmopolitan mandarin speaking city populated in its vast majority by immigrants from all over the country and overseas. There is a Chinese common say about Shenzhen, “Once you get to Shenzhen, you become <<Shenzhenese>>”.

Secondly, once we realized that geographical distribution might not be the best option dividing by tiers could seem quite reasonable.

As you probably already know, in China cities are classified in 5 ranges, from Tier 1 to Tier 5, so dividing by tiers is again a mistake.

The example just exposed would serve also as explanation. Another example would be Beijing and Shanghai. Both belong to Tier 1 cities; nonetheless there is no possible comparison between Beijing and Shanghai, despite of the fact that both are super cold in the winter, although they tried to sell us that Shanghai belongs to the south…!

Beijing, capital of the People’s Republic of China, has been the capital of the country for much of the past eight centuries. Beijing is the cultural and political core of the Chinese nation. Tradition is venerated and could be observed in every place of the city.

Shanghai on the other hand, is the largest city in the world and the financial center of China. Luxury, skyscrapers and mix of cultures are some of the characteristics of the city. In Shanghai is common to find a huge number of expats and western style neighbors due to existence of the old French concession. So, there is no point to focus on city size.

Third and yes, Chinese people share several distinctive characteristics which are markedly different from any other culture, but Chinese are still Earthmen.

So please, do not fall into generalizations but neither forget a main description of the modern Chinese consumer:

- First, the Chinese remain best disciplined savers. The Chinese saving is not only driven by culture but also due to its lack of a real social care system

- Second, the Chinese are not loyal to brands, and they love experimenting trends, products and services

- Third, Chinese are savvy consumers, based on the price variable

- Fourth, Chinese shoppers have begun to understand the gap between price and value

Therefore, which would the best way to segment China?

Recently, Mckinsey studied which would be the best way to segment China into reasonable pieces. After reviewing many indicators, experts concluded that it was reasonable to cluster the Chinese territory.

It is helpful to focus on cluster size and much more effective. China is huge and Cities can be very far from one to another, so you better bear in mind that distance is a key point when doing business. We also must add that areas can be much attractive to business than cities, due to its bigger GDP and incomes, larger population and better facilities.

In the meantime, take a look beyond historical growth rates can help you to extrapolate future trends and discover if your product or service is going to last. Remember Clusters share trends and determine their evolving. For example, milk was slowly introduced in the country, first in the Shanghai area, to gradually spread.

Landing in China is never easy

In 2 Open we hope you enjoyed the reading but especially, that these tips have helped you know better the Chinese business reality.

Keep in mind that it would be much better if your arrival occurs by the hand of a consulting agency specializing in Chinese business, Ecommerce and Digital Marketing.

Need help to sell online in China?

This article was edited by Paula Vicuña from 2 Open.

Sources:

Alibaba Overcomes Baidu in Chinese Digital Advertising

According to a new report from eMarketer, experts predict that the decline of Baidu in favor to Alibaba is due to the new market conditions in Chinese digital business. Alibaba has adapted fast to the last digital ads regulation and currently enjoys the leadership in terms of online advertising revenue.

The Chinese Internet landscape is characterized by the huge prominence of the three technology giants.

As you may know, Baidu is the largest player in China in digital advertising market, Alibaba is the Chinese eCommerce leader firm and alongside both, plays Tencent.

These Top 3 in digital industry are estimated to command a total of 60% in ad revenue in the present year, and amount around $42 billion.

What factors have led Baidu to its future decline?

Although currently Baidu still controls the largest share of the online advertising market, the success of the company in 2015 is far from repetition. Baidu’s share in China’s digital ad market is expected to drop to 21% in 2016, and forecasts are less positive for the coming year.

In early September, in the team we analyzed in our article “New Online Advertising Rules in China” the new online advertising regulation in China and its impact in all digital business with presence in China.

The Internet Ad Interim Measures is a new regulation prompted by the State Administration for Industry and Commerce of China. It arose from the Government’s claim by adopt new rules over online advertisement, at the time it was expected to impact on Chinese Digital Marketing as a whole.

As we mentioned before, some fields were subject to special regulation: healthcare, medicine, food and beverage. But new regulations also affect to Internet advertising practices with some other measures: it is required that all paid ads to be clearly marks in search results, prescription medication and tobacco ads have been forbidden and it is already mandatory to certain medical and health products.

From the beginning, these changes were identified by outside analysts as a serious handicap for the future of the company. As Shelleen Shum told,

“We think the impact will be larger on Baidu than on the other search engines given Baidu’s larger market share and its dominance in medical service ads.”

But the coming into force of the new rules, is not the only reason for its current decline. The lack of strong mobile devices is also affecting its ability to attract advertisers.

The main driver in the Chinese market is the mobile platform. As Lyu Ronghui said,

“Huge traffic is the bedrock of online advertising business. But unlike Alibaba and Tencent, which have numerous successful mobile products that can attract traffic from users. Baidu still lacks a new cutting-edge to help jumpstart its slowing traditional search business.”

Facing Baidu, Alibaba has surpassed its rivals taken advantage of the new conditions. As Shelleen Shum explains, its reinforcement is due to,

“Although also affected by the new regulations, Alibaba’s ad revenue, particularly from the mobile sector, shows no sign of abating thanks to the robust growth of its e-commerce retail business.”

Although at present Baidu controls 28% of the online ads marketing, Alibaba is expected to become the largest player in China’s digital advertising market before finishing 2016.

New rules in China

In China, digital landscape changes as faster than imaginable. There are plenty of creative ways to sell your services and products in China, but acting in the hand of a company based in the country, is always a big extra bonus for your business in China.

In search of a Digital Marketing & Ecommerce Agency?

Sources:

Can Specialist Retailers Survive against Alibaba and Amazon?

It is said that whoever hits first, hits twice. Some days ago, Zalando signed a partnership with its biggest competitors, Amazon and Alibaba. Far from thinking that they were wrong, we feel confident about the future of these new alliances between Europe, China and United States.

Zalando was founded in Berlin (Germany) in 2008. Born as an European electronic commerce company, the brand already holds the leadership as the largest online fashion retailer, while also has become the second largest group in Ecommerce in European region.

Zalando was founded in Berlin (Germany) in 2008. Born as an European electronic commerce company, the brand already holds the leadership as the largest online fashion retailer, while also has become the second largest group in Ecommerce in European region.

Although originally its activity was focused in marketplaces, in 2010 Zalando starts its jump into developing and selling its own brands. Online selling shoes, clothes and fashion items constitute the core of the company, under a cross-platform perspective.

A step to break: boundaries to online shopping

Even if such perspective still remains today, observers enjoy its dramatic effects: to an unique Refund – Return policy in retail and a highly attractive shipping, have joined an effective logistic management and a recent prospection in offline context.

Although timidly, its development in the offline environment constitutes a new movement to establish its brand in the retail market and its visibility on some physical multibrand markets in Germany. To this point is joined an attractive shipping policy that enhances its appeal to the consumer: it is fast, secure and in case the users feel dissatisfied with their purchase, they have the chance to return them within 90 days.

Even if its payment and reimbursed model is constantly criticized for its high risk, it is also truth that this pillar has become an emblem for Zalando, its trademark and distinction over its competitors.

Zalando pushes online to grow

The company shows a steady growth in its presence in Europe, while designing its jump to the international area. The future seems promising according to their latest analysis prospects, with a year revenue growth close to 20%.

This rise is the result of three main reasons:

- Its total adaptation to mobile user experience: U-commerce is the new king in sales –check our articles “How to Take Advantage of the Latest E-commerce Revolution? U-commerce Trend” and “5 Things to Avoid When Doing Business in China” to discover a bit more!–

- Mobile purchases are already more than half of its sales

- A wide range of products and therefore, a great audience to address

- Its advantage of using a vast network of online platforms

A twist to Ecommerce

The desire of the Group is boosting its international sales and take advantage of the huge possibilities that the electronic market and their highly developed logistics presents to them.

To achieve its goals, Zalando has woven alliances with the giants of E-commerce: Amazon and Alibaba. Although its presence on Tmall is expected for the coming months, its bet for B2C trade -previously discussed by us in our article “Do Other Ecommerce Platforms Stand a Chance Against Tmall?”- some steps further on international distribution are already in discussion.

It is worth noticing that this giant enterprises are transforming traditional business into a new business model. Digital Marketing and Ecommerce helps to create new partnership systems for other companies around the World, and it will become more and more important in the following years.

In search of a Digital and Ecommerce Company? If you have any question or require any information about our services,

Sources:

Europe and China Partner to Provide Mobile Payment Solutions by Alipay

Not quite a month we woke up with the news that two technological giants had joined forces in creating an alliance with huge chance of success. The alliance between Ingenico Group and Alipay is focused on payments innovation as part of a wider international push, but is also a recent demonstration of the growing momentum of Chinese companies in Europe.

Over recent years, Chinese ambitions in Europe are clearly visible: just in 2016, Alipay has forged alliances with Uber app and Wirecard to offer mobile payments services around the World.

The alliance is based in European mobile payments

Ingenico Group is a french company specialized in designing a wide range of payment solutions, whatever the sales channel or payment method is chosen, according to three main needs that merchants and consumer ask: a secure, easy and seamless experience.

In recent years, China has created a vast and well integrated digital ecosystem in which highlights Alipay– a Chinese equivalent to PayPallaunch by Alibaba– which is already China’s leading third-party online payment solution with no transaction fees. The company already has more than 400,000,000 active Users.

Although there are many reasons behind this alliance, the clear purpose was to tap into the huge Chinese tourist flow in Europe. As we wrote in our previous article “How to Acquire Chinese Tourists through Digital Marketing“, the Chinese tourism consumption is already estimated to be the highest in the World. Moreover, Chinese tourism market will keep growing even faster: in year 2019, estimations says that consumption will reach US 264 billion dollars.

Although there are many reasons behind this alliance, the clear purpose was to tap into the huge Chinese tourist flow in Europe. As we wrote in our previous article “How to Acquire Chinese Tourists through Digital Marketing“, the Chinese tourism consumption is already estimated to be the highest in the World. Moreover, Chinese tourism market will keep growing even faster: in year 2019, estimations says that consumption will reach US 264 billion dollars.

The motivation to exploit the partnership is shared: on the one hand, Europe has become the major vacation destination by a sector of the population with high standard of living; on the other hand, Alipay seeks to exploit the existence of more than 120 million Chinese tourists arriving in Europe every year and an approximately cost of $ 875 on average, while offering a payment experience nearest to their day to day.

Chinese tourists in Europe will be able to pay via Alipay App at any store that uses the Ingenico solution

The announcement not only underscores the growing relationship in business between two increasingly interconnected areas, but also the enormous benefits that such collaboration can mean to both. With such a perspective, it is not surprising the happy ending. As Philippe Lazare, Chief Executive Officer of Ingenico Group said,

“We are very excited to partner with Alipay and contribute our unique omni-channel expertise, products and services to help them optimize the user experience and boost sales all over the world. Their choice for Ingenico is a tribute to our high success rate and ability to meet even the most demanding customers’ requirements.”

Chinese tourists are accustomed to using electronic payment methods, an innovation that fails to catch on among European citizens. Presumably, this cultural difference has become a barrier that discourages expenditure among Chinese tourists. As Jacques Behr, Ingenico’s executive vice-president for Europe and Africa said,

Chinese tourists are accustomed to using electronic payment methods, an innovation that fails to catch on among European citizens. Presumably, this cultural difference has become a barrier that discourages expenditure among Chinese tourists. As Jacques Behr, Ingenico’s executive vice-president for Europe and Africa said,

“Payment becomes a friction for business so we are removing this friction by allowing the retailers to capture sales to the Chinese tourist population.”

The measure therefore seeks to stimulate Chinese people expenditure in their major holiday destination, but also tries to take advantage of the huge market Alipay already has in China: more than 450 million users liable to become target audience, and a market share in mobile payments in China higher than 80%. As they themselves spelled out,

“We are building international business step by step. There is much still to do with our customer base, and is still expanding.”

Such collaboration not only benefits the Chinese people, but also means a qualitative leap in technological enjoyment for Europeans. The alliance seeks to provide to European online retailers and to customers the possibility to pay and accept payments through Alipay´s eWallet through some marketplaces. An excellent way to boost e-commerce and sales in China and Europe.

Although the operation has already begun, both companies estimate that Alipay won’t be fully operational in Europe yet.

Just to start

While Alipay makes its movements, the rest of the world watches. Only companies that have a deep understanding of Chinese market can cope with the changes that are to come.

In search of accurate and personalized information to your sector and business?

Visit our Digital Marketing and eCommerce Agency!

Sources:

5 Bugs To Avoid When Doing E-Commerce In China

Have you ever tried to build a new overseas brand and fail in your attempt? In any approach to China, foreign brands often make some common mistakes when trying to sell their products in China mainland. Although such misconceptions are not exclusive to online environment, we will focus on those that particularly affect your approach to e-commerce in China. China is already the world’s first e-commerce market.

Are you going to miss its enormous potential?

First bug: China is mobile, and you better record it

It is not the first time we tell you this, and for sure it won´t be the last. As we mention before in our article “How to Take Advantage of the Latest Ecommerce Revolution?”, Ecommerce has been a great revolution for both companies and customers.

Nowadays, Chinese prefer to use their mobile devices rather than their laptops and according to the new trend, companies have already starting to adapt themselves to portable devices. Moreover, those companies using U-commerce are focused on improving the customer experience through customizing and navigation created in cooperation with the User.

Second bug: E-commerce may be an asset in your country, but in China is irreplaceable

We cannot fail to mention Frank Lavin, CEO of Export Now, when he says,

“In China, Ecommerce is the cake.”

This may mean that you will need to adapt your business to the new environment. Do not expect it to be China who suits you, this does not work this way.

Remember that whoever hits first, hits twice. Embrace e-commerce as the enabler of your business it is, and take advantage of the immense benefits that electronic commerce can bring to your company to start selling around the World!

Third bug: Social Media is there to stay. Register your account and start moving!

Surely you’ve never heard the words Baidu, WeChat and Weibo… and let us tell you that you have a huge problem in China.

Not only around the 93% of the online searches in China are done in their own search engines –Have you ever heard Google does not work in China?– but also about a 68% of the customers take a look on the official Social Media account before buying.

Do not miss the opportunity to have a voice in that huge chicken coop is the network, start developing a tailored communication strategy for your brand and gain your piece of the cake!

Fourth bug: Domestic and lazy thinkers, or how the triumph from a day doesn’t make it daily

Do you think you will keep doing in China pretty much the same things you were doing before and as a result you will achieve success?

A basic rule you should never forget again is, no matter the experience and the many different markets in which you have entered before, is that new horizons always implies a new starting on your understanding of the target, so we definitely encourage you to start a market analysis.

Will your brand be competitive in China?

Do you offer something different regarding your competitors?

Is there a suitable market niche in the country ?

These and a thousand more questions require a prior discussion, keeping in mind that China should not be underestimated: the country enjoys some peculiarities you definitely must know before starting your landing.

We strongly recommend you seek assistance from professionals focused on the Chinese market, in order to enhance your chances of success in the country.

Fifth buf: Do not try to do everything by yourself, ask for advice

We are not tired of saying it, and will do so again: China is not a flat road. Do not try to embark on this mission unaccompanied, but pick very well with whom.

Look for complementary partners interested in joining forces, go to Government agencies dedicated to external actions and internationalization and definitely search for specialized agencies in the country to start outsourcing some tasks.

Already in search of a consulting expert in digital marketing and e-commerce? You have come to the right place.